5 Key Elements to Consider For Your Prototype

- Banks

- Branch Transformation

- Credit Union

- Retail

Categories:

Any branch project should always start with, if not be greatly informed by, a solid strategy.

As you begin the efforts of considering and planning a new prototype branch (whether it be with LEVEL5 or you go it alone), we present to you 5 key elements for you to consider as you form a final strategy.

1. Prioritize Customer Experience

Customer experience in the branch is paramount. That’s why so many branches are moving past the traditional, stuffy teller line-oriented layouts and replacing them with a more open floor concept design. These designs are considered commonplace by now and foster open communication.

Technology like Assisted Self-Service machines give your clientele the power to make transactions themselves and helps them avoid standing in frustrating lines.

But don’t forget the small things! Comfortable seating in a waiting area with coffee at the ready is still a great way to deliver on the customer experience.

2. Design For Your Brand

Your brand helps you relate to your members, so tailor the design to appeal to the right demographics and to properly portray your organization’s values.

The branch and its design are the physical manifestations of your brand. It should portray your mission and values, while also reflecting your overall member/customer base, even at the trade area level.

LEVEL5 has worked with many FI’s who operate both in a rural and urban settings. While there is an overall branch prototype, the design is specific to the neighborhood – and its clientele.

3. Integrate Technology According To Your Needs

Studies illustrate that the majority of consumers enjoy using touch-screen interfaces and automated tellers while at their branch. These technologies reduce wait times and free up your employees so they can assist others or accomplish other tasks.

But the latest and greatest may not always fit your brand, per se.

Again, decisions should be based on your members’ unique needs, so always consider that beforehand.

For example, many of your clientele may be senior citizens who would prefer a more personal approach. If that’s the case, a blend of the old and new may be worthwhile.

4. Use Natural Elements

The days of the deep, dark wooden panels are gone.

Branch designs have moved to using more natural elements. Not only is this design aesthetic more common, it is also more pleasing to the visitor.

It reflects your brand better, and provides a better branch experience.

5. Make Your Exterior Shine

There are 2 major elements when considering your exterior:

- Brand – Does the exterior design reflect your brand well

- Billboard – Your branch is an advertisement. Make it work for you 24/7

Your branch is your member’s “banking home” so have the overall design reflect that mentality.

You know your members best so how can the branch reflect them?

A modern branch can have large windows, metal siding and technology.

A traditional branch has deep woods, brick and maybe even columns.

There is not necessarily a right or wrong approach, but rather the branch, and the strategy to designing the prototype needs to reflect your brand and your clientele.

Contact our team now to discuss your new branch prototype. For nearly 20 years we’ve utilized best design build practices to help a multitude of clients create and implement effective, beautiful branch templates.

Designing Your Branch Prototype

- Banks

- Branch Transformation

- Credit Union

- Retail

Categories:

Your branch is the physical manifestation of your institution, oftentimes a critical beacon for attracting new members in the market and in growing the client relationships you already have. That’s why it’s so important to make sure you get branching right.

With your branch space, you’re providing a place where people can interact with an actual person to provide solutions. It’s the arena for primarily opening accounts, having questions answered or taking care of larger or more complex transactions. Digital channels simply cannot provide the desired human element, or solve the complex issues your clients face every day.

When looking to reinvent your brand, sometimes the branch, and a new prototype at that, is what is needed to begin anew.

Why? Because a new prototype branch universally establishes and dictates your brand and culture. It should provide the functionality and services needed to fit the changing requirements of your modern clientele.

In fact, almost all of LEVEL5‘s projects involve a new branch prototype. Wise financial institution leaders truly see the value of it.

In this article, we’ll cover the purpose and successful implementation of a prototype and what it means for you in 2022 and beyond.

When Do You Need A Branch Prototype? How Is It Developed?

You need a branch prototype when you want an effective, uniformed, comprehensive way to optimize your entire branch network. Notice we said your entire branch network, not just the future locations that are built to turn heads in newer markets.

Once your critical branch elements have been identified and put into the design, they can be translated into all of your existing branch spaces too.

This is monumentally important to point out since many credit union and community banks often look up one day and find themselves with multiple locations having a stale, unengaging ambience to them. A prototype helps with needed rejuvenation as well as future builds.

So how is it developed?

