Is the Fox Guarding the Hen House?

- Announcements

- Branch Transformation

Categories:

“Very cool.” “Incredible!” “This doesn’t look like a bank.”

Showing the world that a traditional bank doesn’t have to feel like one, today’s financial institutions are finding new ways to wow customers. So much so, it seems like the “design” in most building plans should come first and foremost. To that we say, “slow your roll.”

How to build a better bank.

Actually, maybe the statement should be revised to “How to build a bank better.” In its simplest terms, every branch or main office project has an owner, a designer and a general contractor. From there are two models to compare:

- Design-Bid-Build (aka “Old School”) – This is the traditional model, where the architect and builder are separate. The architect creates a set of blueprints independent of the contractor. It’s on the owner to submit bids and determine who is right for the project.

- Design-Build (aka “New School”) – The more modern approach. This is where the owner hires one firm to be responsible for design and construction. This model maximizes value (Download White Paper) and eliminates the owner as the middle man.

Two kinds of Design-Builders

1 – In-House Design (Design Led) – Not all design-builders are the same. Some have design in-house and others don’t. Firms with in-house designers (on staff) lead with design, and not construction. For banks and credit unions this can introduce risk into the equation – especially when cost is king. Risk is not starting the project with a budget. Risk is using the same designers for all projects. Risk is more costly projects.

All firms charge their client overhead costs. Overhead of the business (indirect overhead), which would include costly designers, as well as direct overhead for the project (cost to do the work). These firms also charge a design fee. Sounds a lot like the Fox is now “in” the Hen House.

2 – Out-Source Design (Construction Led) – Design-builders who outsource design are construction led firms. Research shows less than 15% of the total cost of a branch is branding, furniture, fixtures and equipment. So, the key cost buckets are the non-sexy components that no one sees.

By outsourcing design, the cost of the project is lower. Only the cost of the designer (design fee) is assigned to the project. So, there is no double-dip on overhead and design fee. Moreover, by leading with construction, the budget for the project is preserved. The budget is the north star and is what defines what happens next. In this way, designers can be free (freed knowing the budget) to create “beginning with the end in mind”.

Beware of Wolves in Sheep’s Clothing

Jim Collins in his revolutionary book “Good to Great” characterized great companies as those that focus on their hedgehog concept. Few design-builders, who specialize in banks and credit unions, grew up in construction – it is not their hedgehog. Some of these firms grew up as bank equipment firms, others focus on branding, and nearly all lead with design aesthetic. These firms are not vanguards of budget and branch performance, because it is not in their DNA. They cannot offer what they don’t have.

At LEVEL5, we are a construction-led design-build firm who incorporates data, local market knowledge, and expert site selection to maximize your return on investment. We understand that lowering risk is in on the minds of banks and credit unions night and day.

This is not just our opinion, but the testimony of banks and credit unions across the country. What else is keeping them up at night? Listen to what they have to say in these videos and decide if we are the right fit for you:

Branch Success is a Three-Legged Stool

- Announcements

- Branch Transformation

Categories:

The branch of the future may not resemble the serious, conservative look of the past, but what’s behind all that glitz is anything, but fly-by-night.

Lobbies filled with furniture that looks as if it could double as a set from the 60’s era sci-fi show Star Trek. Lounging areas that are one disco ball short of a setting for a hot new nightclub. Lighting that would feel equally at home in an art gallery for postmodern sculpture.

Is this the lobby of a bank, or a leftover set from a 60’s sci-fi show? Actually, it’s Mazuma’s 50,000 square ft. main office. And thanks for asking!

What’s behind all that design

This is, after all, the place where all of your bank and credit union’s channels converge. It’s the key cog in your service delivery network. The branch is more than just four walls, a vault and a teller line. As the saying goes, there’s a method to the madness. The branch of the future is a three-legged stool composed of the right mix of:

- Function

- Experience

- Technology Integration

What’s your function?

