Designing Your Branch Prototype: Creating a Future-Proof Banking Space

- Banks

- Branch Transformation

- Credit Union

Categories:

A space says more than a thousand words, and your credit union branch prototype says a lot. In the ever-evolving landscape of credit union retail banking, your branch serves as the physical embodiment of your institution’s identity. A well-designed branch not only attracts new members but also nurtures existing relationships. It’s a space where face-to-face interactions occur, complex transactions are handled, and solutions are provided.

In this digital age, the branch remains a critical avenue for delivering the human touch that digital channels simply cannot replicate. As you consider reinventing your brand and enhancing your member experience, one vital strategy is the creation of a new branch prototype.

The Role of a Credit Union Branch Prototype in Modern Banking

Your branch isn’t just a building; it’s a strategic asset that showcases your brand, culture, and commitment to member service. A well-executed prototype branch serves as the foundation for your entire network, ensuring consistency and efficiency across all locations.

At LEVEL5, as leaders in credit union branch design for over 20 years, we emphasize the significance of a new branch prototype. The majority of our projects center around this concept.

Identifying the Need for a Branch Prototype in a credit union

The decision to develop a retail branch prototype arises when you seek a comprehensive and uniform approach to optimizing your branch network. This extends beyond new market entries, encompassing your existing branches in need of rejuvenation.

Often, established credit unions and community banks find themselves with multiple locations that lack engagement and alignment with their brand. A prototype offers a solution, breathing new life into tired spaces and setting the stage for future growth.

The Development Process

Creating a successful branch prototype involves a meticulous development process that caters to your institution’s unique needs, goals, and brand identity. The journey begins with an in-depth Programming and Visioning phase, where you collaborate closely with key stakeholders. During this phase, you uncover critical insights into your institution’s requirements, retail strategies, influences, and brand elements.

Once this foundational knowledge is gathered, the next step is synthesis. Our skilled designers work to weave these elements into a cohesive and functional design. The resulting prototype branch includes:

- Structural outlines and preferred technology

- Thoughtfully curated design choices

- Integration of banking equipment and brand deployments

- Incorporation of iconic elements

- Attention to details like furniture style, tile selection, and carpet color

This comprehensive approach ensures that every aspect of your prototype branch aligns seamlessly with your institution’s vision.

Flexibility And Adaptability

One of the remarkable benefits of a well-designed branch prototype is its adaptability. The prototype serves as a template that can be tailored to various needs, which saves time and costs on re-designing from scratch. This adaptability extends beyond replicating the prototype in new locations. You can seamlessly translate the standard-sized floor plan into:

- Micro branches

- Standalone kiosks in smaller towns

- Adaptation for regional offices and operational centers

This flexibility ensures that your branch design components and member experiences remain aligned with your strategic goals no matter where you are meeting your members at.

Embrace the Future with Your Branch Prototype

In an ever-changing banking landscape, where technology and member expectations evolve rapidly, having a modern branch prototype ready for deployment is a forward-thinking strategy. It’s a blueprint that accommodates growth, adapts to changing market dynamics, and ensures your branch network remains a relevant and vibrant growth asset.

Embark on Your Branch Transformation Journey

The role of the branch cannot be underestimated as you contemplate your credit union or bank’s future. It’s not just a physical space; it’s a strategic touch point that connects your institution with its members. Embracing a branch prototype approach, backed by a team experienced in design and implementation, can reshape your institution’s identity, enhance member experiences, and set the stage for sustained success in the dynamic world of banking.

Don’t hesitate to reach out to our team to discuss how a new branch prototype could transform your institution. With decades of experience in implementing effective and visually stunning branch design templates, we’re ready to guide you on this exciting journey toward branch innovation and excellence.

How to Choose the Perfect Location for Your Credit Union or Bank Branch

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

Categories:

a data-driven branch strategy approach

Selecting the ideal site for your credit union’s or bank’s next branch is a critical decision that can significantly impact your institution’s long-term success. Gone are the days of relying on intuition alone; today, financial institutions need to use data-driven strategies to make informed choices.

At LEVEL5, we understand the importance of coupling data with our Branch Site Selection services to provide well-informed, actionable recommendations. In this article, we’ll explore why it’s crucial to let the data dictate the right location in your trade area and how partnering with a developer-minded firm like LEVEL5 can lead to the best results.

Data-Informed Branch Site Selection: More Than Drawing a Circle on a Map

Simply drawing a circle around a location on a map based on gut feelings won’t guarantee the best site for your next credit union or bank branch. Accurately assessing growth markets requires a comprehensive analysis of multiple data points that leads to a quantifiable recommendation.

However, while having data pointing to a specific site is essential, it doesn’t guarantee the availability of suitable locations in that area. That’s why LEVEL5 synthesizes our data strategy with our vast real estate acquisition experience and capabilities.

Aligning Strategy with Actionable Branch Site Recommendations

Data without a clear strategy is meaningless. Paying for data analysis is only valuable if it leads to actionable insights. We combine our Site Selection services with the data obtained during our Branch Market Analysis Strategy sessions so that we only recommend prime sites which can be acquired.

