Technology hasn’t just required an upgrade in equipment, but a shift in employee skill sets.

As American as apple pie.

Community based financial institutions (FI’s) are the heart and soul of America. These locally owned and operated institutions are woven into the fabric of the communities we live in, work in, raise our families and build our lives. That building involves our careers, our hobbies and our futures. That future in large part depends on…money, investment and risk.

The saying “It takes money to make money” is still…right on the money.

Most of us are not born with the equity we need to see our hopes and dreams come true. We need money to finance our education, our houses, cars and businesses. We need equipment, tools, facilities and employees to make our lives work. The local community bank and credit union steps in to make all of this possible. It is the reason they were created, and they fuel the economy and future.

In order to serve, first we must adapt.

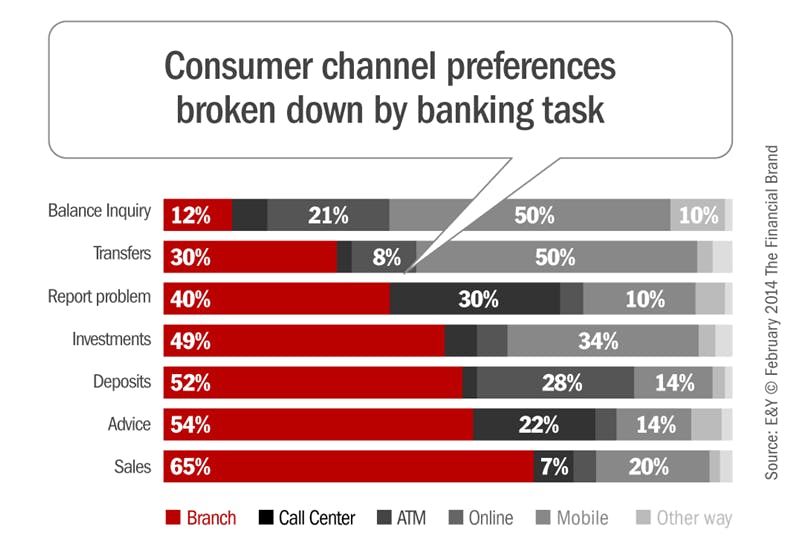

In today’s changing consumer environment, where omni-channel delivery is the norm, community banks and credit unions are also challenged with delivering services in a way that deepens their wallet share, household penetration and margins…so they can continue to fuel the American spirit.

The old way worked. In years past, that service was almost universally delivered the same way.

A customer interacted with a “banker” in a branch across three feet of mahogany. Most interactions were transactional in purpose…check cashing, payments and order filling. The world had fewer channels for consumers to access financial resources and the delivery model…worked. No, it worked great!