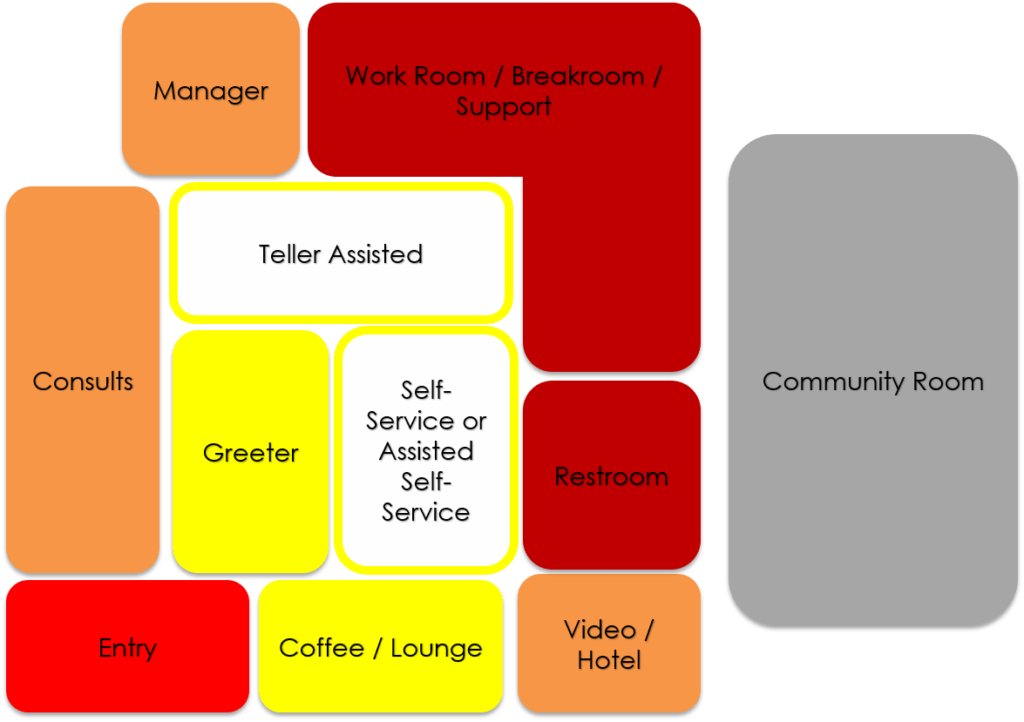

The branch houses a process for people – staff and customers. So, the first step in developing a branch is to understand what functions are needed within it. A common starting point is uncovering and understanding the function of a transaction. Is the transaction teller-assisted (teller line or pods)? Self-service (ATMs)? Or assisted self-service (Interactive Teller Machines)?

Knowing and naming all the functions for the branch process is the key to decisions about placement, staffing and tools needed. Additional services offered in the branch potentially include lending, insurance or investments and should be included in this phase.

The design process starts inside the branch and then builds layers to offer services for the customers or members, and the community.

Experience – Think in Zones

As the function takes shape, then the desired experience is layered on top of the function. (The second piece of the three-legged stool.) Many a bank or credit union skip over the branch’s function and go straight for the experience because that is what is considered hip, cool or relevant. Certainly the experience matters, and matters a lot, but not at the expense of function – first.

The branch experience starts from the first impression, then zones of customer activity, and support. Each zone accomplishes both a function and experience through the branch’s staff and tools. Zones are established by length of time:

- Entry zone – where first impressions happen

- 1-5 minute zone – where self-service, assisted self-service, or teller-assisted decisions are made

- 5-20 minute zone – consultants, manager access, and full screen video helps customers or members solve larger concerns or questions

- Support zone – workroom, break rooms and storage are part of the process too – don’t forget about it

- Add on – something extra, like a community room

Zones are matched with function to facilitate experience of the branch with customers and members.

Tech is the final piece

Once the functions of the branch, and the desired experience of customers and members are identified, the all-important integration of technology is applied to make everything run. (The three-legged stool is complete!) Cash automation and recycling at the point of the transaction creates time for staff to focus less on counting, and balancing and more on tending to the needs of the customer. Self-service tools like ATMs and ITMs (Interactive Teller Machines) allow customers or members to serve themselves or with the assistance of staff during our after hours. Automation is not limited to cash transactions. It also includes video conferencing, security, and back office equipment – anything to accelerate the business.

When all three legs come together, it often looks something…like this:

LEVEL5 is trusted by banks and credit unions across the country for our ability to implement the three-legged stool to a successful branch. Each component of the stool is needed or you risk sinking the Titanic.

The branch is as important as ever for customers and members to conduct business. However, it is not just about the design. What else helps you avoid the Iceberg?

Don’t let your branch suffer the same fate as the Titanic

- Announcements

- Branch Transformation

Categories:

Who doesn’t love that new bank smell?