This integration ensures that the locations we recommend not only meet the data criteria but also align with your defined business strategy. By fusing data and strategy, we present you with workable options that truly support your long-term growth goals.

The Benefits of a Developer-Minded Branch Network Partner

Choosing a site is about understanding how the chosen location fits into your long-term plan. That’s why we think of ourselves as developers with your overarching plans as the goal, not mere brokers. Our approach involves a thorough assessment of the geographies and available options within a given trade area.

Moreover, we overlay the Credit Union or Bank Branch Design types that best suit the specific location, directly aligning with your 10-Year Branch Pro forma developed during the Strategy phase. This approach ensures that the site chosen will indeed support your long-term objectives.

Location, Location, Data-Driven Action: Partner with LEVEL5 for the Perfect Credit Union or Bank Branch Site

Selecting the right site for your branch or headquarters is a critical process that requires more than just intuition or simple mapping. A data-driven approach, coupled with a clear strategy, is essential to making informed and actionable decisions to grow your branch network.

At LEVEL5, we bring you the expertise of a developer, not a broker, as we assess geographies, identify suitable options, and align them with your long-term goals.

Let the data guide you to an optimal site and work with a partner who understands your unique needs. Contact LEVEL5 today to ensure that your financial institution makes the best location choices for sustainable growth and success.

Core Deposit Growth Strategy: Part 1

- Consulting

- Credit Union

- Retail

Categories:

Understanding Historic Trends is Critical for developing & executing strategy for core deposits growth

This is part 1 of a 3-part series to help credit unions develop effective, long-term strategies to grow core deposits.

What Was the Financial Industry seeing in historic trends for core deposits in January 2000 and How Has it Affected Today?

Let’s set the stage by thinking back to January 1, 2000. We all awoke with a wary eye. Had our efforts to ensure all our electronics were Y2K compliant succeeded? Or had civilization imploded at the stroke of midnight due to a glitch that the earliest programmers never envisioned? The glow from our bedside alarm clocks gave us a glimmer of hope. When our trusty coffee makers bubbled to life, we began to rest assured that life would go on indeed.

When we were in our “just glad to be alive” moment, we couldn’t imagine the changes that the next twenty-plus years held for our economy and the financial services industry.

Strategies for the Future of Financial Services Should be Informed by the Past

Although the economic shifts in the last 2-3 years have appropriately created a growing level of concern for credit unions, additionally considering the past two decades puts today’s financial landscape in clearer perspective.

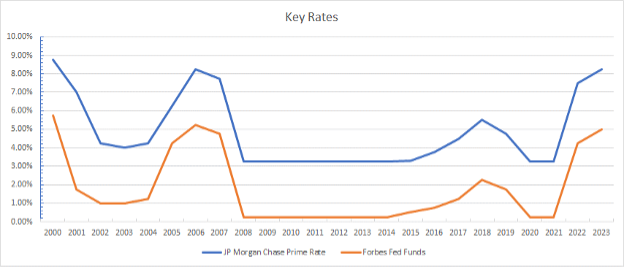

A review of the prime and Fed Funds rates will give us insight into the challenges we’re facing today.

Following the dotcom boom and Y2K was the dotcom bust. Then the horror of 9/11 weighed in and rates headed for the cellar.

The economy regained its strength, largely led by a housing boom, and rates went up.

Then, like a lightning strike, the housing bubble burst, and we found ourselves in the “Great Recession.”

This resulted in a protracted period of unbelievably low rates. Again (and predictably) home prices started to rise, and rates were adjusted upward. Then came COVID, and the rates were pushed back down to their historic lows.

Eventually and thankfully, the pandemic subsided, but we were faced with “new normal” conditions—just to name a few examples, remote work became more of the norm, retirement/resignations spiked, and a blistering housing market ensued. In response to this “new normal” the Federal Reserve instituted fast-paced, significant rate hikes to the point that nothing about our economy seems certain.

How Did We Get Here?

It’s clear that the season of very low rates resulted in a readjustment in personal and corporate budgets. Low rates made everything more affordable and we adjusted our sails to take advantage of the favorable breeze.

For the financial services industry, there is a renewed focus on core deposits. Why? The low-interest rate days are gone and unlikely to return. Borrowing to fund lending is significantly more expensive.

Further, borrowing of any sort is more expensive, which threatens loan demand. Highly-driven lending teams are constrained by the institution’s ability to fund loans and maintain adequate spreads.

This is all brought up to make this point…There are banking professionals in the industry who have 15 years of experience on their resumes but have never experienced a “normal” rate environment. It’s not their fault—they couldn’t choose the year they were born!

BUILD WITH CONFIDENCE

Put LEVEL5’s proven expertise to work for you. De-risk your future growth with the strategy, technology, site selection, design, and build services you need to launch the next phase of your credit union’s branch network.

Our Team Helps You with Core Deposit Growth Strategy in Today’s Market

Given the current economic landscape, now is certainly the time to reexamine your credit union’s strategic planning for the long-term. In many ways, the conditions that threaten the industry are more of a “return to normal” adjustment than a doomsday scenario.

To find solutions to guide us into the future, we need to understand more of the industry’s historic response to similar conditions and return to some tried-and-true long-term strategies for sustainable growth.

