Building Relationships: the Heartbeat of the Universal Banker

- Announcements

- Branch Transformation

Categories:

Technology hasn’t just required an upgrade in equipment, but a shift in employee skill sets.

As American as apple pie. Community based financial institutions (FI’s) are the heart and soul of America. These locally owned and operated institutions are woven into the fabric of the communities we live in, work in, raise our families and build our lives. That building involves our careers, our hobbies and our futures. That future in large part depends on…money, investment and risk.

The saying “It takes money to make money” is still…right on the money. Most of us are not born with the equity we need to see our hopes and dreams come true. We need money to finance our education, our houses, cars and businesses. We need equipment, tools, facilities and employees to make our lives work. The local community bank and credit union steps in to make all of this possible. It is the reason they were created, and they fuel the economy and future.

In order to serve, first we must adapt. In today’s changing consumer environment, where omni-channel delivery is the norm, community banks and credit unions are also challenged with delivering services in a way that deepens their wallet share, household penetration and margins…so they can continue to fuel the American spirit.

The old way worked. In years past, that service was almost universally delivered the same way. A customer interacted with a “banker” in a branch across three feet of mahogany. Most interactions were transactional in purpose…check cashing, payments and order filling. The world had fewer channels for consumers to access financial resources and the delivery model…worked. No, it worked great!

Automation is Everything!

Times have changed. However, today we have smart phones, the Internet, and global mobilization thanks to technology. Routine components of all things financial are now automated. Checking balances, moving money, making payments and even loan applications are handled via smart phones, tablets, laptops, drive thru’s, and ATMs. Therefore, the purpose of the physical channel i.e. the branch has changed and with it the identity of the banker.

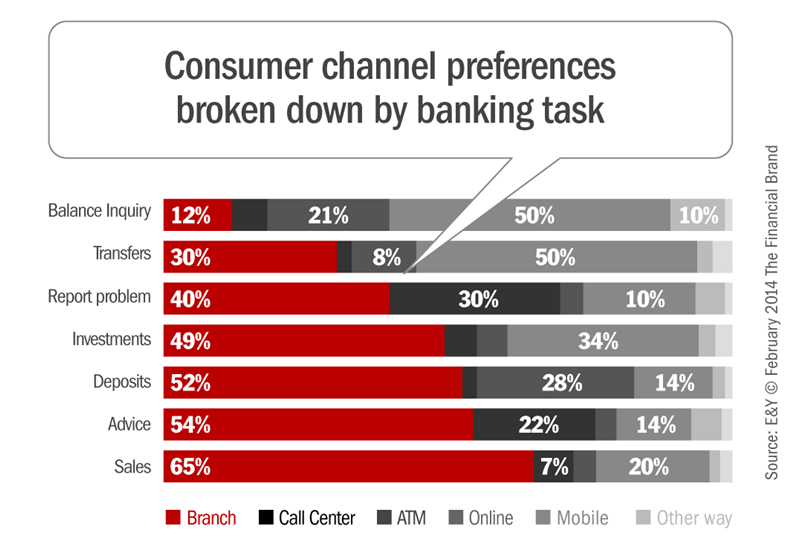

Change didn’t happen overnight. But it still came fast. A 2014 study by Ernst & Young sheds tremendous light on what is happening, and what FI’s have done to adapt. The graph below shows consumer channel preference by banking task. The study found the more routine and automated the task, the more likely the consumer is to choose a “nonhuman” interfacing channel. However, the more complex the interaction, the more likely the consumer prefers a physical channel…especially when it comes to sales.

New skill sets emerged. Over the last decade, FI’s have been moving toward a different branch delivery model based on these preferences by consumers, so they can continue to deepen wallet share, reach more households, businesses and boost margins. What was born are Universal Bankers who do so much more than the routine…they now educate, advise, and teach consumers as they discuss products, introduce experts and create deeper relationships with their customer or member in the process. In fact, NCR estimates Universal Bankers can handle up to 95% of customer requests; the remaining 5% are referred to subject matter experts.

From “doer” to “partner”. The deepening of relationships with the customer is the key. Consumers today are becoming so much better at research and analysis, but they need help making decisions and choosing a partner. So, they’ll ask a friend or a thought leader, and then go and meet the people others also trust.

How to grow your people. FIs can strengthen these interactions and introductions by following these steps as they develop their own Universal Bankers:

- Hire people who like people and are engaging. Customer engagement is a culture shift that moves away from transactions and toward conversations.

- Train the banker to ask questions. Educate the consumer before offering solutions. The Banker’s job is to listen first, and then speak from his/her wealth of knowledge or bring in experts…when needed.

- Invest in tools that automate routine activities and create margin for the banker to invest time with their customers. Scheduling tools, staffing models, cash handling equipment, ATMs, and or Interactive Teller Machines (ITMs) are examples of such investments.

- Remove the barriers to the customer. Often this involves eliminating fixtures that separate the customer from the banker, but it doesn’t have to be radical. The key is the facilitation of the desired experience.

- Promote the bank or credit union’s brand in the physical environment. Stay away from artwork and use flat screens and marketing materials to communicate your unique brand message. Promote your value proposition so the community and customer know what you are about.

