Don’t let your branch suffer the same fate as the Titanic

- Announcements

- Branch Transformation

Categories:

Who doesn’t love that new bank smell?

The grand opening of any new bank or credit union is typically cause for celebration. Ribbon cuttings, community leaders posing for the local press, and free hot dogs for the kids. These images remind us of a simpler time, when simply opening a branch was the key to success.

But for all the time spent on decor, messaging and branding, and even what type of potted plant is most appropriate, it’s the not-so-glitzy stuff that really determines if the new location will be a success. That’s not to discount the importance of branding. Marketing communications and advertising help differentiate one bank from another. But in truth, design decisions represent only 10% and 15% of a new branch’s costs. Surprised?

The unseen iceberg

With much to-do about what’s going on above the surface, too many executives put emphasis on design, rather than projecting a realistic budget, determining schedule and controlling construction costs. These massive costs represent the iceberg. The 85% that can cause you to, yes, sink or swim.

If you don’t effectively impact the major centers of gravity for costs (size of the branch, building materials, time and quality) then branch performance will suffer.

What we found…

LEVEL5 looked back at historical spending by banks and credit unions on the total cost of projects. Here’s what we found:

First, branding is important, from the color schemes to retail merchandising to point-of-purchase displays. But, too much focus on this may not be the best use of creative energy for a component representing less than 5% of total dollar spend.

Second, store layout, furniture decisions, and even floor finishes matter. Materials can be expensive, and the need to create a space to fit your local community’s desires can result in costly considerations. Still, these costs are often just 7-10% of the entire spend.

Third, total cost projections of a branch should reference three data points:

- National cost databases

- Historical cost data

- Market pricing

Whenever client budgets run over, it’s almost always because whoever was estimating the project at the bank or credit union overlooked something crucial.

Market pricing and schedule

While clients and other design-build firms spend most of their time and energy on the visible 15%, LEVEL5 understands that the 85% below the water drives performance.

Determining what the credit union or bank is willing to spend and aligning that spend with design, and the supply chain is what we do well. At LEVEL5 we specialize in solutions that go beyond design-build, by helping you decide what kind of branch solution works best for your markets and needs.

With our guidance and expertise in construction, the only fire you’ll need to attend to is the one cooking up the hamburgers and hot dogs. How do you start building a successful plan?

Millennials and the Branch: Strange Bedfellows

- Announcements

- Branch Transformation

Categories:

How do financial institutions connect with Millennials? Answer: A marriage of Science and Art

Earlier this year, shock waves were sent through the financial industry as study after study echoed the same message – Millennials highly value the branch. Though millennials and all consumers look digital-first for connection from their bank and credit union of choice, the branch is equally as important to consumers.

Human Connection. The research by Bain and Fiserv point to an inherently human response during the banking process, establishing trust and demonstrating value through relationship. Relationship is the heartbeat of the financial services industry and relationships are established over time.

Branching is about relationship. Banks and credit unions all offer similar products and services (perhaps at slightly different rates), but the motivation to buy (a loan) from one company over the other comes down to relationships. And consumers of all demographies are coming to the branch for that connection. In fact, the Fiserv study found that Millennials are the most likely demographic segment to visit the branch, and they are the most-likely to apply for and receive a loan through the branch.

Therefore, a key question for all banks and credit unions should ask is: How can we better connect with a demographic that wants what we have?

Science and Art. When it comes to branching there are no silver bullets or secret sauces to success. However, there are guiding principles, call them natural laws that govern victory, and it’s a marriage of Science and Art.

Science of branching. If there is one step we witness financial institutions (FIs) skip over in their pursuit of connection with consumers through the branch is developing a business case. In our industry, we have data at our fingertips and its plentiful. But, the science of branching is not about the data, it is the interpretation of the data for a specific outcome.

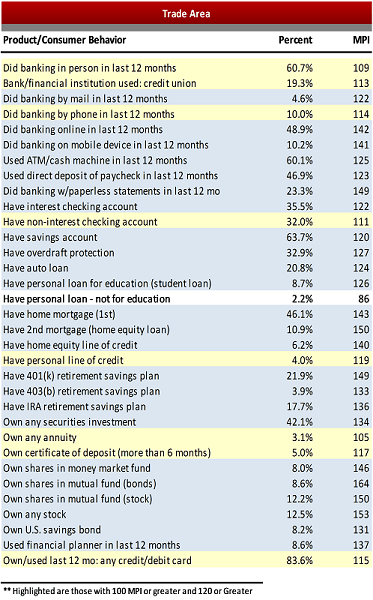

Market conditions. Collecting specific data about the local market conditions around your existing branches, or proposed new ones reveals more than you could imagine. It reveals the preponderance of consumers who desire what you have – loans. It shows how they want to connect with you (mobile, automated, and the branch), and it reveals the specific products and services we should offer in branches.