What are those strategies? That’s what we’ve covered in the next parts of this series.

Growing Core Deposits Blog Series Part 2 ➝

Growing Core Deposits Blog Series Part 3 ➝

Have questions today? Please contact us! For over 2 decades, LEVEL5 has developed winning credit union growth strategies through every ebb and flow of the economic landscape, so you can certainly say we know a thing or two about charting a course for a healthy future.

Branch Optimization: Choosing the Right Path for Long-Term Success

- Branch Transformation

- Consulting

- Data

Categories:

increase Growth and Profitability with curated branch network strategy

What is important in branch network strategy?

When it comes to strategically managing branch networks, financial institutions face crucial decisions about whether to keep, remodel, relocate, or close branches. These decisions can significantly impact growth and profitability over many years. While data plays a vital role in informing these choices, there are several factors to consider beyond mere numbers to ensure your resources and efforts are allocated correctly for healthy growth.

In this article, we delve into the strategies for making the right decisions and highlight the importance of strong leadership in shaping a successful credit union or bank branch network.

The Four options

Keep: Identifying High-Performing Branches

Identifying branches worth keeping involves a comprehensive assessment that goes beyond immediate performance. It requires evaluating various factors such as financial benchmarks, forecasts, and environmental considerations.

By examining both internal and external data, financial institutions can determine branches that not only perform well in the present but also show promising long-term potential.

Branch Remodel: Breathing New Life into Branches

Sometimes, a branch in the right market may experience a decline in performance. Instead of closing it outright, a remodel can be a viable option.

how the remodel helps

Through incorporating new technologies, design elements, and layouts, financial institutions can rejuvenate the member experience and attract and engage more customers with a fresh and modern ambiance. An updated branch remodel design enables them to tap into the untapped potential of existing locations.

Relocate: Unlocking Potential through Strategic Moves

Under-performing branches in suitable markets might benefit from relocation. The decision to move can arise from factors such as branch type, traffic patterns, or location restrictions.

data for relocation

Analyzing external data, including market trends and demographic information, helps financial institutions identify areas with greater growth potential.

By strategically relocating branches, they can leverage favorable conditions and improve overall branch performance.

Close: Making Tough, but Necessary Decisions

Closure is a challenging decision for any financial institution. However, there are instances where it becomes necessary to maintain the network’s performance. Branches that not only underperform but also adversely impact the entire network may require closure. Strong leaders must rely on internal and external data to make the tough call of closing branches that are no longer viable.

Work with Credit Union & Bank Growth Consulting Experts

Effective branch management involves making strategic decisions about keeping, remodeling, relocating, or closing branches.

In the dynamic landscape of branch network management, making informed decisions is vital to maximizing your credit union’s or bank’s growth and profitability. Financial institutions need a partner that can provide expert guidance and data-driven insights to navigate the complexities of keeping, remodeling, relocating, or closing branches.

That’s where LEVEL5 comes in. As a leading growth consultancy and best-in-class branch design and construction firm, we’ve specialized in branch transformation for over 20 years, offering actionable, comprehensive solutions tailored to the unique needs of financial institutions.

Contact us today for help making your branch network optimization a success!

3 Reasons to LAUNCH: Discover

- Announcements

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Leadership

- Retail

- Services

Categories:

We Have Liftoff

LEVEL5 is excited to help your FI with your growth initiatives in 2023 and beyond with our LAUNCH Program.

We’ve built this phased approach to assessing and launching your growth strategy around the methodical steps aimed at uncovering the challenges getting in the way of your Credit Union or Bank achieving its objectives and goals.

Phase I: Discover

The first phase in. our LAUNCH Program is called “Discover” – when our relationship will begin with a casual conversation, no more than 30-minutes, where we simply have a chat.

In this discussion, we’ll go over our services and background – but this phase is frankly about you. We’ll want to know about your FI’s history, your place and positioning in the communities you serve, and most importantly, current state versus desired state.

Your “Current State” is where you are today – number of branches, trade areas, assets, branch type mix, and of course, your member/customer base.

Your “Desired State” is where you want to be – expansion plans, asset goals over the next 3-5 years, thoughts on branch types, hub & spoke models, as well as any M&A’s that may be in play.

From here we’ll start to discuss next steps. Most importantly, we’ll need to uncover what is getting in the way of you executing and achieving your goals. That bridge from here to there is typically full of roadblocks, but that’s where LEVEL5 comes in.

Why LAUNCH At All?

The LEVEL5 LAUNCH Program follows a methodical, yet casual approach to uncovering the critical needs of your Financial Institution. Through a series of easy discussions, our team will be able to capture your goals, but also understand what is getting in the way of you achieving them.

From there, we’ll be able to move into the other phases of the LAUNCH Program and make actionable recommendations on how to execute to these goals.

To learn more about our LAUNCH Program, and to schedule your first “Discover” call, contact us today to get going.

