Bear State Bank Enters with a Roar

- Branch Transformation

Categories:

Bear State Bank enters with a Roar | $25 Million in Loans in the first year!

Bear State Bank headquartered in Little Rock, Arkansas, opened its first branch in Conway, AR with a big bear roar! The Bank acquired a vacated branch at the corner of Prince Street and Salem Road and worked with our LEVEL5 team to transform the branch from a traditional, stuffy environment into an open, modern and welcoming environment that is designed to transform the banking experience for its consumers.

The branch offers high-touch, personalized banking service to its consumers that includes a dialog tower (a kiosk/pod to replace the teller line), a waiting area with refreshment bar, flat screen HD monitors, technology bar and a “Community Wall” to highlight local events, activities and businesses. The design-build team at LEVEL5 also incorporated a Bear State Bank gumball machine into lobby design and customer experience.

The new Bear State Bank customer experience begins even before the customer enters the facility. The branch has a prime location, so the Bank’s team and LEVEL5 wanted to create a unique exterior element that would make a big impact in the Conway market. The Bear State Bank logo was a perfect solution that put the Bear State Bank ‘stamp’ on the renovated exterior of the branch.

“The feedback from the public has been very positive this past year. The friendly and inviting environment has people staying inside the doors a longer period of time, giving our team the opportunity for further conversations, and getting to know one another on a more personal level.” said Chad Russell, Conway Market President of Bear State Bank.

Shelly Loftin, Chief Marketing Officer of Bear State Bank stated, “Conway is a young and vibrant city with 3 universities. We wanted to make a splash in this market with our first location. LEVEL5’s experience in designing and building branches helped us create an atmosphere that allows our bankers to deliver a high level of personal service to our customers. LEVEL5 has been great to work with. They understand how to integrate new technology, and methods of constructing banking services in more open, contemporary and unique environments.”

The Branch opened last year and has $12 Million in Deposits and a $25 Million loan portfolio!

To view more images of this project click, HERE!

Branch transformation is an omni-channel experience because the focus is density. Density of the right kind of branches, automation and virtual channels. One of the newest kinds of branches is the Micro Branch.

What is a Micro Branch? Maybe this will help.

Ready, Fire, Aim! | Branch & Main Office Transformation

- Branch Transformation

Categories:

Expansion and loan growth lead to transformation.

The number one question we hear about branch and main office transformation is “What’s in it for us?”

This is an indirect way of asking about Return on Investment (ROI) for transforming their business. Discussions about loan growth, market expansion and the future of banking are about transforming the business to allow it to flourish and grow. All CEOs want to know what’s in it for their company if they invest in growth.

Question #1 – How do you calculate returns for transformation?

To solve ROI for transformation, we divide the Return by the Investment. So, the first variable to solve for is return that is the opportunity. Opportunity is what we get from a market for the investment. Therefore, return is defined by the loans and deposits (i.e. opportunity) resulting from a project. Historically, our consulting team can quantify loans and deposits with 92% accuracy. How do they do it? Well, read more about it here:

Question #2 – How do you define the investment?

So with the opportunity quantified, the cost to acquire the business is a major variable yet to be solved. The white paper linked below addresses the investment portion of the equation. This article is quick page-turner that will help you lower the risk of developing your next branch or main office. We all want the return, so maximizing the investment can be a reality.

Click on the target below to download the white paper…you won’t regret it.

Mazuma Branch of the Future

- Announcements

Categories:

Mazuma’s Olathe Branch Dismantles Traditional Banking

Mazuma Credit Union (Overland Park, KS) has chosen LEVEL5 to design-build their new Branch of the Future. The branch will be located in Olathe, KS near the Menards, and will represent the Credit Union’s newest approach to branch banking.

“We are very excited to be awarded this project,” said David Lapp, Senior Project Manager for LEVEL5. “The Mazuma Team is listening to their membership and responding with a brand-new member experience using the latest in-branch technologies.”

