3 Reasons to LAUNCH: PROPOSAL

- Announcements

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Retail

Categories:

We Have Liftoff

LEVEL5 has officially launched our LAUNCH Program.

This program is perfect for the Credit Union and Bank executive struggling to execute their strategic goals.

Phase I was the Discover phase, Phase II was Alignment. In Phase III, we’ll discuss the delivery of the Proposal and what that means to getting you that much closer to Liftoff.

Phase III: Proposal

By Phase III, if we’ve done our job, we’ve listened intently, captured all of your thoughts and concerned, and have now translated them into a Proposal for your review.

In this proposal, we’ll outline the overall scope of services, whether they be singular, or reflect an integrated deal, where all of our services are reflected, to present budget considerations and proposed schedules.

In this Phase, we’ll look to set up one final call, where we’ll be able to review the proposal, but most importantly, allow you the opportunity to ask any final clarification questions because from here, this proposal is either signed, or goes to the Board for final approval and signature.

Once the proposal is signed, we are officially at LIFTOFF.

While your project has been accounted for up to this point, the execution of the Proposal allows for your project to officially be assigned. Depending on scope of services, you will be introduced to your project lead and the project will commence in earnest.

Why LAUNCH At All?

The LEVEL5 LAUNCH Program follows a methodical, yet casual approach to uncovering the critical needs of your Financial Institution. Through a series of casual conversations, our team will be able to capture your goals, but also understand what is getting in the way of you achieving them.

From there, we’ll be able to make actionable recommendations on how to execute to these goals.

To learn more about our LAUNCH Program, and to schedule your first Discover call, Contact Us today to get going.

In the News: Chasing Chase

- Banks

- Branch Transformation

- Consulting

- Retail

Categories:

With so much being written over the years about the demise of the branch, especially in the wake of the pandemic and the rise of digital, it’s interesting to note the recently released article from The Financial Brand relating to the retail strategy revealed by Chase.

Among the click-bait worthy headlines such as digital first darlings, FinTech disruptors and industry pundits standing on their soap box eulogizing the branch and its prominence from a by-gone era, there is a level-headedness in analyzing what Chase is doing with their branch strategy over the past several years.

At LEVEL5, we work with community banks and credit unions each day developing and executing growth strategies and inevitably, these strategy sessions always hold discussions relating to the Big Banks – BofA, Chase, Wells Fargo and Citi.

There are two sides of the coin when watching what the Big Banks are doing – they are often (way) ahead of the curve when it comes to innovation, spend, resources and strategy. This can be a blessing and a curse. On one hand, they have the financial prowess and horse power to be a first mover. On the flip side, community banks and credit unions can sit and wait to see if those strategy work or now, and can extrapolate their own strategies thereafter.

When it comes to analyzing Chase’s retail branch strategy, there are some interesting lessons to be learned, particularly of note is their effort in “expanding their branch network.”

BANKING RELATIONSHIPS BEGIN AT THE BRANCH

Chase continues to innovate and offer a wide array of products, but the branch acts as an important anchor. Not only do most new relationships stem from the branch, but the branch purpose itself is morphing away from transactional and more toward advisory. This strategy is not only stated by Chase, but also recently corroborated by BAI in their recent “From branch to engagement center” article.

IT’S NOT ABOUT BRANCH REDUCTION, IT’S ABOUT BRANCH OPTIMIZATION

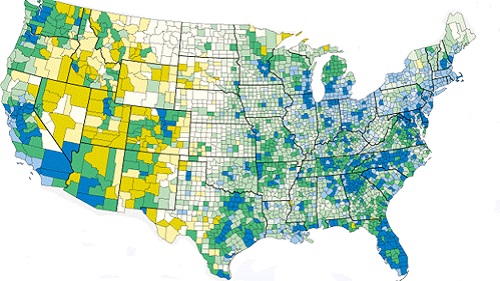

But it’s not just strategic lip service – the numbers support this as well. In 2017, Chase had approximately 5,150 branches across ~25 states, serving 61% of the population.