The Branch and Its Zones

- Banks

- Branch Transformation

- Brand Deployment

- Credit Union

Categories:

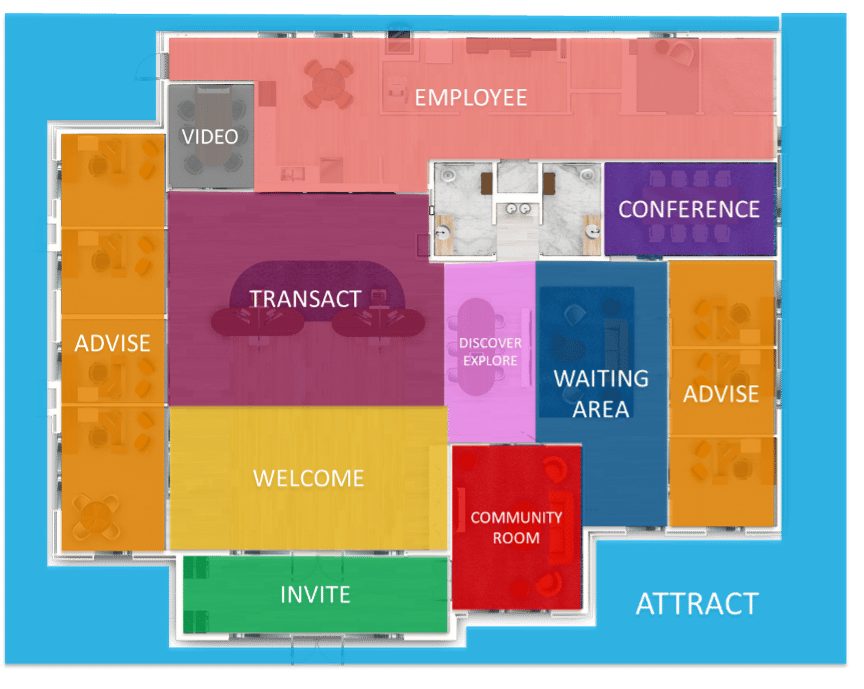

In order to ensure that your branch runs as efficiently and effectively as possible while also meeting your members’ expectations, you must consider the Branch Zones and how your floorplan is built strategically to support those zones.

This will make or break the Member Experience in your branch.

The branch zones determine the function of each section of the branch, beginning from a warm entrance, to advising, transacting, and even providing places to rest and reenergize. Every single part of the branch should be built purposefully with strategy behind the design and elements in each area. Not only that, but they should also be built to optimize member and employee directional flow according to their placement next to each other.

A correctly-zoned credit union or bank branch prototype design is vital for a positive overall Member Journey as it fosters seamless and logical progression from one space to the next.

This strategy provides your members with a nearly effortless and intuitive visit into and throughout your branch, making it easier for them to achieve their financial purposes and goals with your team and more enjoyable for them to return again and again!

Use the graphic above to reference as you read more about each zone and its purpose.

ATTRACT ZONE

This first zone is the exterior of your branch. It not only includes the building façade, but the entire property as well, which will likely include road signage, drive-thru, directional signage, and landscaping. This zone should work for you 24/7, day and night.

Key Elements:

- Road Signage

- Building Signage

- Nighttime Illumination

- Iconic Design Elements

- Entry/Exit Points

- Directional Signage

- Drive-Thru

INVITE ZONE

This zone is the first entry point of the branch, also referred to as the vestibule. This zone may include double entry doors, 24-hour ATM/ITM’s and be well-lighted for nighttime use.

Key Elements:

- Card Entry

- Lighting

- 24-hour ATM/ITM

- Branding

- Marketing Signage

- Branch Hours

- Music

WELCOME ZONE

The Welcome Zone is the first zone of the main branch. It should have key lines of site to employees and other, easily accessible zone through the branch. This is also a key point for visitors to be welcomed and directed to their needs.

Key Elements:

- Well-lighted

- Cleanliness

- Visibility/Good Lines of Sight

- Digital Signage

- Branded graphics

- Iconic feature

- Universal Banker/Greeter/Concierge

TRANSACT ZONE

Likely the anchor point of your branch, if not the traditional purpose of a customer or member’s visit. Can be the central design element, or off-set based on strategic intent.

Key Elements:

- Teller Pods

- Traditional Teller Lines

- Drive-Through Screens/Tubes

- Cash Recyclers

- ATMs

- ITMs

- Assisted Self Service

DISCOVER/EXPLORE ZONE

This is a multi-purpose zone meant for self-discovery of products and services, while also acting as an informal location for onboarding and semi-private advisory sessions.

Key Elements:

- Touchscreens (Large Format and/or Tablets)

- Digital Signage

- Tech Bar

- Consulting/Engagement Fixtures

- Marketing Collateral (Traditional or Digital)

ADVISE ZONE

A critical branch differentiator when compared to digital channels, the Advise Zone affords opportunity for in-person dialogue, counseling and advice and acts as an important component in account openings, cross-selling and thus share of wallet.

Key Elements:

- Consulting/Engagement Fixtures

- Offices

- Computers/Touchscreens

- Digital Signage

- Traditional Signage

COMMUNITY/CONFERENCE ZONE

Whether combined for smaller footprint branches, or as separate zones/rooms for larger square-foot branches, this zone acts as an opportunity for employees to huddle and meet, whether they be branch staff, or those from corporate using the rooms for miscellaneous meetings. Additionally, the room can be offered to the community as a gathering place, which can be booked independently, with it also having an “off hours” entry point for non-employees.