The branch’s retail lobby and drive-up will utilize Interactive Teller Machine (ITM) technology. Using in-branch automation via ITMs enables Mazuma team members to focus on relationship building and not simply transactions. Furthermore, using ITMs in the drive-up allow for longer hours to the community beyond traditional branch hours.

“For the Olathe Branch, we wanted to dismantle traditional branch culture and service models,” said Brandon Michaels, President/CEO of Mazuma. “For years, routine transactions have left the branch, but not the opportunity to serve members in ways that best benefit them.”

“The Olathe Branch is our latest move toward what our membership wants – convenience with maximum engagement. We worked with LEVEL5 for our headquarters facility built around a culture experience, so when it came time for the Olathe Branch opportunity they were our clear choice. Their expertise with credit unions and in-branch technology are big value-adds for our team.”

The Olathe Branch design is near completion and the project will break ground before the end of 2017. Construction of the branch will conclude in the Spring of 2018. The Olathe Branch is the fourth project LEVEL5 and Mazuma have partnered together.

The branch continues to thrive because consumers highly value human interactions. However, locating a branch is anything, but simple. A new approach to site selection is a key component to take branching from Good to Great.

Financial Resources FCU | Micro Branch of the Future

- Announcements

Categories:

Financial Resources FCU “Micro” Branch of the Future

Much is written about the “Branch of Future”, but a version of it may be in operation, today in New Jersey. LEVEL5 is proud to announce Financial Resources FCU’s new micro branch in Jersey City, NJ. This start-of-the-art branch focuses on automation and brand to serve its consumers and community.

The 1,100-square foot facility is located in the Newport Tower on Washington Boulevard near the subway. The branch is powered by NCR’s Interactive Teller technology, which allows the Credit Union to operate the facility 24-hours a day. NCR’s Interactive Teller machines (ITMs) provide the normal operation of an ATM, but with a video option that allows consumers to interact with a live representative.

“Advancements in retail technology, like ITMs, are allowing the community-based financial institution (FI) to compete, at scale with much larger FIs,” said Mike Colvin, Executive Vice President of LEVEL5. “Financial Resources has taken the next leap in consumer experience with this new branch allowing convenience, service and brand in a much smaller footprint.”

The branch’s two ITMs are connected via video back to the Credit Union’s call center. This allows the physical branch to operate with fewer staff, while consumers, using the ITMs, interact with live Financial Resources’ member reps in the call center. The in-branch staff, no longer encumbered by teller fixtures and balancing cash, are focused on service and sales to meet the needs of its consumers. In summary, routine transactions are handled more efficiently through technology, allowing for more complex interactions with branch staff.

Frank Almeida, COO of Financial Resources added, “Though routine banking needs are now being automated, we have found the human component to still be a primary need of our members.” Mr. Almeida continued, “The value of the branch and our use of ITMs is not to replace the importance of the human interaction, but to enhance convenience outside normal hours, and have the ability to provide depth for all their financial needs.”

The branch’s focus on convenience is also evidenced by the use of two-way video in the conference room allowing consumer-access to Credit Union specialist at other locations. Furthermore, the Financial Resource FCU brand is on full display throughout the space inclusive of video displays to educate consumers on how the Credit Union can integrate with their daily lives.

Mr. Almeida offered, “We chose LEVEL5 for our newest branch because they understand consumer experience, new branch technologies, and are experts in bringing together all of the components in the design-build of financial facilities.”

Smaller branches are not just a trend they are a new reality. Check out this new freestanding branch that is heavy on automation in a small footprint.

Branch of the Future | Farmers National Bank

- Announcements

Categories:

LEVEL5 Builds Branch of the Future for Farmers National Bank

Farmers National Bank (Danville, KY) has chosen LEVEL5 to design-build the Bank’s new Branch of the Future. The facility will be located off South Bypass in Danville, and will represent the Bank’s new approach to retail and commercial banking.

“We are very excited to be awarded this project,” said David Lapp, Senior Project Manager for LEVEL5. “The team at Farmers National Bank is listening to their consumers and community and responding with a brand-new customer experience focusing on engagement.”