At the close of 2021, Chase’s retail branch strategy had ~4,800 branches, but covered the entirely of the lower 48 states, serving 79% of the population.

Don’t let the fewer number of total branches fool you you here – these were not out and out closures, they were consolidations, or branch optimization plans in effect, all the while, Chase was expanding, aggressively entering 300 new markets with 500 new branches, and saturating high value markets such as Boston, Philadelphia and D.C.

WHAT CAN YOU LEARN FROM THE CHASE BRANCH STRATEGY

Your FI is never going to be Chase. You’ll never outspend them, never spend as much on innovation, and never will offer as many products and services. You shouldn’t try to be them – but you sure can learn from them.

Regarding the branch, the lesson here is this: the branch is important – as important as it ever has been. It is your living billboard, an anchor in the community, and it drives new acquisitions.

The numbers game here when it comes to your branch network is not about how many, but how many in the right trade areas. Branches acts as an anchor in a given trade area, but that serviceable trade area’s geography may be bigger than what it was five years ago. Right sizing your branch network is key, but you need to optimize your branch network for the right amount of coverage, to serve your customers or members in and around where they live and work.

If the question of your branch network and the best path to optimization comes up a little too often in your strategy meetings, it’s time you reached out to LEVEL5. Our Strategy team analyzes branch networks and expansion geographies every day for community banks and credit unions across the country.

When to Remodel Your Branches

- Branch Transformation

- Credit Union

- Retail

Categories:

Here at LEVEL5, we talk a lot about how the world of retail is changing with the evolution of technology and how important it is for banks and credit unions to follow suit with the change. While adapting with the times is imperative for survival, it should be emphasized that change should never happen without strategy and clear intention.

While designing a new prototype to build a network of updated branches might be the most exciting prospect, it might not be the most efficient move based on available budget and/or operational capacity. Every financial institution is different, so it is important to know what makes the most sense for you.

This is where remodeling comes in.

Most branches across the country are already outdated. Most tend to be functional to a degree, but they lack the modern strategies that an open floor plan, technology, Universal Teller and journey/flow offer.

At LEVEL5, the branches that are presented to us as part of a remodel project tend to be over 10 years old. In fact, we’re working with a client that has a branch last touched since the 1960’s. That may be a record.

Regardless of age, the need is there. To understand the path forward for a remodel, we have identified three tiers of remodeling, each with their own varying levels of complexity, cost and impact.

Refresh

Refreshing your branch network is the least involved of the three, focusing purely on the surface-level aspects of your branches. This would include putting a fresh coat of paint on the walls, fixing up any dinged surfaces, possibly replacing the carpet, or any other small fixes. These would not take very much time and would have minimal impact on your branch operations. These changes are meant to cover up the natural wear and tear that a branch compiles over time.

Redesign

A redesign would be a step up from the refresh. This wouldn’t necessarily mean overhauling the branch, but more so taking a look at what is outdated and isn’t working in the branch design anymore. If you still have traditional teller lines, this might mean taking them out and replacing them with teller pods. Along these lines, introducing additional technology could also involve ITM’s or adding a tech table with some iPads for consumers to use if that makes sense for your demographics. With the introduction of tech, inevitably some fixture modifications would fall in line as well.

Reinvent

The most involved (and presumably, the most impactful) way to remodel your branch would be a reinvention of the space. This means a complete overhaul of your branches, just short of building new ones from the ground up. This would include all of the elements of refreshing and redesigning, and more.

From knocking down walls to not only create a more open concept, but to allow for better flow and offer a better retail journey for each visitor.

This is also an opportunity to reinvent brand deployment. This is not necessarily calling for a rebrand, but a reinvention of the way your brand is executed in the physical space.

Technology here is a foregone conclusion as it creates a superior consumer experience. Wall graphics to support the zones in your branch could allow your consumers to know exactly where they want to go in the branch for their specific purposes. Even lighting could alter the consumer experience.