Key Elements:

- Digital Signage

- Two-Way Video

- Table and Chairs

- Community/Branded Wall

VIDEO ZONE

A smaller room suited for a customer or member to communicate with a “remote expert” via 2-way video.

Key Elements:

- 2-way video (camera & screen)

- Remote Expert at secondary location

- Room for several customers & Employee

- Can act as secondary office

EMPLOYEE ZONE

Also considered “back of the house” for employees, this zone will likely the critical elements for an employee’s need before and after work, as well as during lunch breaks.

Key Elements:

- Tables

- Lockers

- Quiet Room

- Refrigerator

- Kitchenette

- Tablets/Computers (personal use)

Contact LEVEL5 to enhance your Credit Union or banking member experience!

A seamless, interactive journey throughout the branch is imperative to take care of your members’ needs. They want to be comfortable with their financial institution, knowing that they can trust that their finances are in good hands, and the first step to building trust is creating a high quality, unparalleled in-person branch user experience.

Here at LEVEL5, we understand the importance of the Member Journey. It is an undeniably important concept to consider when we design and build credit union and bank branches for our clients. We have the years of experience needed to execute this strategy, enhancing your branch in your network with a modern, effective floorplan zone that speaks to your members’ needs.

Contact us today and find out how we can help you!

Crystal Ball 2022: The Full Series

- Branch Transformation

- Retail

Categories:

For those who have read the entire series thus far, or for those who may have missed a week, but are looking for a consolidated version, this is the version for you.

Below, we present our combined 4-part Crystal Ball 2022 series.

Part 1 – Costs Continue to Rise

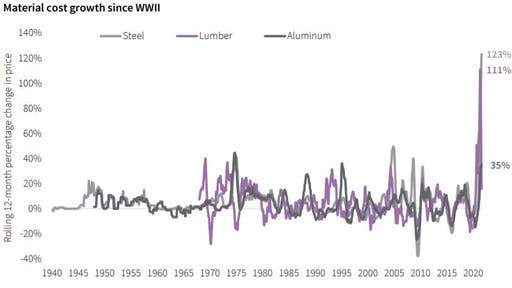

While indicators seem to be pointing to a “recovery” from the pandemic, such as employment rates, and even total cases per day/month, one of the lagging hangover effects that has not begun to ease are construction costs.

One of the impacts of the pandemic, foreseen or not, was the spike in construction across the board, both residential and commercial.

As seen with the below graph from the U.S. Bureau of Labor Statistics, costs of materials have not only spiked, but are also the highest since World War II.

Regardless of prices, this has not translated into construction projects being put on ice – quite the opposite.

Cranes are flying over downtown skylines, and residential neighborhoods are replete with both new homes, remodels and extensions.

So what does this all mean for a Bank or Credit Union who is looking to grow, and looking at the branch as a main driver of this growth?

It comes down to a matter of investment.

While it may cost “more” to build a branch compared to pre-pandemic cost structures, if it’s growth you seek, and it can only/mostly be done via new members bringing in new Loans and Deposits via a new branch in a new Trade Area, you have to ask yourself if it’s worth the investment.

Wayne Gretzky famously said, “You miss 100% of the shots you don’t take.”

In banking growth terms, this quote can be translated into the simple economic situation of needing to invest to grow, or, “you have to spend money to make money.”

Material costs are predicted to rise, or stabilize at least through the first half of 2022, but what is the trade off of NOT doing anything? How can you value being stagnant, and how do you justify to the board to sit and wait for an unknown “cost” future?

The reality is, for a Bank or Credit Union looking to grow, you act now.

So, how do you counterbalance higher material costs for optimal margins?

Economies of Scale

Typically, when LEVEL5 begins a client engagement, the discussion of a branch is never singular, it typically involves 2 or more branches, even if the schedules for the builds is over a 12-36 month period.

If the plan is to indeed design and build more than one branch, buying the raw materials in advance will yield savings, and aid the overall margin.

Labor Discounts

Deals on labor can be had when multiple projects are happening either concurrently, or successively.

As the General Contractor, LEVEL5 has existing relationships with different Trades (sub-contractors) across the country, and have had success in booking these Trades for multiple jobs. This aid the sub-contractor, who can keep their workers engaged for longer.

Real Estate/Site Selection Transactions

LEVEL5 has been acquiring land and buildings for clients for over 20 years. In doing so, we veil your identity during the negotiation phase. The reason this is important is because in doing so, we have more negotiation power, and often save our clients up to 18% on the transaction price – helping your bottom line.

Time is Money

The other benefit of working with LEVEL5 when it comes to overall cost is the savings you’ll get from working with a proven national General Contractor. In today’s economic climate, the supply chain is compromised and there are labor shortages – both of these typically mean that a standard construction job inevitably is going over on schedule – and added time is added money.

We have been successful in queuing up work well in advance, which is why we subscribe to the “Design-Build” philosophy, not Design-Bid-Build.