The Bank will utilize the latest in technology and retail delivery methods in the branch (see fly through video below). The retail lobby will be serviced via cash automation and dialogue towers (teller pods) to create the opportunity for dynamic and advisory interactions between the Bank’s staff and its customers. The drive thru facility will utilize NCR’s Interactive Teller Machine (ITM) allowing for longer hours to the community. Farmers National Bank is the first bank in the area to offer extended hours through this technology.

“We are breaking the traditional banking mold in this move toward our Branch of the Future,” said Marty Gibson, President of Farmers National Bank. “For years, routine transactions have left the branch, but not the opportunity to serve our customers. We chose LEVEL5 to help us with our new branch because they understand the role of the Universal Banker, Retail Banking and are experts in bringing predictability to the design-build of branches.”

A ceremonial groundbreaking is scheduled for the end of March and construction of the branch is planned for completion in late Summer of 2017.

No Shortcuts to Transformation

- Announcements

Categories:

Re-thinking the branch, re-training the banker for transformation

Change is inevitable. The world we live in and the people we know change constantly. Businesses are changing as competition intensifies, technology accelerates and information moves at the speed of light. The world has transformed into a global economy, no longer bound by walls, geography or time. We are in an age where busyness is the norm, and we dictate our own realities by the choices we make…daily.

Who needs a branch anymore? For the community-based financial institution (FI), “the times” have changed them too. No longer can FIs rely on just branches, or just service to meet consumer demands. Today, we live in a world where consumers demand an Omni-Channel approach. Consumers demand automated channels, virtual channels and physical branches to meet their needs.

Branches are no longer one-size-fits-all. Branches today are still about convenience and market density, but each branch can and does fit a different purpose. Starting with the largest of all facilities, the cornerstone branch, which includes main offices, these large format facilities play a different role than others.

Where Community meets Technology. Today’s main office sets the tone for the company’s culture and identity. Furthermore, the rapid loan growth being enjoyed by FI’s across the country is causing ripple effects throughout the main office. Call centers in these facilities are changing. With the advent of Interactive Teller Machines (ITMs), community-FIs can serve their consumers 24-7-365, which means the call center is in the midst of transformation, now staffed with Universal Bankers who can be a one-stop-shop for the customer’s needs.

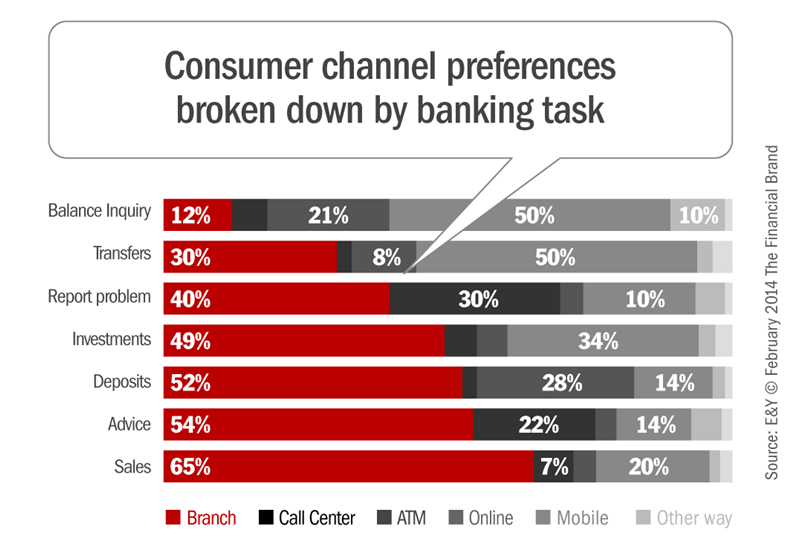

Engaging consumers. After all, building relationships are at the heartbeat of the Universal Banker model. Surveys show that 65% of sales occur in a physical branch, so the days of relying on a relationship built across three feet of mahogany are over. Today, banks are challenged with differentiating themselves and some are more aggressive than others in their use of technology, retail concepts and design to facilitate a more engaged consumer experience.

