The Universal Banker the Real Gold in the Branch

- Announcements

- Branch Transformation

Categories:

What Would Motivate Consumers to Bypass the Most Convenient Branch in the World?

Think back 11 years ago. It is the Summer of 2007 and only a select few are forecasting the fall of the financial industry. Maybe even less see that a Senator from Illinois will be our new President in 18 months. And no one knows how Steve Jobs’ brand-new invention, the iPhone, will change the world. The iPhone revolutionized consumer expectation for convenience and experience. This is especially true in banking. As the financial industry recovered from the recession, consumers had been taught that the most convenient branch in the world lives in their back pocket.

The advent of digital convenience created omni-channel banking, the triune relationship between delivery channels:

Physical Branches, Cash Automation and Virtual Branches.

What do consumers want?

In a handful of years, consumers in one voice had communicated we want multiple channels. Few consumers held on to a single-channel approach to banking; preferring multiple ways to communicate with their financial institution of choice. And by 2017, consumers had said we prefer digital channels (website plus mobile) over the physical branch for day-to-day transactions.

It’s remarkable that in less than a decade from the iPhone launch date, consumers had been reprogrammed

to understand the unique value of a digital branch.

What is so great about a digital branch?

This view (the convenience of a digital branch) is also shared by financial institutions. Thanks to some research from Bain & Co. we can quantify the real value of a mobile banking consumer. The average mobile transaction costs a bank or credit union about $0.10 for each interaction. The average teller transaction (visiting a branch or calling a person) costs at least $4. Therefore, there is tangible value in mobile banking that is unmatched by physical branches, especially for transactions.

What is so great about the branch?

However, consumers still visit branches on a regular basis. Study after study shows that over 50% of all consumers visit branches on a monthly basis, and 60% of consumers visit branches twice year. What’s more, millennials are the most likely demographic to visit branches every month.

Bringing the channels together…

So, what’s really going on? A 2018 report by Foresee brings many of the pieces together. In their study, they found that 60% of all bank and credit union new-account journeys start online. (About 35% of consumers go straight to the branch.) Probably not too shocking to hear that people shop online? What is shocking is that over 70% of all consumers end up in a branch during their journey.

The Real Gold in the Branch

Therefore, there must be something intrinsically valuable to a consumer that they would bypass the most convenient branch in the world to visit one further away than their elbow, back pocket, or purse. The ongoing dance by consumers between digital and physical branches explains why physical branches continue to transform at a rapid pace. Consumers use the branch for something they cannot get over a device – a face-to-face personal interaction. Open environments, cash automation, pods, branding, point-of-purchase imagery, and transformative experiences are in place in today’s branch to leverage the high-value opportunity of a face-to-face interaction with consumers.

In 10 years from now will we have fewer branches? Yes. Over the next decade will the branch continue to change? Yes. Will the need for a human experience diminish? No. Because the real gold in today’s branch isn’t in the vault, it is you and your team. We call this the Universal Banker.

Since everything in today’s physical branch is about optimizing the face-to-face interaction with the consumer, then we need a guide to walk us through the process.

How about a three-legged stool?

Bricks, Clicks and Community Banks Webinar

- Announcements

- Branch Transformation

Categories:

Maximizing Digital and the Branch Equals Transformation

Our recent webinar on Bricks, Clicks and Community Banks dove into the need for financial institutions to optimize digital and physical channels. Consumers today desire an omni-channel approach (online, physical and automation) because digital channels have redefined the notion of “convenience”. A financial institutions ability to maximize online and mobile banking can have a dramatic impact on performance. Digital transactions cost banks and credit unions about 10 cents per interaction compared to $4 for a transaction with an employee in a physical branch. By automating the routine, then the scale and efficiency provided through online channels is possible in a way that physical branches cannot duplicate.

Consumers and the Branch

Yet, consumers still visit branches on a regular basis, including millennials (generation Y). In fact, research shows that millennials are the mostly likely demographic to visit a branch to apply for an receive a loan. A 2018 study by Foresee sheds more light on consumer behavior across all channels. Their research looked at customer acquisition throughout their journey to open an account. Foresee uncovered that 60% of all bank and credit union consumers start their journey online (website and mobile) – whereas 35% start at the branch. Not too shocking that most consumers would start their banking journey online. However, 60% of online originators (remember the original 60%?) end up in branch. The main point is more than 70% of all customers end up in a branch at some point in their journey.

The Gold in the Branch

All the data points to customers believe something more valuable than gold is within the four walls of today’s branch. The real gold are the bankers within a bank or credit union’s facility. Today’s universal banker has the ability to serve consumer’s needs better than ever. So optimizing optimizing the branch is a top priority. Matching consumer needs and the services offered at bank or credit union is sucess.

The process for Branch of the Future and/or Transformation is a Three-Legged Stool. The three legged stool is Function, Experience and Technology. (We’ve written an entire blog post on this topic)

Stories from the Field

To bring the concepts and presentation into a real life context, Shaun Burke – President and CEO of Guaranty Bank in Springfield, MO joined the webinar. Shaun and his team are going through the process of transforming so much at their Bank. He walked the audience through where they have been, where they are today and where they are tomorrow. Some of the evidence of transformation is in the Bank’s new Headquarters which houses their “Branch of the Future”. (You can watch the the headquarter’s story here and download the entire 45-minute webinar below)

As always, there is so much more to be said and done in regards to optimizing the digital and physical channels. This webinar sought to bring together several pieces of the puzzle, and focus on a process to optimize the branch portion.

To download the webinar and watch it at your convenience click below.

Building Relationships: the Heartbeat of the Universal Banker

- Announcements

- Branch Transformation

Categories:

Technology hasn’t just required an upgrade in equipment, but a shift in employee skill sets.