Design-Build forecasts materials and labor during the planning stage. When things are known and predicted up front, plans can be made, and money can be saved.

Part 2 – Supply Chains & Trades Issues

While the pandemic seems to be drifting away, at least in its economic impacts, construction materials supply chain problems and availability of Subcontractors will continue to remain a challenge to credit unions and community banks looking to open a new branch in 2022 or 2023.

A critical component to executing a Branch plan is to have the right partner on your side.

Advance Planning, Advance Savings

During the past 2 years, more and more of LEVEL5’s clients have been opting for advance design and planning of multi-year, multi-branch rollout strategies for their prototype branches. We believe this is happening largely because the antidote to such an unpredictable construction landscape is predictability that translates into advanced planning with the benefit of cost savings.

So how does working with our team help you plan for the future and reduce your spending?

Establishing a supply chain means that you have a defined product to execute upon. Let’s use a branch prototype as example. Once you’ve worked with LEVEL5 to design and finalize your prototype, this means that you’ve already specified materials needed for the majority of your branches. At this point, our team can work proactively with different manufacturers, subcontractors, suppliers for furniture, equipment, fixtures and so forth.

This advanced heads-up will give our sourcing partners an upfront and predictable way of understanding allocation needs. It will in turn helps to bring down prices for you.

The Design-Build construction method allows you to make material selections based on current availabilities. We factor this in with you in the design process.

Conversely, in the Design-Bid-Build process, a stand-alone architect designer may not be as privy to current materials costs in the design stages. Not being able to account for fluctuations here can result in unexpected costs once bids are turned in.

Think of the saying “knowledge is power.” In this context, we’re talking about the knowledge of future needs. It is a power that keeps costs down for your financial institution.

As you can see, advanced design and planning of rollouts can certainly drive down cost.

Knowing Costs Now Helps You Make Better Business Planning Decisions

To your advantage, you have an annual business planning cycle that needs to be built on sturdy information.

Once your professional credit union and bank consulting is complete, you’ve decided on the prototype and strategy. Then, we supply you with an accurate price estimate on your new branch or branches.

Having an accurate estimate now takes a huge unknown out of your organization’s plans, giving you more assurance and a realistic scope of your budget. It also allows you to make effective projections and preparations for changes in personnel at varying locations.

Secure Necessary Subcontractors Amid Shortage & Strain

Subcontractor labor shortages have been an issue even before the pandemic. Think all the way back to the great recession in 2008. But now, it’s become even more strained due to the aftermath (or continued impact) of COVID-19.

Because of these circumstances, the ability of your General Contractor to secure the right kind of Subcontractors for your project will only become more difficult the longer you wait to get things started. Less time to plan ahead and communicate properly with Subcontractors on their availability can cause obvious hurdles for your goals.

This goes for both singular branch builds and multi-branch rollouts. However, we want to note that Subcontractors will be more aggressive sometimes. For example, bidding and staffing for projects that are part of an integrated/multi-location rollout will be aggressive. A one-off branch project will be much less so.

Regardless of the branch rollout volume, you can see how moving forward with long-term action now will put you in a preferable spot. It will minimize unknowns in both project staffing and pricing.

Don’t linger too long when making growth decisions – it could cost you greatly in finances, stress, and timeline goals for your bank or credit union.

Part 3 – The Branch Lives

Gone are the days of industry commentators preaching “the branch is dead!” and gone are the talks of moving to solely digital platforms (we hope, we think, but probably not).

Long live the branch!

Let me explain:

The Surprising Aftermath of an ongoing Pandemic

Long ago, in the ancient days of 2018 and 2019, the percentage of people using branches was declining. In 2010, 83% of people surveyed said that they visited bank or credit union branches at least once a month. That number steadily declined to 70% and 69% as mobile and online banking steadily increased.

Everything changed when the pandemic hit. For a brief time, branch use obviously hit an all time low as the whole world shut down. Then, the strangest thing happened. As the world hesitantly began to open back up, as stimulus checks were sent out, as FDA-approved vaccines rolled out, people stepped back out into the sunlight. People not only started visiting branches again, but they started visiting them even MORE than before. In 2020, it was reported by the Fiserv company, Raddon, that 77% of consumers went to a branch at least once during the pandemic.

Despite the health risks of going in public, despite business shutting down, and despite the convenience and rise of mobile and online banking on top of all of that, the branch prevailed. People WANTED to leave the house and go interact with other people. People craved that human interaction.

The New Branch

Now, don’t get me wrong, digital banking is still rising and will continue to rise. But the rise of digital does not have to mean the death of the branch. They are not mutually exclusive. In fact, for either of them to work to their fullest potential, they must support each other. While mobile banking rises, brick and mortar will also rise. It might not be the traditional physical building that you’re used to, but it’s a physical building nonetheless. There’s a new branch in town.

Your branch locations must be used to fill the gaps that mobile leaves. This means the human element to branching is imperative. When a modern-day consumer walks in the branch, their first touchpoint should be a human one inquiring about their needs. After that, they can move either to the transactional zones of the branch or the advisory.