The grand opening of any new bank or credit union is typically cause for celebration. Ribbon cuttings, community leaders posing for the local press, and free hot dogs for the kids. These images remind us of a simpler time, when simply opening a branch was the key to success.

But for all the time spent on decor, messaging and branding, and even what type of potted plant is most appropriate, it’s the not-so-glitzy stuff that really determines if the new location will be a success. That’s not to discount the importance of branding. Marketing communications and advertising help differentiate one bank from another. But in truth, design decisions represent only 10% and 15% of a new branch’s costs. Surprised?

The unseen iceberg

With much to-do about what’s going on above the surface, too many executives put emphasis on design, rather than projecting a realistic budget, determining schedule and controlling construction costs. These massive costs represent the iceberg. The 85% that can cause you to, yes, sink or swim.

If you don’t effectively impact the major centers of gravity for costs (size of the branch, building materials, time and quality) then branch performance will suffer.

What we found…

LEVEL5 looked back at historical spending by banks and credit unions on the total cost of projects. Here’s what we found:

First, branding is important, from the color schemes to retail merchandising to point-of-purchase displays. But, too much focus on this may not be the best use of creative energy for a component representing less than 5% of total dollar spend.

Second, store layout, furniture decisions, and even floor finishes matter. Materials can be expensive, and the need to create a space to fit your local community’s desires can result in costly considerations. Still, these costs are often just 7-10% of the entire spend.

Third, total cost projections of a branch should reference three data points:

- National cost databases

- Historical cost data

- Market pricing

Whenever client budgets run over, it’s almost always because whoever was estimating the project at the bank or credit union overlooked something crucial.

Market pricing and schedule

While clients and other design-build firms spend most of their time and energy on the visible 15%, LEVEL5 understands that the 85% below the water drives performance.

Determining what the credit union or bank is willing to spend and aligning that spend with design, and the supply chain is what we do well. At LEVEL5 we specialize in solutions that go beyond design-build, by helping you decide what kind of branch solution works best for your markets and needs.

With our guidance and expertise in construction, the only fire you’ll need to attend to is the one cooking up the hamburgers and hot dogs. How do you start building a successful plan?

Branch Cost and Change Orders. Please, stop the Madness!

- Announcements

Categories:

The battle to lower branch costs begins earlier than you think.

There is probably no more despised phrase in all of construction than “change order”. The phrase elicits thoughts of pain and suffering beyond measure. Imagine Dante’s Inferno, Nails on a Chalkboard, or Crying Babies on an all-day flight to nowhere! Maybe I went over the edge a little there, but for an owner (who is paying the bills), change orders can be more than a little unpleasant.

What few owners know, or realize is that the battle lines against higher branch costs and change orders are NOT established after the design is produced, and the project is being bid. The fight for lower cost is won much earlier in selecting your project delivery method.

Getting Low = Change Orders

Most Banks or Credit Unions are accustomed to hiring an architect to design their branches or main office, and then bidding that project amongst qualified general contractors (GCs). Though this method is familiar, it is far from the most effective, and wrought with competing voices.

- Architects design without a clear understanding of costs.

- Furthermore, GCs only bid what they see in drawings.

In the fight to get low (to win the work), GCs are forced to forget what they know. The strategy is to win the work, and then manage change to make a profit.

Another option is available

There is an upgrade available to this methodology – hiring both the designer and GC, simultaneously (under one contract) i.e. design-build. A large study completed by Penn State University compared different methods to deliver construction across the US. Their research uncovered projects using design-build had lower cost (over 6% in savings) and were completed 33% faster. Furthermore, projects using design-build (hiring one firm to design and construct) were also much less likely to incur cost growth (5% less) and schedule growth (11% less) – FEWER CHANGE ORDERS!

Faster. Lower Costs. Fewer Surprises.

Design-build was created to deliver projects faster by overlapping phases of design and construction. So speed to market deals with opportunity cost. The other key benefit is getting constructability input on the front end to nail down costs, schedule, and reduce as many surprises as possible. When we created our company 13 years ago, we had several options available to us. However, we chose design-build because we understood how important cost, quality and schedule are to banks and credit unions.

In fact, over our last $100 million in construction projects – encompassing 25 states – our change orders average less than 2.45%.

Design-build delivery allows us to partner with our clients, not compete with them on costs. And that partnership is producing greater certainty and predictability to their business.

Banking today is very different than in the past. Risk is everywhere.

But you can quantify the ROI for Branching.