Now more than ever, change is not only important, but necessary for survival.

If you’re interested in assessing your branch needs to build a strategy, CONTACT US now.

The yin and yang of branching

- Branch Transformation

- Credit Union

- Retail

Categories:

Much has been written about the branch of the future. What does it look like? What are the key strategies? How does the member/customer experience play out? Is it even already here?

The short answer is there is no short answer – only different perspectives. The right answer, if there is a singular one to consider, is this: the branch of the future construct is entirely on you and your organization to make it as you see fit.

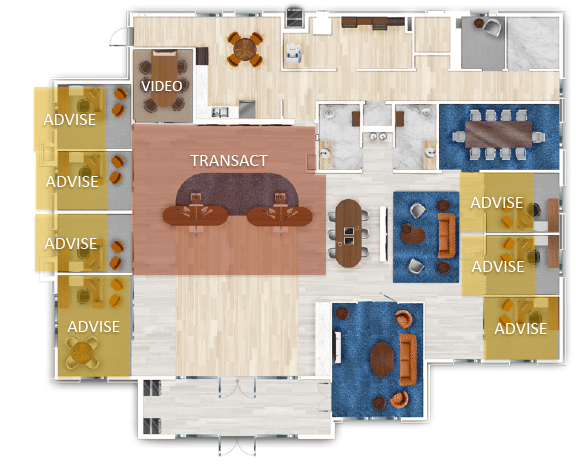

One perspective on the future of branching is the discussion point involving the traditional legacy of a branch and its core being the transaction, while also understanding the momentum to the modern branch being advisory.

The problem with contemplating a branch strategy from either a transactional perspective or an advisory perspective is in the “or.” Your branch strategy should not be rooted in “or” – it should be rooted in “and.”

Think about it from the perspective of Yin and Yang. Colloquially, Yin and Yang are used commonly to describe to diametrically opposed concepts, like oil and water. But in reality, the concept of Yin and Yang is actually describing two things that compliment each other – not opposing one another.

So when you are contemplating your Branch of the Future and trying to figuring out the anchor strategy of a branch that is either transactional or advisory, the answer is both.

A well designed branch will have both a transactional and advisory zone. The layouts may differ, as long as the strategy is rooted in the member experience. And the way it is executed may also vary, with different forms of cash machines deployed across different areas (both inside and outside) of the branch to appease those short visit based transactions, whether it be ITM’s in the drive-through, Cash Recyclers affixed to floating Teller Pods, Assisted Self-Service machines flanking the Teller Stations, right up to a traditional ATM for walk-up traffic.

On the advisory side of the house, designs can see casual Onboarding Stations with tablets at the ready for initial conversations, semi-private conversations at high top counters with screens for a deeper financial planning session, or a fully private conversation in an enclosed office with a resident Personal Banker, or even in a video enabled room where members/customers can speak to a remote expert.

When you’re contemplating your next branch strategy and the discussion of transactions versus advisory arises, remember the Yin and Yang – they are not individual strategies unto themselves, they are complimentary strategies that are part of a larger, engagement-based branching experience.

If you’d like to learn more about branch strategy and review floor plans demonstrating a well-executed transaction and advisory zone, contact LEVEL5 today.

The Network Effect

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Retail

Categories:

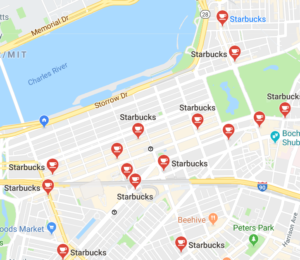

Have you ever visited a new city and find yourself needing a pick-me-up that only a good cup of coffee will satisfy? As tempting as a local cafe can be, they are an unknown and you don’t want to take a chance and risk a good cup of coffee on a bad mom and pop shop. Luckily, you know they’ll be a Starbucks nearby. Heck, there’s likely several of them nearby. Even if it’s not your favorite cup of coffee, it’s a familiar place and you know exactly what you’ll be getting.