The index data above is much more than good local information about product and service demand. With this data in-hand we can go to the next level to establish the total headcount, and the function of the branch. So instead of staffing branches “how we always do” we can staff for a specific outcome based on what local consumers want today, and what they will need, tomorrow.

Loans and Deposits. Furthermore, all data collection for branching should result in a specific loan & deposit forecast for that opportunity. Only with this information can we build a business case that will allow for measurements of return on investment. Historical experience has proven that a freestanding branch’s profitability comes into focus at $25 Million (deposits & loans). Nevertheless, as branches get smaller and more flexible perhaps lower opportunity can be feasible. In any case, understanding opportunity and starting to develop a detailed plan – if it’s a 70% one – will create a greater likelihood for a predictable outcome.

Art of branching. Certainly, much of the business case for the branch is art as we interpret the data; however, the art also flows into design. The function and headcount of the facility are finite components so that is science, but how we integrate those into our consumer experience is unique to the local community we serve, and your business, and that is an art.

A unique consumer experience. Connecting with the local demography, the community and your consumers is unique to your business. The experience should be well planned and purposeful, always remembering your personality and value proposition are unique to you. A consumer experience that begins before the consumer walks through the door, and continues through the branch environment. And the beauty is though again we have guiding principles that govern victory, we have freedom of creativity to build connection, so the branch experience it takes on different personalities in each community we serve.

[metaslider id=6198]

Training drives performance. And the glue that holds all of it together is your human capital – your people. Nothing in branching drives success better than training your staff to learn how to connect with people and opportunities. For many FIs, this means adopting the Universal Banker model for their business. This means we combine skills training to optimize each opportunity our staff has to connect with consumers. To shift the employee mindset and branch purpose from order-taker to advisor, teacher, council and guide through the consumer’s financial journey. Every consumer is at a different stage, and they look to their bank or credit union for help. Your success depends on your ability to capitalize on those opportunities.

So, what’s next? That’s really up to you. The process outlined above is but an overview, a 30,000-foot glimpse into a portion of the process of connecting with consumers who want what you have in the branch. So, a good question follow-up question might be:

What is the Business Case for the Branch in a Fintech World?

No Shortcuts to Transformation

- Announcements

Categories:

Re-thinking the branch, re-training the banker for transformation

Change is inevitable. The world we live in and the people we know change constantly. Businesses are changing as competition intensifies, technology accelerates and information moves at the speed of light. The world has transformed into a global economy, no longer bound by walls, geography or time. We are in an age where busyness is the norm, and we dictate our own realities by the choices we make…daily.

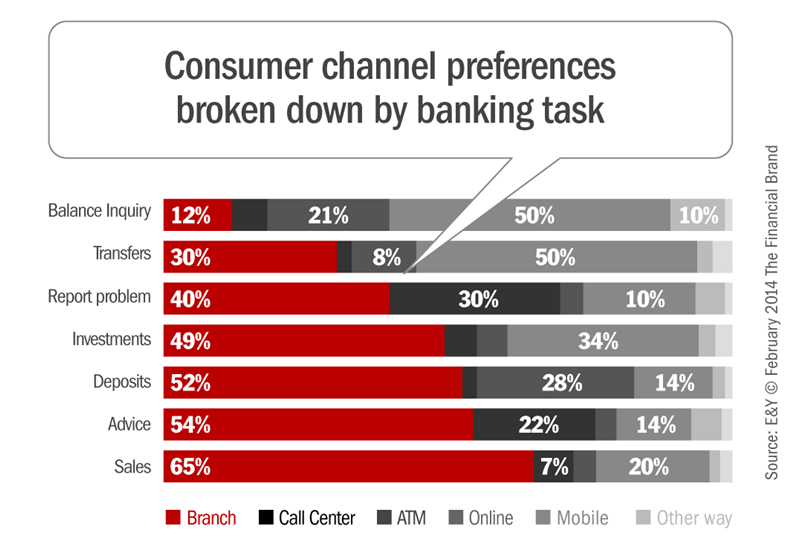

Who needs a branch anymore? For the community-based financial institution (FI), “the times” have changed them too. No longer can FIs rely on just branches, or just service to meet consumer demands. Today, we live in a world where consumers demand an Omni-Channel approach. Consumers demand automated channels, virtual channels and physical branches to meet their needs.