The people have spoken. Market research, customer concentrations and analytics now dictate how FIs should design their branches to relate to their markets. If the model is best supported by a teller line, then stick to that plan. If a more engaging environment, powered by technology is indicated, boldly adopt that plan. In all cases, the transformation of the branch is crucial to reach consumers.

When a big branch doesn’t make sense. The cost and time to implement branches has also given rise to the Micro Branch. Micro branches today still include storefronts and in-store branches, but can now also include mobile branches, freestanding facilities, and “pop-up” branches. The key component of Micro Branches are their size and flexibility as well as their cost.

How best to serve? In the end, banks and credit unions are faced constantly with decisions on how to serve their consumers, communities, and employees. Change is inevitable just for relevancy, but the FIs that are changing with a plan achieve specific results.

Proof that change can work. Based on FDIC data, one Southeast Bank grew organically from $1 Billion to over $3.5 Billion in the last five years by making branching decisions around a business case. Another FI grew its assets by 37% in the Carolinas over a seven-year period embracing technology and universal bankers. Still another near the Great Lakes moved its loan to deposit ratio from 88% to 92% in less than two years by implementing a more engaged branch culture.

The bottom line is the bottom line – transformation, driven by a well-devised plan and business case, succeed.

Improving your performance. In today’s ever-changing environment, financial institutions are faced with two opportunities for performance improvement:

- Their existing footprint

- Moving into new markets

The FIs that flourish, marry business planning and execution into a seamless model driven by a business case to maximize their investment and gain optimal returns for their stakeholders. Predictability, timing, risk management and engagement can all be folded together so the business, consumers and community win!

So, as you face the future, start making decisions and then take bold action. Over time, those actions lead to transformation…there are no shortcuts.

Financial institutions who do their homework are the ones best positioned to succeed in a brand new playing field.

Branch Transformation | An Omni-Channel Experience

- Announcements

- Branch Transformation

Categories:

A new distribution network emerges…Omni-Channel

Today’s financial services environment is characterized by change. The drivers of change include consumers, technology, and delivery systems. Moreover, financial institutions must change with these elements to remain relevant and competitive in today’s omni-channel economy. In addition, balancing service to younger and older segments and their preferences for how service is delivered will define success for the financial institution in the future – and keep in mind, that the customer is the judge of service quality.

Location, location, location

One of the biggest questions that we hear is, “How do branches maintain their relevance in an increasingly technological age?” Surveys underscore that 60 – 80% of new banking relationships are established through the branch network. Furthermore, a recent Ernst & Young study says 65% of sales occur in a physical location i.e. a branch. However, once the relationships are made, regardless of the financial institution’s size, customers migrate through a variety of delivery channels, with each customer seeking his or her most comfortable and effective method of interacting with the institution.

So…how does the branch fit today and tomorrow?

Omni-Channel Delivery – defined

What we are describing is the distribution system that financial institutions will employ tomorrow (that is, if they haven’t already started) – the omni-channel distribution network. This network combines automated, physical, and virtual channels into a flexible, and consistent branded customer experience.

Furthermore, the physical branch synchronizes these channels by establishing customer expectations and the institution’s brand image in the market.

It’s always on. The automated channel includes the institution’s ATMs and Interactive Teller Machines (ITMs). These channels are often self-service or assisted service and can operate 24/7/365, locally. The virtual channels include the phone system, web-based, and mobile platforms. These channels may be self-service or offer some level of assistance and operate 24/7/365…globally.

Evolution of Physical Channels

In the omni-channel network, the physical channel contributes to service density by providing visibility, accessibility, and the institution’s full range of products and services. As always, convenience is a driver in the consumer’s choice of financial institution. Remember…65% of consumer sales occur in a physical branch. So, convenience is aligned with a habitual consumer commuting pattern between where individuals live, work, and shop.

