Millennials and the Branch: Strange Bedfellows

- Announcements

- Branch Transformation

Categories:

How do financial institutions connect with Millennials? Answer: A marriage of Science and Art

Earlier this year, shock waves were sent through the financial industry as study after study echoed the same message – Millennials highly value the branch. Though millennials and all consumers look digital-first for connection from their bank and credit union of choice, the branch is equally as important to consumers.

Human Connection. The research by Bain and Fiserv point to an inherently human response during the banking process, establishing trust and demonstrating value through relationship. Relationship is the heartbeat of the financial services industry and relationships are established over time.

Branching is about relationship. Banks and credit unions all offer similar products and services (perhaps at slightly different rates), but the motivation to buy (a loan) from one company over the other comes down to relationships. And consumers of all demographies are coming to the branch for that connection. In fact, the Fiserv study found that Millennials are the most likely demographic segment to visit the branch, and they are the most-likely to apply for and receive a loan through the branch.

Therefore, a key question for all banks and credit unions should ask is: How can we better connect with a demographic that wants what we have?

Science and Art. When it comes to branching there are no silver bullets or secret sauces to success. However, there are guiding principles, call them natural laws that govern victory, and it’s a marriage of Science and Art.

Science of branching. If there is one step we witness financial institutions (FIs) skip over in their pursuit of connection with consumers through the branch is developing a business case. In our industry, we have data at our fingertips and its plentiful. But, the science of branching is not about the data, it is the interpretation of the data for a specific outcome.

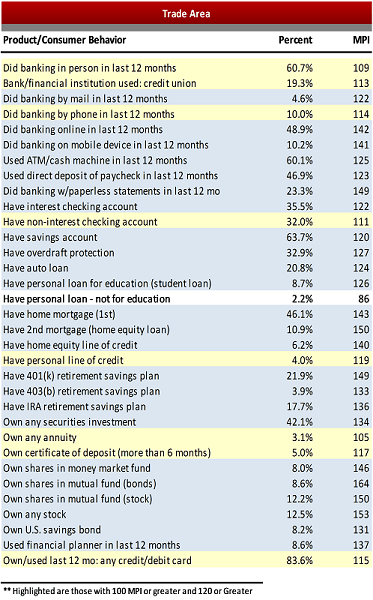

Market conditions. Collecting specific data about the local market conditions around your existing branches, or proposed new ones reveals more than you could imagine. It reveals the preponderance of consumers who desire what you have – loans. It shows how they want to connect with you (mobile, automated, and the branch), and it reveals the specific products and services we should offer in branches.

The index data above is much more than good local information about product and service demand. With this data in-hand we can go to the next level to establish the total headcount, and the function of the branch. So instead of staffing branches “how we always do” we can staff for a specific outcome based on what local consumers want today, and what they will need, tomorrow.

Loans and Deposits. Furthermore, all data collection for branching should result in a specific loan & deposit forecast for that opportunity. Only with this information can we build a business case that will allow for measurements of return on investment. Historical experience has proven that a freestanding branch’s profitability comes into focus at $25 Million (deposits & loans). Nevertheless, as branches get smaller and more flexible perhaps lower opportunity can be feasible. In any case, understanding opportunity and starting to develop a detailed plan – if it’s a 70% one – will create a greater likelihood for a predictable outcome.

Art of branching. Certainly, much of the business case for the branch is art as we interpret the data; however, the art also flows into design. The function and headcount of the facility are finite components so that is science, but how we integrate those into our consumer experience is unique to the local community we serve, and your business, and that is an art.

A unique consumer experience. Connecting with the local demography, the community and your consumers is unique to your business. The experience should be well planned and purposeful, always remembering your personality and value proposition are unique to you. A consumer experience that begins before the consumer walks through the door, and continues through the branch environment. And the beauty is though again we have guiding principles that govern victory, we have freedom of creativity to build connection, so the branch experience it takes on different personalities in each community we serve.

[metaslider id=6198]

Training drives performance. And the glue that holds all of it together is your human capital – your people. Nothing in branching drives success better than training your staff to learn how to connect with people and opportunities. For many FIs, this means adopting the Universal Banker model for their business. This means we combine skills training to optimize each opportunity our staff has to connect with consumers. To shift the employee mindset and branch purpose from order-taker to advisor, teacher, council and guide through the consumer’s financial journey. Every consumer is at a different stage, and they look to their bank or credit union for help. Your success depends on your ability to capitalize on those opportunities.

So, what’s next? That’s really up to you. The process outlined above is but an overview, a 30,000-foot glimpse into a portion of the process of connecting with consumers who want what you have in the branch. So, a good question follow-up question might be:

What is the Business Case for the Branch in a Fintech World?