Why move in this direction? The answer…ROI.

Banks and credit unions that embrace this model often see dramatic results. According to FDIC reports, a community bank in the Southwest organically grew its assets from $1.0 billion to $3.5 billion in five years with this engagement model. Furthermore, NCUA loan and asset data prove a credit union in Tennessee grew its loan portfolio by 50% in four years and another in the Carolinas grew its book of business by over $100 million in a similar period. These are real results, from real financial institutions who have embraced the Universal Banker model - engaging customers in a new way…and there are more.

Investment in people and creating an environment that fosters engagement can change cultures. And, that culture is about building relationships…the heartbeat of the Universal Banker.

The Universal Banker delivers a world of knowledge in a very personalized way.

Today’s branch is moving at a rapid pace as well as its relevance. How has it changed? Read more below.

PLACES! TRAINING

- Training

Categories:

PLACES! is designed around a theatrical theme. As in a theater production, everyone in the “cast” or your organization has a place, whether it is onstage out in front or back stage behind the scenes. No matter the role, everyone must know their lines and be ready to make a vital contribution as part of your cast and crew.

Numerous clients have taken advantage of PLACES! training, introducing their employees to a program that promotes the importance of maintaining a consistent brand throughout the branch system and entire organization. This training program is for organizations who want to incorporate a Service and Sales culture from top to bottom. Outcomes are most effective when participation includes all levels, ranging from front line to back office. Inclusion of senior management and involvement of board members helps accelerate the evolution of the desired changes in culture.

An initial phase of the PLACES! Training includes an on-line communications assessment that helps employees and management to improve their lines of communication both internally and externally. Next, a gap analysis is conducted early in the process to determine the organization’s current state and desired end-state. The PLACES! training is customized to address the organization’s gap analysis, resulting in a tailored training curriculum that works to both close the gap and raise the bar.

Benefits of the PLACES! training include:

- More effective lines of communication

- Better understanding of the organization’s purpose in the community

- Improved recognition of the needs of the customer base

- Connection of customer needs to relevant products and services

- Improved relationships internally and externally

- Increased coaching skills

- Better accountability to sustain desired behaviors

PLACES! offers a flexible 3- to 12-month modular certificate program with interactive and engaging sessions led by a master facilitator. Video taping of communication skills and ongoing individual skills assessment are interwoven into personal development plans which reinforce performance reviews, scorecards and annual goal setting.

The goal is for your organization to distinguish itself in the marketplace just as LEVEL5’s goal is to be unique with its full-service offerings to its clients.

Ask to speak with a LEVEL5 PLACES! Client today…

PROFESSIONAL DEVELOPMENT OFFERINGS

- Training

Categories:

Computer-Based Training via Webinar

Each Webinar is topic-specific. Included in the investment are:

- A toll free call in number in advance of each Webinar

- A master “learning guide” suitable for reproduction in advance of each Webinar

- Professional facilitation of each Webinar

- An audio reinforcement (in an MP3 format) after each Webinar

A select list of Webinar topics include

| Sales Productivity Topics | Management Effectiveness Topics |

| Acquiring New Customers | Coaching for Optimal Performance |

| Addressing Sales Objections | Managing for Results |

| Building Rapport | Managing/Motivating your Employees |

| Influencing versus Selling | Managing your Outside Sales Rep |

| Making Time Work for You | Setting Clear Goals/Expectations |

| Outsmarting your Competition | Techniques of World Class Managers |

| Proven Prospecting Techniques | The Five Fatal Flaws of Management |

| Referrals = Success | The 5 “P’s” of an Effective Leader |

| Sales Conversations vs. Presentations | |

| The Secrets to Cross-Selling | |

Two-hour, Lunch & Learns

Each Lunch & Learn is topic-specific. Included in the investment are:

- A presentation PPT used to facilitate each Lunch & Learn

- A master “learning guide” suitable for reproduction in advance of each Lunch & Learn

- Professional facilitation of each Lunch & Learn

A select list of Lunch & Learn topics includes:

- The Keys to Mining your Existing Book of Business

- Secrets to Outsmarting your Competition

- How to Plan your Day…Work your Plan!

- Effective Sales Conversations with Business Owners/Executives

- Proven Prospecting Techniques

- Selling to Different Buying Behaviors

Half-day Seminar

Introduction to the Productive Selling Zone® for Commercial Banking

Included in the investment are:

- A presentation PPT used to facilitate the seminar

- A master “learning guide” suitable for reproduction in advance of the seminar

- Professional facilitation of the seminar

- Written documentation at the conclusion of the seminar inclusive of chart notes and action steps for a successful integration of what was taught.

- At the conclusion of the seminar attendees will create a Personal Call-to-Action based upon what they learned during the seminar

One-day Workshop

Creating a Productive Selling Zone® for Commercial Banking

Included in the investment are:

- A presentation PPT used to facilitate each Lunch & Learn

- A master “learning guide” suitable for reproduction in advance of each Lunch & Learn

- Professional facilitation of each Lunch & Learn

- Written documentation at the conclusion of the workshop inclusive of chart notes and action steps for a successful integration of what was taught.

- At the conclusion of the seminar attendees will create a Personal Call-to-Action based upon what they learned during the workshop