Familiarity and consistency may be at the heart of why franchises exist, but there’s more to the story – especially when considering the economic factors of a high concentration of locations for a specific business.

The reason you’re seeing so many Starbucks around town, and sometimes even across the street from one another, is not because they are doing you a favor and having so many locations for your convenience. Those stores are making money. And making even MORE money by the sheer fact that there are so many concentrated within a geographic region.

According to Investopedia, the “Network Effect” is “a phenomenon whereby increased numbers of people or participants improve the value of a good or service.” Translating this into retail locations, there is an increase in overall store performance by the sheer fact that there are other stores nearby.

To put this in simple economic terms, if a specific trade area has 4 Starbucks each earning $800,000 per year. The fifth location in this Trade Area will not only likely earn that $800,000 average, but because of the concentration of locations (the Network Effect), all five Starbucks locations can expect a X% lift across the board.

You can easily translate this retail strategy to your Branch Network.

If you have a good saturation of branches around a city, you are not only providing retail location conveniences to those living in that market, you will be gaining market share, share of wallet, and pinching your competitors.

Doing this even more so by accurately saturating a market with locations not only accomplishes the above, but your overall revenues and profits across the board will benefit from the Network Effect.

Now, this all sounds well and good when you talk about it in theory. The key here, however, will be execution. If you scatter branches arbitrarily around a market in efforts to achieve The Network Effect, you might not like the results. It is imperative that you do your data homework before executing this plan, or, better yet, work with a partner who specializes in interpreting data to produce the most effective strategy.

Once you’ve gathered the data, interpreted it, and created a strategy for your branch network, it’s time to execute. Not executed hesitantly, one branch at a time, to test the waters. The Network Effect can’t take place unless the network (concentration) is there. Entering one market strong with a few branches will yield better results and more loans and deposits than entering a couple different markets with individual branches.

Contact LEVEL5 today to learn more about our Strategy and Market Analysis work, which can help you find the right location, and determine the right amount of branches in a market to help you achieve the Network Effect.

Hub & Spoke model

Any branch optimization and expansion strategy should have a well-laid out plan regarding Hub & Spoke.

A classic and well-known strategy within the retail sector, implementing a Hub & Spoke model has a play within your branch strategy as well.

The foundation of a Hub & Spoke strategy is born in the Market Analysis phase, where geographic assessments are analyzed and overlaid with branch types that are a fit for that market. They are then perfected in the Design phase where a branch prototype is completed, along with accompanying Kit of Part components for scalability across different branch types and markets.

Here, we’ll break down the key sequential steps to planning and executing a well-planned Hub & Spoke strategy.

Step 1 – Strategic Market Segmentation Analysis

In looking at the broader Market Segmentation Analysis, this geographic assessment is your “50,000 foot” view of expansion areas, which could be at the state or county level, or both. Within this, there will be multiple Trade Areas deemed as viable expansion opportunities.

When working with LEVEL5, the key point of differentiation between other “Real Estate Consultants” is that we only make recommendations in specific Trade Areas where viable sites are available.

The sites of consideration are then ranked in order.

If you’re looking to build multiple branches in multiple geographies over the course of a 5-year aggressive growth plan, LEVEL5 will help you plot your Trade Areas based on different and varying priorities such as growth markets, demographies, loans, deposit, build-out costs, etc.

Step 2 – Branch Type Mix

Once multiple Trade Areas have been identified across a large Market Segment, you need to start thinking about which branch types fit in which Trade Areas, while also considering adjacent trade areas and their branch types.

Choosing the right branch type in a given market can be daunting, and the wrong decision can result in an underperforming branch leaving loans and deposits unclaimed in that Trade Area.