Branches are no longer one-size-fits-all. Branches today are still about convenience and market density, but each branch can and does fit a different purpose. Starting with the largest of all facilities, the cornerstone branch, which includes main offices, these large format facilities play a different role than others.

Where Community meets Technology. Today’s main office sets the tone for the company’s culture and identity. Furthermore, the rapid loan growth being enjoyed by FI’s across the country is causing ripple effects throughout the main office. Call centers in these facilities are changing. With the advent of Interactive Teller Machines (ITMs), community-FIs can serve their consumers 24-7-365, which means the call center is in the midst of transformation, now staffed with Universal Bankers who can be a one-stop-shop for the customer’s needs.

Engaging consumers. After all, building relationships are at the heartbeat of the Universal Banker model. Surveys show that 65% of sales occur in a physical branch, so the days of relying on a relationship built across three feet of mahogany are over. Today, banks are challenged with differentiating themselves and some are more aggressive than others in their use of technology, retail concepts and design to facilitate a more engaged consumer experience.

The people have spoken. Market research, customer concentrations and analytics now dictate how FIs should design their branches to relate to their markets. If the model is best supported by a teller line, then stick to that plan. If a more engaging environment, powered by technology is indicated, boldly adopt that plan. In all cases, the transformation of the branch is crucial to reach consumers.

When a big branch doesn’t make sense. The cost and time to implement branches has also given rise to the Micro Branch. Micro branches today still include storefronts and in-store branches, but can now also include mobile branches, freestanding facilities, and “pop-up” branches. The key component of Micro Branches are their size and flexibility as well as their cost.

How best to serve? In the end, banks and credit unions are faced constantly with decisions on how to serve their consumers, communities, and employees. Change is inevitable just for relevancy, but the FIs that are changing with a plan achieve specific results.

Proof that change can work. Based on FDIC data, one Southeast Bank grew organically from $1 Billion to over $3.5 Billion in the last five years by making branching decisions around a business case. Another FI grew its assets by 37% in the Carolinas over a seven-year period embracing technology and universal bankers. Still another near the Great Lakes moved its loan to deposit ratio from 88% to 92% in less than two years by implementing a more engaged branch culture.

The bottom line is the bottom line – transformation, driven by a well-devised plan and business case, succeed.

Improving your performance. In today’s ever-changing environment, financial institutions are faced with two opportunities for performance improvement:

- Their existing footprint

- Moving into new markets

The FIs that flourish, marry business planning and execution into a seamless model driven by a business case to maximize their investment and gain optimal returns for their stakeholders. Predictability, timing, risk management and engagement can all be folded together so the business, consumers and community win!

So, as you face the future, start making decisions and then take bold action. Over time, those actions lead to transformation…there are no shortcuts.

Financial institutions who do their homework are the ones best positioned to succeed in a brand new playing field.

ECCU – Measuring Branch ROI

- Branch Transformation

Categories:

Branch ROI and Engagement – Great Bedfellows!

Modular facilities, limited visibility and modest brand image are not exactly recipes for success in dynamic retail areas, but when desire meets capabilities, the result is transformation. This is a story about one Credit Union’s journey toward a shift in culture, member experience…and the results they achieved.

Educational Community Credit Union (ECCU), a $450 Million community-chartered credit union in Kalamazoo, MI was challenged with creating a new branch experience focused on member engagement, creating more conversations, and building their brand in the community.

In developing the new proto-type, the ECCU team wanted to dive deeper into member relationships using the branch environment to facilitate dynamic interactions with each member. No longer did they want to focus on transactions, but wanted to focus on engaging each member in conversation.

The Credit Union had some existing branded elements, but they wanted to eliminate physical barriers (teller lines) and embrace technology with the enhanced new brand.

To enforce this new culture shift, ECCU deployed LEVEL5 branch training for the entire ECCU staff (executive management, branches, and back office/operations) to make the culture transition a reality.