While putting your prototype together, we work closely with you and key stakeholders through an in-depth Programming and Visioning phase to identify and deeply understand your:

- Needs

- Goals

- Retail Strategies

- Influences

- Brand Elements

We then synthesize all of this into a design with our experienced Design team.

Once finished, your prototype branch will include the basic structural outlines, preferred technology, design choices, banking equipment, brand deployments and iconic elements, narrowing down to aspects like your furniture style, tile selections, and carpet color.

Tweak Your PROTOTYPE to Fit Varying Needs

Having an excellent branch template makes it more convenient to proliferate uniformed locations in a myriad ways, allowing you to minimize time and cost spent re-designing as the prototype can simply be adjusted to fit.

Your standard-sized floorplan can be seamlessly translated into micro branches, stand-alone kiosks in smaller towns or even for your regional offices or Ops Center, keeping your design components and member experiences in lock-step with your strategy.

Contact our team now to discuss your new branch prototype. For nearly 20 years, we’ve utilized best design build practices to help a multitude of clients create and implement effective, beautiful branch templates.

3 Reasons to LAUNCH: PROPOSAL

- Announcements

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Retail

Categories:

We Have Liftoff

LEVEL5 has officially launched our LAUNCH Program.

This program is perfect for the Credit Union and Bank executive struggling to execute their strategic goals.

Phase I was the Discover phase, Phase II was Alignment. In Phase III, we’ll discuss the delivery of the Proposal and what that means to getting you that much closer to Liftoff.

Phase III: Proposal

By Phase III, if we’ve done our job, we’ve listened intently, captured all of your thoughts and concerned, and have now translated them into a Proposal for your review.

In this proposal, we’ll outline the overall scope of services, whether they be singular, or reflect an integrated deal, where all of our services are reflected, to present budget considerations and proposed schedules.

In this Phase, we’ll look to set up one final call, where we’ll be able to review the proposal, but most importantly, allow you the opportunity to ask any final clarification questions because from here, this proposal is either signed, or goes to the Board for final approval and signature.

Once the proposal is signed, we are officially at LIFTOFF.

While your project has been accounted for up to this point, the execution of the Proposal allows for your project to officially be assigned. Depending on scope of services, you will be introduced to your project lead and the project will commence in earnest.

Why LAUNCH At All?

The LEVEL5 LAUNCH Program follows a methodical, yet casual approach to uncovering the critical needs of your Financial Institution. Through a series of casual conversations, our team will be able to capture your goals, but also understand what is getting in the way of you achieving them.

From there, we’ll be able to make actionable recommendations on how to execute to these goals.

To learn more about our LAUNCH Program, and to schedule your first Discover call, Contact Us today to get going.

In the News: Chasing Chase

- Banks

- Branch Transformation

- Consulting

- Retail

Categories:

With so much being written over the years about the demise of the branch, especially in the wake of the pandemic and the rise of digital, it’s interesting to note the recently released article from The Financial Brand relating to the retail strategy revealed by Chase.

Among the click-bait worthy headlines such as digital first darlings, FinTech disruptors and industry pundits standing on their soap box eulogizing the branch and its prominence from a by-gone era, there is a level-headedness in analyzing what Chase is doing with their branch strategy over the past several years.

At LEVEL5, we work with community banks and credit unions each day developing and executing growth strategies and inevitably, these strategy sessions always hold discussions relating to the Big Banks – BofA, Chase, Wells Fargo and Citi.

There are two sides of the coin when watching what the Big Banks are doing – they are often (way) ahead of the curve when it comes to innovation, spend, resources and strategy. This can be a blessing and a curse. On one hand, they have the financial prowess and horse power to be a first mover. On the flip side, community banks and credit unions can sit and wait to see if those strategy work or now, and can extrapolate their own strategies thereafter.

When it comes to analyzing Chase’s retail branch strategy, there are some interesting lessons to be learned, particularly of note is their effort in “expanding their branch network.”

BANKING RELATIONSHIPS BEGIN AT THE BRANCH

Chase continues to innovate and offer a wide array of products, but the branch acts as an important anchor. Not only do most new relationships stem from the branch, but the branch purpose itself is morphing away from transactional and more toward advisory. This strategy is not only stated by Chase, but also recently corroborated by BAI in their recent “From branch to engagement center” article.

IT’S NOT ABOUT BRANCH REDUCTION, IT’S ABOUT BRANCH OPTIMIZATION

But it’s not just strategic lip service – the numbers support this as well. In 2017, Chase had approximately 5,150 branches across ~25 states, serving 61% of the population.