The key branch types of consideration in a Hub & Spoke model are:

- Flagship Branch – Your primary, free-standing branch, likely offering the most services, best experience and boastful brand deployment components

- Satellite Branch – A full-service, free-standing branch, just not to the level of your Flagship

- Headquarters Branch – A full-service branch, embedded in your Headquarters location

- Storefront Branch – A full-service branch embedded in a shopping center

- Micro Branch – A smaller footprint, not offering as many services/functions, but still delivers the transactional needs of your consumers

- Branch with Regional Office – A full-service branch, located far from your headquarters, thus the need for “back office” facilitates to support that “remote” geography

Step 3 – Staffing Models

When a branch type is considered for a specific location, layering a Staffing Model is the next step.

Based on the branch type, total volume of employees can be calculated based on square footage, assumptive traffic patterns, as well as product and service mix.

Staffing specialties to consider are Universal Tellers, as well as Mortgage, Investments, etc. based on the needs of the customer/member in that area.

Step 4 – Technology Models

The final component of a Hub & Spoke model involves the technology and equipment needed to fully execute a branch type. Considerations here are ATM’s, ITM’s, Cash Recyclers, Digital Signage, among others.

Developing your Hub & spoke model

While the four steps outlined above are presented sequentially, their considerations actually should be viewed more as a variable matrix.

Knowing how all the elements intertwine is one thing, but understanding how to execute a Hub & Spoke model, specifically when the disparate parts make up a proforma to aid decisions, is an entirely different task.

Lucky for you, LEVEL5’s Strategy and Site Selection departments do this every day.

If your Bank or Credit Union is in need of a full branch assessment and right-sizing for a fully formed, well-executed Hub & Spoke retail branch model, you deserve to contact LEVEL5 today.

Data Points the Way

- Branch Transformation

- Credit Union

- Data

- Retail

Categories:

Using data to make informed decisions is nothing new. We’ve seen (or at least heard) the stories of mega e-commerce platforms that know what and precisely when to deliver us ads on things we didn’t even know we needed. Sports leagues use data to determine the value and output of a player beyond what a scout can see with the naked eye and thirty years of industry experience.

When it comes to informing your Branch Playbook (download here), and determining the right methodologies and decision, you need to have the right access to data (and likely the right partner).

LEVEL5’s approach to Strategy and Market Analysis goes beyond the traditional “consulting” engagement of other firms. Firstly, Market Analysis and the data does not live unto itself, we pair it with Site Selection.

While traditional firms will tell you a market area is viable, we take the data and hand it off to our Site Selection department to determine actionable properties. What good is data pointing to a broad section of a map if there is nothing actionable.

To further understand how LEVEL5 does Market Analysis, we have broken out the data components into two broad categories, with four sub-sets in each.

The first four components of our Market Analysis represent the critical INPUTS that fuel our proprietary algorithms.

- Data Points – We begin by feeding the data engine with proprietary data points exclusive to LEVEL5, as well as data points exclusive to you, the Financial Institution

- Staffing Interviews – Our Strategy team conducts a series of staff interviews, both qualitative and quantitative, which are then gathered and computed into the overall input engine

- Market Segmentation Analysis – Geographic assessments are conducted over a defined area to include currently existing footprints and growth areas, which include competitive analysis, current consumer overlays, population densities and growth trajectories, demographics and product propensities

- Trade Area Analysis – The final layer is a further drill-down at the geographic level, determining a several square block radii with viable, actionable properties

The second phase of a data-rooted Market Analysis effort is the OUTPUTS.

- 10 Year Proforma – LEVEL5 delivers a 10-year proforma on a specific branch’s performance over a 10 year period with several variable factors, giving you visibility into the break-even point, loans, deposits, and Return on Investment (ROI)

- Branch Type Model – One of the key variables to the 10 Year Proforma is branch type, with the modeling allowing for plug and play entries for free standing, storefront, and micro branch types, among others

- 10 Year Staffing Model – Staffing, and their inherent costs greatly impact the model of a branch’s performance, with entries allowed for number of staff and staff types (salaries/costs)

- Technology Needs Assessment – Technology, whether it be banking equipment and/or digital signage are an important capital cost consideration into your overall branch growth decisions

If you’d like to learn more about how LEVEL5 approaches data differently, and can give you the visibility into your growth potential and help you de-risk decisions, Contact Us today.