As American as apple pie. Community based financial institutions (FI’s) are the heart and soul of America. These locally owned and operated institutions are woven into the fabric of the communities we live in, work in, raise our families and build our lives. That building involves our careers, our hobbies and our futures. That future in large part depends on…money, investment and risk.

The saying “It takes money to make money” is still…right on the money. Most of us are not born with the equity we need to see our hopes and dreams come true. We need money to finance our education, our houses, cars and businesses. We need equipment, tools, facilities and employees to make our lives work. The local community bank and credit union steps in to make all of this possible. It is the reason they were created, and they fuel the economy and future.

In order to serve, first we must adapt. In today’s changing consumer environment, where omni-channel delivery is the norm, community banks and credit unions are also challenged with delivering services in a way that deepens their wallet share, household penetration and margins…so they can continue to fuel the American spirit.

The old way worked. In years past, that service was almost universally delivered the same way. A customer interacted with a “banker” in a branch across three feet of mahogany. Most interactions were transactional in purpose…check cashing, payments and order filling. The world had fewer channels for consumers to access financial resources and the delivery model…worked. No, it worked great!

Automation is Everything!

Times have changed. However, today we have smart phones, the Internet, and global mobilization thanks to technology. Routine components of all things financial are now automated. Checking balances, moving money, making payments and even loan applications are handled via smart phones, tablets, laptops, drive thru’s, and ATMs. Therefore, the purpose of the physical channel i.e. the branch has changed and with it the identity of the banker.

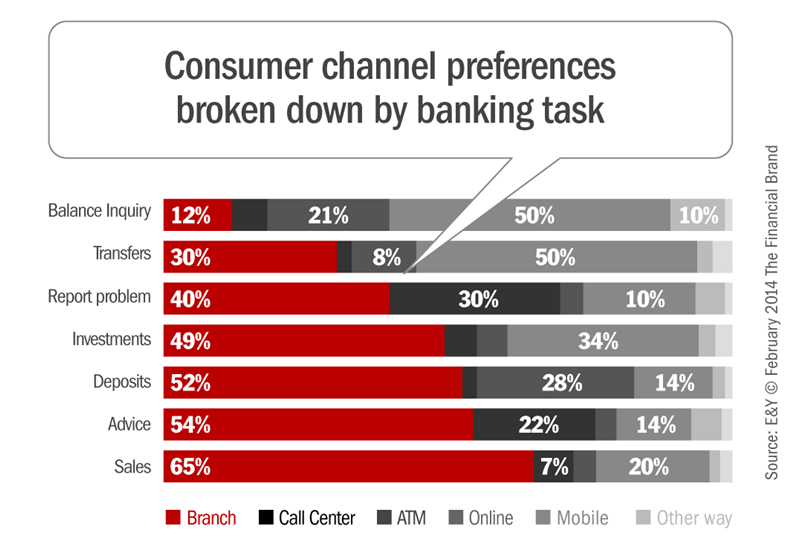

Change didn’t happen overnight. But it still came fast. A 2014 study by Ernst & Young sheds tremendous light on what is happening, and what FI’s have done to adapt. The graph below shows consumer channel preference by banking task. The study found the more routine and automated the task, the more likely the consumer is to choose a “nonhuman” interfacing channel. However, the more complex the interaction, the more likely the consumer prefers a physical channel…especially when it comes to sales.

New skill sets emerged. Over the last decade, FI’s have been moving toward a different branch delivery model based on these preferences by consumers, so they can continue to deepen wallet share, reach more households, businesses and boost margins. What was born are Universal Bankers who do so much more than the routine…they now educate, advise, and teach consumers as they discuss products, introduce experts and create deeper relationships with their customer or member in the process. In fact, NCR estimates Universal Bankers can handle up to 95% of customer requests; the remaining 5% are referred to subject matter experts.

From “doer” to “partner”. The deepening of relationships with the customer is the key. Consumers today are becoming so much better at research and analysis, but they need help making decisions and choosing a partner. So, they’ll ask a friend or a thought leader, and then go and meet the people others also trust.

How to grow your people. FIs can strengthen these interactions and introductions by following these steps as they develop their own Universal Bankers:

- Hire people who like people and are engaging. Customer engagement is a culture shift that moves away from transactions and toward conversations.

- Train the banker to ask questions. Educate the consumer before offering solutions. The Banker’s job is to listen first, and then speak from his/her wealth of knowledge or bring in experts…when needed.

- Invest in tools that automate routine activities and create margin for the banker to invest time with their customers. Scheduling tools, staffing models, cash handling equipment, ATMs, and or Interactive Teller Machines (ITMs) are examples of such investments.

- Remove the barriers to the customer. Often this involves eliminating fixtures that separate the customer from the banker, but it doesn’t have to be radical. The key is the facilitation of the desired experience.

- Promote the bank or credit union’s brand in the physical environment. Stay away from artwork and use flat screens and marketing materials to communicate your unique brand message. Promote your value proposition so the community and customer know what you are about.

Why move in this direction? The answer…ROI.

Banks and credit unions that embrace this model often see dramatic results. According to FDIC reports, a community bank in the Southwest organically grew its assets from $1.0 billion to $3.5 billion in five years with this engagement model. Furthermore, NCUA loan and asset data prove a credit union in Tennessee grew its loan portfolio by 50% in four years and another in the Carolinas grew its book of business by over $100 million in a similar period. These are real results, from real financial institutions who have embraced the Universal Banker model - engaging customers in a new way…and there are more.

Investment in people and creating an environment that fosters engagement can change cultures. And, that culture is about building relationships…the heartbeat of the Universal Banker.