At the close of 2021, Chase’s retail branch strategy had ~4,800 branches, but covered the entirely of the lower 48 states, serving 79% of the population.

Don’t let the fewer number of total branches fool you you here – these were not out and out closures, they were consolidations, or branch optimization plans in effect, all the while, Chase was expanding, aggressively entering 300 new markets with 500 new branches, and saturating high value markets such as Boston, Philadelphia and D.C.

WHAT CAN YOU LEARN FROM THE CHASE BRANCH STRATEGY

Your FI is never going to be Chase. You’ll never outspend them, never spend as much on innovation, and never will offer as many products and services. You shouldn’t try to be them – but you sure can learn from them.

Regarding the branch, the lesson here is this: the branch is important – as important as it ever has been. It is your living billboard, an anchor in the community, and it drives new acquisitions.

The numbers game here when it comes to your branch network is not about how many, but how many in the right trade areas. Branches acts as an anchor in a given trade area, but that serviceable trade area’s geography may be bigger than what it was five years ago. Right sizing your branch network is key, but you need to optimize your branch network for the right amount of coverage, to serve your customers or members in and around where they live and work.

If the question of your branch network and the best path to optimization comes up a little too often in your strategy meetings, it’s time you reached out to LEVEL5. Our Strategy team analyzes branch networks and expansion geographies every day for community banks and credit unions across the country.

Why FI Leaders Should Think Like a Developer

Just like the leader of a credit union or community bank, land developers always have growth in their sights and there are many strategies that a financial institution could benefit from to expand in an intelligent and financially advantageous way. Here’s how.

Let’s look at the big picture first; you know that your growth depends on increased loan and deposits, and a major factor of those numbers is your ability for new members to open new accounts. Branches are major avenues for creating and retaining new clients.

Having well-placed brick and mortar branches is a necessity by geo-locating the right branch near those targeted new members/customers, so you might as well do it in a way that benefits you the most, from varying angles, just like a savvy developer.

3 Ways to Optimize You real estate efforts

1. Develop a Multi-Tenant Plaza, Occupy and Fill

If you build it, they will come.

When you’re searching for a new prime piece of land, task one is to ensure it’s right for your organization’s needs. Beyond that, you can drive even more foot traffic into your place by making convenient shopping experiences surrounding it. Convenience is valued and appreciated ever more in our modern-day culture. Here’s how you can leverage that.

Small retail outlets, coffee shops, restaurants, an urgent care, nail or hair salon, you name it. You’re creating a place of value for the local community and your branch is included in this hotspot.

Prospect clientele may be drawn in by your new development, peruse shops, and realize that their banking needs can be met there as well. Another thing they can check off their “shopping” list.

This can enhance relationships with existing clients in this market as well. They may have more incentive to drop into your branch on their shopping or errand trips, opening up the floor for more discussion, deepening relationships. Perhaps after their coffee next door, they’ll remember about that new account they’ve been meaning to open.

If the idea of a plaza seems overwhelming, sublet just one part of your building to a boutique business like one of our clients did with a soda shop in Utah!

2. Extra Land Extra Value

Secure a parcel of land that’s larger than your immediate needs require. This doesn’t necessarily mean go all out and grab 20 acres more than you need, but this can be done with a purposeful and lean strategy. Remember, the developer is always thinking ahead, just as you are.

One LEVEL5 client benefitted greatly with this strategy by purchasing a 2 acre plot, then built their new, best-in-class branch on 1 of them. The property value of the empty acre then rose due to the modern branch’s proximity.

The grand finale? This client ended up selling the empty acre for more than what they had bought both acres for.

Now that’s a return on investment for the record books.

When considering site selection, always work with a team who has ample experience and resources in locating the right credit union or bank branch real estate for your needs.

3. Repurpose Your Existing Space & Scale Up Simultaneously

Developers understand the need for new space, but they also know the value of strategically making the most out of an existing space, too.

Use your goals as guideposts, then take due action.

Consider the example story of our client Hoosier Heartland State Bank’s branch transformation and operations center needs in Indiana. They desired to breathe new life into their main branch to better meet the needs of their modern, expanding customer base while also developing a new operations center to support an increase in employees.

This all needed to be done in a way that differentiated the bank as a leader in their community.