Crystal Ball 2022: The Full Series

- Branch Transformation

- Retail

Categories:

For those who have read the entire series thus far, or for those who may have missed a week, but are looking for a consolidated version, this is the version for you.

Below, we present our combined 4-part Crystal Ball 2022 series.

Part 1 – Costs Continue to Rise

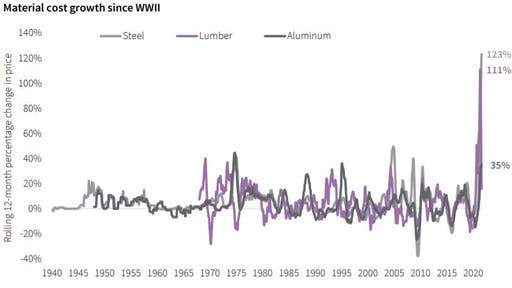

While indicators seem to be pointing to a “recovery” from the pandemic, such as employment rates, and even total cases per day/month, one of the lagging hangover effects that has not begun to ease are construction costs.

One of the impacts of the pandemic, foreseen or not, was the spike in construction across the board, both residential and commercial.

As seen with the below graph from the U.S. Bureau of Labor Statistics, costs of materials have not only spiked, but are also the highest since World War II.

Regardless of prices, this has not translated into construction projects being put on ice – quite the opposite.

Cranes are flying over downtown skylines, and residential neighborhoods are replete with both new homes, remodels and extensions.

So what does this all mean for a Bank or Credit Union who is looking to grow, and looking at the branch as a main driver of this growth?

It comes down to a matter of investment.

While it may cost “more” to build a branch compared to pre-pandemic cost structures, if it’s growth you seek, and it can only/mostly be done via new members bringing in new Loans and Deposits via a new branch in a new Trade Area, you have to ask yourself if it’s worth the investment.

Wayne Gretzky famously said, “You miss 100% of the shots you don’t take.”

In banking growth terms, this quote can be translated into the simple economic situation of needing to invest to grow, or, “you have to spend money to make money.”

Material costs are predicted to rise, or stabilize at least through the first half of 2022, but what is the trade off of NOT doing anything? How can you value being stagnant, and how do you justify to the board to sit and wait for an unknown “cost” future?

The reality is, for a Bank or Credit Union looking to grow, you act now.

So, how do you counterbalance higher material costs for optimal margins?

Economies of Scale

Typically, when LEVEL5 begins a client engagement, the discussion of a branch is never singular, it typically involves 2 or more branches, even if the schedules for the builds is over a 12-36 month period.

If the plan is to indeed design and build more than one branch, buying the raw materials in advance will yield savings, and aid the overall margin.

Labor Discounts

Deals on labor can be had when multiple projects are happening either concurrently, or successively.

As the General Contractor, LEVEL5 has existing relationships with different Trades (sub-contractors) across the country, and have had success in booking these Trades for multiple jobs. This aid the sub-contractor, who can keep their workers engaged for longer.

Real Estate/Site Selection Transactions

LEVEL5 has been acquiring land and buildings for clients for over 20 years. In doing so, we veil your identity during the negotiation phase. The reason this is important is because in doing so, we have more negotiation power, and often save our clients up to 18% on the transaction price – helping your bottom line.

Time is Money

The other benefit of working with LEVEL5 when it comes to overall cost is the savings you’ll get from working with a proven national General Contractor. In today’s economic climate, the supply chain is compromised and there are labor shortages – both of these typically mean that a standard construction job inevitably is going over on schedule – and added time is added money.

We have been successful in queuing up work well in advance, which is why we subscribe to the “Design-Build” philosophy, not Design-Bid-Build.

Design-Build forecasts materials and labor during the planning stage. When things are known and predicted up front, plans can be made, and money can be saved.