The branch must find its purpose. As the retail branch evolves, it will be developed with a specific target market and “business case” as the motivation. Branches will have a reduced footprint, scaled to meet market and customer demands and styled to match those same preferences. Space within the branch will be open and flexible to facilitate change as needed to respond to changing market conditions.

The four types of branches

The branch of the future (or today) will be scaled and styled to accomplish several purposes. Many markets will include a cornerstone branch. This office is usually a large-format facility staffed by universal bankers and subject matter experts, and additional amenities. This office is the institution’s “statement” in the marketplace. (Here are some examples.)

Community branches are smaller than the cornerstone offices, but offer a similar level of service. They are focused on customer service and sales, staffed by universal bankers, and showcase the institution’s technology and automation. They offer the ability to schedule subject matter experts either by appointment of through an automated or a virtual connection. (Here are some examples.)

Micro branches are often found in storefront locations or leased space. These offices can be transaction focused, but are staffed with fewer employees and more technology to boost efficiency. They are heavy on technology, automation, and branding. Micro branches rely on automated channels (ATMs, ITMS, etc.) to provide most of the transactional capacity, with employees available for sales and service as needed. (Here are some examples.)

Finally, the self service branch is fully automated and heavily branded and has no employees. You can imagine a full service ATM installation or, more likely in today’s economy, an ITM creating an outpost of service for customers with extended hours capability.

Conclusion: Branches still matter

Although the role of the branch is changing, retail branches remain an important element in an institution’s omni-channel delivery strategy. As financial institutions evaluate their current networks or contemplate new branches for branch transformation, they must be keenly aware of the market they intend to serve and the business case that supports the decision.

In the future, branches will be smaller and will focus on customer service and sale of more sophisticated products and services. The branch will work in a hub and spoke relationship with a variety of other delivery channels to offer the customer a wide variety of access points to the institution to deepen wallet share and long term stickiness with the institution.

In the omni-channel network, the branch plays a different and even more valuable role than ever – providing connection with the customer and community.

Sometimes stories bring new ideas into focus. We have an easy button for that!

How are Branches Relevant?

- Announcements

- Branch Transformation

Categories:

The role of the branch has changed- and there’s no going back.

Three articles crossed my desk recently that combine to tell an interesting story about branch banking. Each article conveys how retail branches are indeed relevant and point out some “musts” for community financial institutions (FIs).

Customer Satisfaction scores are dropping

First, Cornerstone Credit Union League dissected some results found in the American Customer Satisfaction Index (ACSI). According to Cornerstone’s report, banks “slid” 2.6% from their previous rank, and smaller banks posted a 4% drop in satisfaction. ACSI Director, David VanAmburg, told The Washington Post, “As banks try to get fees and aren’t successful at doing so [see operational excellence below], they have to cut costs – reducing the number of branches, downsizing staff – which results in lower satisfaction scores.”

The takeaway? Community FIs must concern themselves with customer satisfaction. There is plenty of competition out there looking for an opportunity to take away business.

Why the physical branch still matters in an increasingly digital world.

SNL Financial’s Ken McCarthy recently reported to the FDIC’s Advisory Committee on Community Banking meeting. In his report, he quotes the FDIC Division of Insurance and Research Chief Economist, Richard Brown, as saying, “Community banks tend to rely very heavily on physical offices.”

Brown’s comments reveal that he believes that there is both a substitutionary and complementary relationship between physical branches and technology. Citing a statistic that 79% of households use tellers to interact with their bank, Brown states, “So it really gives a sense that the physical banking office is a complement to these technological changes, especially in a world of ‘who do you trust online.’ Having that personal relationship with bankers…seems to be important in establishing trust.”

The takeaway? Branches add a personal sense of connection to FIs, and remain as important elements in customer satisfaction, so pay attention to them.

Are all banks the same?

Mike Fotis, founder of SmartMoneyPeople.com submitted a post asking the question, “Are all banks the same?” He surveyed and plotted three measures of bank performance: product leadership, operational excellence, and customer intimacy. While he focused on big banks, his findings have an intuitive appeal for small banks as well. Mr. Fotis used the following definitions in his analysis:

- Product Leadership – Very strong innovation and marketing. This normally isn’t a long-term source of advantage as competitors just copy what works well.