They partnered with LEVEL5, who knows bank construction inside and out, and thinks like a developer.

Their branch got an update with a new floor plan, diverging away from traditional teller lines, into a more open retail environment, giving staff a more effective way to interact with members and forge deeper relationships.

Their operations center now fits their long-term staffing needs, and the new exteriors reflected their forward-thinking culture.

Hoosier Bank’s President, Brad Monts added, “We chose LEVEL5 as our partner because of the value they bring to the complete design-build process. Few firms in the country can study markets, address headcount, procure real estate, design and construct facilities like their team.”

Furthermore, their HQ is part of a larger renovated complex, where they have sub-leased space to small business owners that not only benefit their employees, but also help revitalize their home town.

Contact us today for assistance locating the right land or updating an existing branch for your needs. We have experience helping partners get the most value and return from their property.

Act On Your Branch Growth Data Plan Before It’s Too Late!

- Banks

- Branch Transformation

- Consulting

- Credit Union

Categories:

When you go to the grocery store, and you see those ripe, crisp apples at their peak of freshness, you buy a bunch with every intention to consume them over the next day or so.

You put them in a bowl, on the counter, but if they go unattended, they begin to stale, go past their peak freshness, eventually going rotten.

In the world of banking, data and apples are one in the same. When delivered they are fresh. If left alone, they begin to stale with each passing day.

If you are a banking executive looking to grow and you are given fresh data, do you intend to do something with it, or will you just watch it rot?

When you hire a firm like LEVEL5 to assess your current and potential growth markets, you are given irrefutable data points and a 10-year proforma back-tested at 96% accuracy.

When looking to de-risk decisions, you can’t really have more confidence in the black and white, binary numbers to help support your decisions. But that data has a shelf life.

Strike the iron is while it’s still hot. Otherwise, you may miss out on real growth potential because as time ticks on, your data becomes stale, all the while, your competition will likely be making their moves.

Let’s say you receive the data and you don’t act on it for 6 months…that’s 6 months you could’ve been making progress, now lost.

Can your institution really afford to be behind for so long?

To illustrate the real implications of inactivity, we’re highlighting some vital junctures where taking steps soon on your fresh credit union and community bank consulting analytics can have a huge impact on your future.

3 Ways Current & Valid Data Assist Your Overall Growth

Change is the only constant, and how you fare rests on the ability to adapt accordingly.

That goes for branch networks too, one of your major avenues for gaining and maintaining the desired clientele.

Visualize your branch network as an ever-adapting entity, acclimating to the winds of change in market viability and customer demographics. You need to play this strategy correctly and decisively to win out.

In this state of flux, accurate analysis for fruitful future steps can certainly be made, but lingering on current quality data longer and longer places your organization further and further behind in making highly effective moves for your network’s viability.

There are 3 pivotal ways to optimize your network, but acting on your current data analysis is highly time sensitive in order to reap the rewards:

1 – Opening New Branches In The Right Areas

With accurate market and demographic analysis aligned with your specific goals, you understand the logic and purpose behind opening up new branches in high-quality locations. You don’t want to let solid direction pass you by here, as you’ll be missing out on prime locations that will be building up your clientele portfolio and holdings. Worse yet, a savvy competitor may beat you to saturating a market before you can.

Watch our video on Northeast Credit Union where we helped them grow into new places with informed market analysis.

2 – Closing Underperforming Branches

Branches that are repeatedly in the negative need to be closed and waiting too long means they’ll keep pulling valuable resources from your organization, resources that could be reutilized for growth.

Don’t worry, closing a branch is not the end of the world, in fact, it’s just par for the course. Similar to retail environments, this is just part of the evolution. Their absence can be made up for in spades with your new locations that are prime for future performance.

Do you act soon and save resources based on your valid data? Or do you wait to see what happens while running a real risk of detriment to your institution?

3 – Crafting Your New Branch Prototype

Your prototype works on so many levels to drive your institution into the future and holding back in its implementation sets you back even further.

A world-class prototype design accounts for everything needed to make a success including, but not limited to:

- A floor plan to facilitate employee and member interaction

- A modern appearance that solidifies you as a leader in your market

- Branding consistent with your culture and values

- An easily repeatable and malleable design for effective, rapid deployment

When you meticulously create a new branch prototype, you’re laying the foundation for attracting new members and offering excellent quality experiences for years to come. This design is carefully crafted and tailored meet the needs of your clientele’s unique demographics as well as to accommodate for the future of financial institution needs.