Part 2 – Supply Chains & Trades Issues

While the pandemic seems to be drifting away, at least in its economic impacts, construction materials supply chain problems and availability of Subcontractors will continue to remain a challenge to credit unions and community banks looking to open a new branch in 2022 or 2023.

A critical component to executing a Branch plan is to have the right partner on your side.

Advance Planning, Advance Savings

During the past 2 years, more and more of LEVEL5’s clients have been opting for advance design and planning of multi-year, multi-branch rollout strategies for their prototype branches. We believe this is happening largely because the antidote to such an unpredictable construction landscape is predictability that translates into advanced planning with the benefit of cost savings.

So how does working with our team help you plan for the future and reduce your spending?

Establishing a supply chain means that you have a defined product to execute upon. Let’s use a branch prototype as example. Once you’ve worked with LEVEL5 to design and finalize your prototype, this means that you’ve already specified materials needed for the majority of your branches. At this point, our team can work proactively with different manufacturers, subcontractors, suppliers for furniture, equipment, fixtures and so forth.

This advanced heads-up will give our sourcing partners an upfront and predictable way of understanding allocation needs. It will in turn helps to bring down prices for you.

The Design-Build construction method allows you to make material selections based on current availabilities. We factor this in with you in the design process.

Conversely, in the Design-Bid-Build process, a stand-alone architect designer may not be as privy to current materials costs in the design stages. Not being able to account for fluctuations here can result in unexpected costs once bids are turned in.

Think of the saying “knowledge is power.” In this context, we’re talking about the knowledge of future needs. It is a power that keeps costs down for your financial institution.

As you can see, advanced design and planning of rollouts can certainly drive down cost.

Knowing Costs Now Helps You Make Better Business Planning Decisions

To your advantage, you have an annual business planning cycle that needs to be built on sturdy information.

Once your professional credit union and bank consulting is complete, you’ve decided on the prototype and strategy. Then, we supply you with an accurate price estimate on your new branch or branches.

Having an accurate estimate now takes a huge unknown out of your organization’s plans, giving you more assurance and a realistic scope of your budget. It also allows you to make effective projections and preparations for changes in personnel at varying locations.

Secure Necessary Subcontractors Amid Shortage & Strain

Subcontractor labor shortages have been an issue even before the pandemic. Think all the way back to the great recession in 2008. But now, it’s become even more strained due to the aftermath (or continued impact) of COVID-19.

Because of these circumstances, the ability of your General Contractor to secure the right kind of Subcontractors for your project will only become more difficult the longer you wait to get things started. Less time to plan ahead and communicate properly with Subcontractors on their availability can cause obvious hurdles for your goals.

This goes for both singular branch builds and multi-branch rollouts. However, we want to note that Subcontractors will be more aggressive sometimes. For example, bidding and staffing for projects that are part of an integrated/multi-location rollout will be aggressive. A one-off branch project will be much less so.

Regardless of the branch rollout volume, you can see how moving forward with long-term action now will put you in a preferable spot. It will minimize unknowns in both project staffing and pricing.

Don’t linger too long when making growth decisions – it could cost you greatly in finances, stress, and timeline goals for your bank or credit union.

Part 3 – The Branch Lives

Gone are the days of industry commentators preaching “the branch is dead!” and gone are the talks of moving to solely digital platforms (we hope, we think, but probably not).

Long live the branch!

Let me explain:

The Surprising Aftermath of an ongoing Pandemic

Long ago, in the ancient days of 2018 and 2019, the percentage of people using branches was declining. In 2010, 83% of people surveyed said that they visited bank or credit union branches at least once a month. That number steadily declined to 70% and 69% as mobile and online banking steadily increased.