- Operational Excellence – Great operations/execution, with a focus on providing a reasonable quality at a low price.

- Customer Intimacy – Customer service and attention rock! Aim to match and exceed customer expectations.

Mr. Fotis found very little differentiation among the big banks he reviewed. None of them substantially stood out as his findings showed that they focused first on products…and then on operational excellence, and customer intimacy.

The takeaway? For community FIs (banks and credit unions), while competitive products are important, operational excellence and customer intimacy are the areas where success and differentiation can be more influential.

So there you have it. Focusing on customer satisfaction is important, particularly in a competitive industry. The retail branch remains an important tool to support customer satisfaction and omni-channel delivery. Customer intimacy and operational excellence offer the most leverage for community FIs to stand out.

With branch visits down, high value transactions mean customer service is more needed in the branch than ever!

The next step is understanding how the branch fits within your distribution channels.

Fortunately, we have some ideas to share!

First Service CU | Best Branch Building Experience

- Branch Transformation

Categories:

Delivering the Katy Branch ahead of schedule, only possible with design-build.

LEVEL5 is pleased to announce the opening of a new branch in Katy, TX for First Service Credit Union. The new branch is located at the southwest corner of I-10 and Grand Parkway (in front of Costco). “We have thousands of members in the Katy area who have told us they wanted a branch there,” said Mike McWethy, Chief Operations Officer. “Katy is one of the fastest-growing areas in the entire nation, and having a presence there is definitely a plus for us as well as a convenience to our members.

The Katy branch is the first design-build project First Service Credit Union and LEVEL5 have partnered on. Based on the success of the first project, a second project has been agreed upon and is currently in the design phase.

“LEVEL5 helped us acquire a difficult piece of real estate, and then completed construction ahead of schedule on what was already a very tight deadline. My overall experience with LEVEL5 was the best branch building experience I’ve had and we look forward to working with them on future projects.”

The LEVEL5 team made quick work of the 3,500 square-foot ground-up freestanding branch project by completing construction in just over 3 months.

“I couldn’t be happier or more proud of our design-build team” said Jeff Ensweiler, Vice President of LEVEL5. “They were challenged with a tight deadline, rose to the occasion and delivered a beautiful project, ahead of schedule thereby creating another happy LEVEL5 client. The ultimate sign of client satisfaction is additional business, and we are already well down the road with our next project together. We look forward to working with First Service Credit Union for years to come.”

For more project images, click HERE!

Building the Branch on Time is one thing. Staffing it with the right team is another.

Welcome to the Age of the Universal Banker!

New Retail Branch for Bossier FCU

- Announcements

Categories:

Company Continues to Be a Leader in Financial Institution Facilities

LEVEL5 has completed the design-build and branding of Bossier Federal Credit Union’s new Haughton, Louisiana branch. The new 3,000 square foot branch is conveniently located at 100 Mid South Loop in Haughton, which is a rapidly growing community just outside of Bossier City. The branch has two drive through lanes and a dedicated drive up ATM lane with night depository.

The branch has a contemporary look and feel and offers high-touch personalized financial services to its members. Jim Perkins, President and CEO of Bossier FCU said, “LEVEL5 has created a wonderful environment for our members and staff. The branch is everything we hoped it would be. Everyone loves it!”

Mr. Perkins said, “We chose LEVEL5 to design-build and brand our new Haughton branch because of the company’s depth and breadth of knowledge, and experience in retail branches. LEVEL5 understands how to integrate new technology and methods of delivering financial services into retail branches that allows us to cost effectively deliver a higher quality of personal service to our members.”

“LEVEL5 exclusively works with community-based financial institutions like Bossier FCU across the country. It is the trust and confidence that these institutions place in LEVEL5 that allows us to continue to be leaders in the design-build and branding of financial facilities across the country,” said LEVEL5’s Mike Colvin, Executive Vice President and Principal.

The view more images of this project click, HERE!