Consider the following if you’re hesitant to put your prototype into action:

Why go through all that upfront work creating the next generation of your institution, just to never use it?

What optimal land in the market will you place your new state-of-the-art branch prototype on if it’s already been gobbled up by your competitor?

It’s undeniably important to start rolling out the new face and space of your institution before it becomes just an idea lost to time. Both your clientele and stakeholders will greatly value the exciting new look, feel, and functionality of your newly-built or updated branches.

Don’t Let Success Pass By Your Organization

You’re truly doing yourself a disservice by waiting too long to act on quality data, plain and simple.

LEVEL5 visualizes Actionable Data as one of our 5 Elements of a Branch Transformation Playbook and we dissect your data to purposefully point you in the right direction for meaningful, lasting expansion through branch optimization.

Contact our team today for a 10-year pro-forma based on your performance metrics so you can make the most of your institution’s time.

The clock is ticking…

The Network Effect

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Retail

Categories:

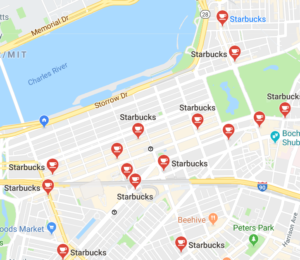

Have you ever visited a new city and find yourself needing a pick-me-up that only a good cup of coffee will satisfy? As tempting as a local cafe can be, they are an unknown and you don’t want to take a chance and risk a good cup of coffee on a bad mom and pop shop. Luckily, you know they’ll be a Starbucks nearby. Heck, there’s likely several of them nearby. Even if it’s not your favorite cup of coffee, it’s a familiar place and you know exactly what you’ll be getting.

Familiarity and consistency may be at the heart of why franchises exist, but there’s more to the story – especially when considering the economic factors of a high concentration of locations for a specific business.

The reason you’re seeing so many Starbucks around town, and sometimes even across the street from one another, is not because they are doing you a favor and having so many locations for your convenience. Those stores are making money. And making even MORE money by the sheer fact that there are so many concentrated within a geographic region.

According to Investopedia, the “Network Effect” is “a phenomenon whereby increased numbers of people or participants improve the value of a good or service.” Translating this into retail locations, there is an increase in overall store performance by the sheer fact that there are other stores nearby.

To put this in simple economic terms, if a specific trade area has 4 Starbucks each earning $800,000 per year. The fifth location in this Trade Area will not only likely earn that $800,000 average, but because of the concentration of locations (the Network Effect), all five Starbucks locations can expect a X% lift across the board.

You can easily translate this retail strategy to your Branch Network.

If you have a good saturation of branches around a city, you are not only providing retail location conveniences to those living in that market, you will be gaining market share, share of wallet, and pinching your competitors.

Doing this even more so by accurately saturating a market with locations not only accomplishes the above, but your overall revenues and profits across the board will benefit from the Network Effect.

Now, this all sounds well and good when you talk about it in theory. The key here, however, will be execution. If you scatter branches arbitrarily around a market in efforts to achieve The Network Effect, you might not like the results. It is imperative that you do your data homework before executing this plan, or, better yet, work with a partner who specializes in interpreting data to produce the most effective strategy.

Once you’ve gathered the data, interpreted it, and created a strategy for your branch network, it’s time to execute. Not executed hesitantly, one branch at a time, to test the waters. The Network Effect can’t take place unless the network (concentration) is there. Entering one market strong with a few branches will yield better results and more loans and deposits than entering a couple different markets with individual branches.

Contact LEVEL5 today to learn more about our Strategy and Market Analysis work, which can help you find the right location, and determine the right amount of branches in a market to help you achieve the Network Effect.

Hub & Spoke model

Any branch optimization and expansion strategy should have a well-laid out plan regarding Hub & Spoke.

A classic and well-known strategy within the retail sector, implementing a Hub & Spoke model has a play within your branch strategy as well.

The foundation of a Hub & Spoke strategy is born in the Market Analysis phase, where geographic assessments are analyzed and overlaid with branch types that are a fit for that market. They are then perfected in the Design phase where a branch prototype is completed, along with accompanying Kit of Part components for scalability across different branch types and markets.

Here, we’ll break down the key sequential steps to planning and executing a well-planned Hub & Spoke strategy.