We’re finding more and more that people are coming in less for the teller lines and more to sit down in a private office to talk to someone about their finances. Now, they want to walk in the branch, tell an advisor about their financial goals, and plan a strategy to meet those goals. They want to learn about the different types of credit card programs you offer and discuss which one would best fit their needs. They want to learn about your high-yield savings account and how to properly invest their money. Some of them are buying houses and want to know about their mortgage options.

Even if they do want a transactional process done, many times, they’ll head straight to the ATM’s or ITM’s. As popular as mobile has and will continue to become, you’ll never be able to withdraw cash from your phone. At a tech table, a consumer might want to use a tablet to go through the steps of opening an account. You might ask yourself, “Why would they do this at a branch when they could go through the same steps on their phones?” Well, it might seem the same, but again, that lacks the human component. if they wanted to open an account quickly on a tablet inside the branch, they would also be able to ask questions to the nearest teller about the different types of accounts and which of them best suits their needs.

Your consumers cannot have the same level of security in informed decision making from their couches.

Whatever reason the modern consumer has for needing brick and mortar branches, there’s no denying the existence of that need. The people have spoken and the branch is here to stay.

Part 4 – The Branch Strategy Shift from Transactional to Advisory

Last week, we predicted the importance and need for the branch in the year to come. This week, let’s talk about the why and how of it all.

The Shift is Happening

While it is true that the branch is indeed alive and well, it is also true that the branch we used to know and love has irreparably changed. A study done by Raddon right before the pandemic surveyed consumers on their branch preferences. The results showed that when it came to the older generations, they did prefer those traditional branch layouts with the teller lines and transactional components. It’s what they were used to and knew how to use. When it came to Millennials, however, the results told a different story. The study showed that Millennials preferred very technology-oriented branches, and/or the “coffee bar” model of branch.

The technology focused branch is the branch that you walk into to see digital screens around, displaying local news, the weather, the stock market trends, advertisements about products that the financial institution is offering, and events in the area. It holds interactive teller machines and a tech table with tablets for consumers to use for transactional needs. The rest of the branch, then, is for advisory offices and maybe a teller pod or two.

A Cup o’ Coffee for Your Thoughts

The “coffee bar” branch is the branch with an attachment of a Starbucks, a Peet’s coffee (if you’re Capital One Café), or a local café that the financial institution is partnered with. That’s the branch that you, as a consumer, can visit to enjoy a coffee and dessert while you take out a car loan or open a new account. It can be a convenient place for students to go to for financial advice or to begin the learning process for the upcoming adult responsibility of money. Then, they can stay for the coffee and snacks with peace and quiet while studying.

The existing Capital One Café is the perfect example of this. In order to be successful, these branches are conveniently located and strictly advisory.

Both branch types represent solutions to needs that mobile banking does not and cannot fill. Millennials are no longer those kids that can’t get off their phones. They are now financially independent adults with careers, families, and homes. They are now thinking about how they can move up in the world and this means investing their money, taking out car loans and mortgages, creating financial strategies, and even planning early for retirement. Properly designed advisory branches are the perfect (and only) fit for those needs.

A Strategic Plan First

Now, that’s not to say that every single traditional branch must be shut down immediately. You must root every decision in strategy. You must take a look at your branch network, target markets, and consumer demographics before making the decision of what type of branch you need in each area. The market surrounding a college campus would benefit a lot more from the “new” branch than the market surrounding a retirement community, for example.

Lucky for you, LEVEL5 has the leading Market Analysis team for Financial Institutions in the country. Our experts will evaluate the relevant data to draw conclusions and then align them with your strategies and goals. After that, we can come up with a game plan together and begin the execution.

Whew, that was a lot. But good stuff, right?

Contact Us today to discuss any items herein. We’ve been future-proofing growth plans for Credit Unions and Banks for twenty years, helping our clients grow at twice the national average. It’s time you work with LEVEL5.

2019: Year Half Over and Glass Half Full

- Branch Transformation

- Consulting

Categories:

Let’s look back on the first half of 2019, and then we can look ahead.

With 2019 now half over, we thought it might be worthwhile to revisit The Financial Brand’s article from the beginning of the year entitled, “Top Branch Trends for Banks and Credit Unions in 2019” and see if the commentary outlined in the article is still relevant. How is Branch Transformation taking hold at the mid-point of the year? Has the commentary held true? What does the (near) future look like?

Branch Closures

Our newsfeeds are still dominated with the announcements of branch closures. This may spell doom and gloom for an industry continuously accused of not modernizing fast enough for the evolving consumer sentiment, but the “death of the bank branch” is not really the story here. Under the catchy, clickbait-oriented closure headlines, the real story unfolds, telling of consolidation as a result of mergers and acquisitions and/or due to branch relocations. In fact, just under the branch closure articles may very well be a companion article talking about branch expansion.

Branch Expansion

The big banks (large national brands and dominant regional players) have announced aggressive expansion plans at the onset of the year, and those announcements haven’t died down at the year’s mid-point.

On the coattails of Chase announcing aggressive plans to expand into Philadelphia, the Financial Institution announced this Spring to open nearly 100 new branches across 9 major metro areas.

And now, Chase has just announced their new New York City Flagship Branch, meant to be the epitome of how they intend to do brick and mortar banking from here forward.