Step 1 – Strategic Market Segmentation Analysis

In looking at the broader Market Segmentation Analysis, this geographic assessment is your “50,000 foot” view of expansion areas, which could be at the state or county level, or both. Within this, there will be multiple Trade Areas deemed as viable expansion opportunities.

When working with LEVEL5, the key point of differentiation between other “Real Estate Consultants” is that we only make recommendations in specific Trade Areas where viable sites are available.

The sites of consideration are then ranked in order.

If you’re looking to build multiple branches in multiple geographies over the course of a 5-year aggressive growth plan, LEVEL5 will help you plot your Trade Areas based on different and varying priorities such as growth markets, demographies, loans, deposit, build-out costs, etc.

Step 2 – Branch Type Mix

Once multiple Trade Areas have been identified across a large Market Segment, you need to start thinking about which branch types fit in which Trade Areas, while also considering adjacent trade areas and their branch types.

Choosing the right branch type in a given market can be daunting, and the wrong decision can result in an underperforming branch leaving loans and deposits unclaimed in that Trade Area.

The key branch types of consideration in a Hub & Spoke model are:

- Flagship Branch – Your primary, free-standing branch, likely offering the most services, best experience and boastful brand deployment components

- Satellite Branch – A full-service, free-standing branch, just not to the level of your Flagship

- Headquarters Branch – A full-service branch, embedded in your Headquarters location

- Storefront Branch – A full-service branch embedded in a shopping center

- Micro Branch – A smaller footprint, not offering as many services/functions, but still delivers the transactional needs of your consumers

- Branch with Regional Office – A full-service branch, located far from your headquarters, thus the need for “back office” facilitates to support that “remote” geography

Step 3 – Staffing Models

When a branch type is considered for a specific location, layering a Staffing Model is the next step.

Based on the branch type, total volume of employees can be calculated based on square footage, assumptive traffic patterns, as well as product and service mix.

Staffing specialties to consider are Universal Tellers, as well as Mortgage, Investments, etc. based on the needs of the customer/member in that area.

Step 4 – Technology Models

The final component of a Hub & Spoke model involves the technology and equipment needed to fully execute a branch type. Considerations here are ATM’s, ITM’s, Cash Recyclers, Digital Signage, among others.

Developing your Hub & spoke model

While the four steps outlined above are presented sequentially, their considerations actually should be viewed more as a variable matrix.

Knowing how all the elements intertwine is one thing, but understanding how to execute a Hub & Spoke model, specifically when the disparate parts make up a proforma to aid decisions, is an entirely different task.

Lucky for you, LEVEL5’s Strategy and Site Selection departments do this every day.

If your Bank or Credit Union is in need of a full branch assessment and right-sizing for a fully formed, well-executed Hub & Spoke retail branch model, you deserve to contact LEVEL5 today.

Entering a new market

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Services

Categories:

When assessing growth plans, and following the methodologies outlined in our recent Branch Playbook, you should have a clear understanding of how important data is when making market expansion decisions.

A proper Branch Playbook dives deeper into the geographic components that make up Market Analysis.

Data de-risks growth decisions, and is a critical element of expanding into a new market.

Enacting growth strategies by opening branches in a new market is not as simple as pointing to a map and building a branch. The days of building a new branch in a “busy” area of town just doesn’t cut it.

The right data not only informs these decisions, but gets you beyond generalities and into the specifics you and your Board need to greenlight projects and get you on the right growth path.

When it comes to data, LEVEL5 calculates and delivers an in-depth proforma that reviews variable data points across a 10-year horizon.

Below is a rundown of the critical data components that inform the proforma and aid your geographic expansion plans:

- Loans and Deposits Forecasting – Likely the most important component when assessing the Data Outputs, when assessing expansion geographies and specific Trade Areas, you need to understand the “elbow room” in that market, i.e. are there still Loans and Deposits to be had, or is a given Trade Area saturated, and thus not viable

- Competitive Analysis – Speaking of “elbow room” – is there an opportunity for you as a new retail banking entrant into a given market or not? Going beyond the elbow room, do the competitors in that given market dominate and/or outspend you, or will your entry be well received?