Along those lines, community banks and credit unions continue to look towards aggressive expansion plans, despite the shadow of digital banking, the allure of digital-only banking and the fear instilled in all of us when doom-and-gloom articles speak of a possible recession, etc.

In fact, here at LEVEL5, our Consulting and Real Estate divisions have never been busier. John Hyche, an industry expert often quoted in The Financial Branch article, has seen the expansion trends materializing and his book of business has never been more full. As cited in the article, one of the key drivers in community bank and credit union expansion is the evolving shift in Demography.

Demography Shifts

One of the main reasons we’re talking about expansion plans with our clients is due to the shifting geographies and needs of banking customers. Since we are continually seeking to deliver on the financial needs of the customers/members, we know that location is key and opening a new branch on the wrong street corner is a costly mistake.

It’s not even really about where things have migrated recently or currently. The proper approach to location selection is rooted in the right data approach to understand the need and identify not what’s relevant now, but what will be relevant tomorrow and in three years.

As stated in the Financial Brand article, LEVEL5‘s own John Hyche states, “Branches will continue to follow shifts in demography as new areas develop. These moves reaffirm the popularity and value of physical channels in establishing brand recognition and gaining market share.”

Branch Transformation

The final piece in this overall equation is to not turn a blind eye to trends, but to equally not rush into them haphazardly. The burden of the right digital approach is a heavy one for us all to bare, but purchase and implementation decisions shouldn’t live in a box. The right mix of Digital Signage, Full/Assisted Self Service, Kiosks, Tablets, etc. need to be deployed based on the right strategy and how they will ultimately help enhance the overall customer experience based on the way you do it.

If the year is continuing to take shape and you’re interested in learning more about branch expansion, branch transformation and the right approach, Contact Us today to get the conversation started.

Predictable Growth for Bank of Newington

- Announcements

- Banks

Categories:

Bank of Newington Brings “Full-Service” Banking to Springfield

Success in any business relies on focusing on what matters. Bank of Newington’s (Newington, GA) new Springfield Branch brings full-service banking to its customers and community. The Bank partnered with Atlanta-based LEVEL5 for the site selection (consulting and real estate) and design-build (design and construction) of the branch.

Tripp Sheppard, President of the Bank said, “When we decided to expand via branching there were two driving factors. First, how would a new branch impact our financial performance. And two, can we design and build it efficiently. The team at LEVEL5 addressed both objectives, simultaneously. Their consulting team built a comprehensive ten-year projection, so we could model the full impact of the branch on our balance sheet and capital. Second, they delivered the branch in less than 6 months.”

Mike Colvin, Executive Vice President and Principal said, “Community banks all across the country want to embrace “branch of the future”. What I am most proud of our team is we continue to listen to our clients, and deliver what they want and need.”

Mr Sheppard closed, “The LEVEL5 site selection and design-build team took a very complex process and performed seamlessly. We needed a turn-key solution and they delivered strong results for our Bank.”

Watch this video to hear from Trip and see the branch:

To learn how we can help you change your experience in the branch, contact us today:

Is Your Branch Strategy Keeping Up With the Jones’s?

- Announcements

Categories:

The Five Questions Every Banker Needs to Answer About Their Branch Strategy

The traditional banking business model of the past was built around a decentralized branch strategy. Find a heavily populated area, sprinkle a network of easily accessible branches around it, and watch the growth happen. Pretty simple, right?

It worked like magic.

The psychology behind putting branches everywhere was intriguing: more branches implied a bank was doing well, so one’s money was somehow more secure. It wasn’t necessarily true, but it still seemed that way. Then the Great Recession hit. The large banks initially took the greatest blow, shuttering branches left and right. Then regional players continued the trend, despite the economic recovery that followed years later. Banks chose to put their faith more in cost reduction than customer service.

Market density matters.

What could have kept some of these recently closed branches open? Why close so many, even in places where there wasn’t a lot of competition? Turns out, maybe the bank’s misunderstanding of market density came back to hurt them. Given these ever-changing times, what kind of density solution is required to be successful?

Banks, particularly the larger ones, often close branches, not because of a shift toward digital and mobile channels (it’s certainly a factor), but a failure to plan for them in the first place. Though customers demand omni-channel options, at times, they still desire face-to-face contact with their branch. The latest surveys show the branch is a key channel:

What happens when a branch closes?

Closing a branch is a short-term solution, that while saving money initially, has long term implications. Studies have shown that up to 40% of customers change banks if their branch leaves the area.

Before you build your next branch, consider the following questions:

- Does your branch need to be large or small?

- Should the branch be fully-automated, or mostly?

- How can the bank’s or credit union’s people be convenient to the customer?

- Does it have to be a freestanding facility?

- Is a branch even right for the particular area?

So what’s the answer?

Perhaps bigger banks have done a poor job identifying the opportunities in their markets. Branching today takes considerable planning and precision, and if not done well can lead to unprofitable locations.

Market densities matter and the deployment of the right density matters even more. Density solutions are important and they do not always result in freestanding branches, which can be short-term considering the expense and risk. It’s really about convenience for customers and their needs.