- Consumer Overlays – A critical factor in geographic expansion is answering the question of how many of your existing consumers live in this expansion geography. Having a pre-built consumer base is often an important component

- Demographic Tapestry Profiles – You may know exactly who your consumers are, but do those consumers live in the next town over. Consumer demographics can shift greatly within only several miles, so understand the overlays of your existing base in expansion geographies

- Market Potential Indices – The MPI measures the likelihood of adults in a given geographic area to exhibit purchase behaviors based on certain banking products and services that align to your offerings (or those you plan to introduce)

- 4 Square Quadrant – The final component of the LEVEL5 Market Analysis engine is the delivery of a 4 Square Quadrant reading of a host of proposed branches in a given Trade Area by scatter-plotting them based on the branch performing well or poorly, and cross sectioned with the market potential being good or poor

To learn more about LEVEL5’s Strategy division and our unparalleled Market Analysis, contact us today so we can begin the assessments needed to help you grow the right way.

Crystal Ball 2022 Pt. 2 | Supply Chains & Trades Issues

- Banks

- Branch Transformation

- Brand Deployment

- Credit Union

Categories:

Welcome back, if you missed Part 1, you can access here.

Part 2 – Supply Chains & Trades Issues

While the pandemic seems to be drifting away, at least in its economic impacts, construction materials supply chain problems and availability of Subcontractors will continue to remain a challenge to credit unions and community banks looking to open a new branch in 2022 or 2023.

A critical component to executing a Branch plan is to have the right partner on your side.

Advance Planning, Advance Savings

During the past 2 years, more and more of LEVEL5’s clients have been opting for advance design and planning of multi-year, multi-branch rollout strategies for their prototype branches. We believe this is happening largely because the antidote to such an unpredictable construction landscape is predictability that translates into advanced planning with the benefit of cost savings.

So how does working with our team help you plan for the future and reduce your spending?

Establishing a supply chain means that you have a defined product to execute upon. Let’s use a branch prototype as example. Once you’ve worked with LEVEL5 to design and finalize your prototype, this means that you’ve already specified materials needed for the majority of your branches. At this point, our team can work proactively with different manufacturers, subcontractors, suppliers for furniture, equipment, fixtures and so forth.

This advanced heads-up will give our sourcing partners an upfront and predictable way of understanding allocation needs. It will in turn helps to bring down prices for you.

The Design-Build construction method allows you to make material selections based on current availabilities. We factor this in with you in the design process.

Conversely, in the Design-Bid-Build process, a stand-alone architect designer may not be as privy to current materials costs in the design stages. Not being able to account for fluctuations here can result in unexpected costs once bids are turned in.

Think of the saying “knowledge is power.” In this context, we’re talking about the knowledge of future needs. It is a power that keeps costs down for your financial institution.

As you can see, advanced design and planning of rollouts can certainly drive down cost.

Knowing Costs Now Helps You Make Better Business Planning Decisions

To your advantage, you have an annual business planning cycle that needs to be built on sturdy information.

Once your professional credit union and bank consulting is complete, you’ve decided on the prototype and strategy. Then, we supply you with an accurate price estimate on your new branch or branches.

Having an accurate estimate now takes a huge unknown out of your organization’s plans, giving you more assurance and a realistic scope of your budget. It also allows you to make effective projections and preparations for changes in personnel at varying locations.

Secure Necessary Subcontractors Amid Shortage & Strain

Subcontractor labor shortages have been an issue even before the pandemic. Think all the way back to the great recession in 2008. But now, it’s become even more strained due to the aftermath (or continued impact) of COVID-19.

Because of these circumstances, the ability of your General Contractor to secure the right kind of Subcontractors for your project will only become more difficult the longer you wait to get things started. Less time to plan ahead and communicate properly with Subcontractors on their availability can cause obvious hurdles for your goals.

This goes for both singular branch builds and multi-branch rollouts. However, we want to note that Subcontractors will be more aggressive sometimes. For example, bidding and staffing for projects that are part of an integrated/multi-location rollout will be aggressive. A one-off branch project will be much less so.

Regardless of the branch rollout volume, you can see how moving forward with long-term action now will put you in a preferable spot. It will minimize unknowns in both project staffing and pricing.

Don’t linger too long when making growth decisions – it could cost you greatly in finances, stress, and timeline goals for your bank or credit union.

Contact us now for help avoiding unnecessary expenditures and longer–than–necessary lead times. Our 20+ years of growth consulting for banks and credit unions, coupled with our nationwide relationships with manufacturers and subcontractors, Is the added muscle you need to get a well-executed project off and running.