Everything changed when the pandemic hit. For a brief time, branch use obviously hit an all time low as the whole world shut down. Then, the strangest thing happened. As the world hesitantly began to open back up, as stimulus checks were sent out, as FDA-approved vaccines rolled out, people stepped back out into the sunlight. People not only started visiting branches again, but they started visiting them even MORE than before. In 2020, it was reported by the Fiserv company, Raddon, that 77% of consumers went to a branch at least once during the pandemic.

Despite the health risks of going in public, despite business shutting down, and despite the convenience and rise of mobile and online banking on top of all of that, the branch prevailed. People WANTED to leave the house and go interact with other people. People craved that human interaction.

The New Branch

Now, don’t get me wrong, digital banking is still rising and will continue to rise. But the rise of digital does not have to mean the death of the branch. They are not mutually exclusive. In fact, for either of them to work to their fullest potential, they must support each other. While mobile banking rises, brick and mortar will also rise. It might not be the traditional physical building that you’re used to, but it’s a physical building nonetheless. There’s a new branch in town.

Your branch locations must be used to fill the gaps that mobile leaves. This means the human element to branching is imperative. When a modern-day consumer walks in the branch, their first touchpoint should be a human one inquiring about their needs. After that, they can move either to the transactional zones of the branch or the advisory.

We’re finding more and more that people are coming in less for the teller lines and more to sit down in a private office to talk to someone about their finances. Now, they want to walk in the branch, tell an advisor about their financial goals, and plan a strategy to meet those goals. They want to learn about the different types of credit card programs you offer and discuss which one would best fit their needs. They want to learn about your high-yield savings account and how to properly invest their money. Some of them are buying houses and want to know about their mortgage options.

Even if they do want a transactional process done, many times, they’ll head straight to the ATM’s or ITM’s. As popular as mobile has and will continue to become, you’ll never be able to withdraw cash from your phone. At a tech table, a consumer might want to use a tablet to go through the steps of opening an account. You might ask yourself, “Why would they do this at a branch when they could go through the same steps on their phones?” Well, it might seem the same, but again, that lacks the human component. if they wanted to open an account quickly on a tablet inside the branch, they would also be able to ask questions to the nearest teller about the different types of accounts and which of them best suits their needs.

Your consumers cannot have the same level of security in informed decision making from their couches.

Whatever reason the modern consumer has for needing brick and mortar branches, there’s no denying the existence of that need. The people have spoken and the branch is here to stay.

Part 4 – The Branch Strategy Shift from Transactional to Advisory

Last week, we predicted the importance and need for the branch in the year to come. This week, let’s talk about the why and how of it all.

The Shift is Happening

While it is true that the branch is indeed alive and well, it is also true that the branch we used to know and love has irreparably changed. A study done by Raddon right before the pandemic surveyed consumers on their branch preferences. The results showed that when it came to the older generations, they did prefer those traditional branch layouts with the teller lines and transactional components. It’s what they were used to and knew how to use. When it came to Millennials, however, the results told a different story. The study showed that Millennials preferred very technology-oriented branches, and/or the “coffee bar” model of branch.

The technology focused branch is the branch that you walk into to see digital screens around, displaying local news, the weather, the stock market trends, advertisements about products that the financial institution is offering, and events in the area. It holds interactive teller machines and a tech table with tablets for consumers to use for transactional needs. The rest of the branch, then, is for advisory offices and maybe a teller pod or two.

A Cup o’ Coffee for Your Thoughts

The “coffee bar” branch is the branch with an attachment of a Starbucks, a Peet’s coffee (if you’re Capital One Café), or a local café that the financial institution is partnered with. That’s the branch that you, as a consumer, can visit to enjoy a coffee and dessert while you take out a car loan or open a new account. It can be a convenient place for students to go to for financial advice or to begin the learning process for the upcoming adult responsibility of money. Then, they can stay for the coffee and snacks with peace and quiet while studying.

The existing Capital One Café is the perfect example of this. In order to be successful, these branches are conveniently located and strictly advisory.

Both branch types represent solutions to needs that mobile banking does not and cannot fill. Millennials are no longer those kids that can’t get off their phones. They are now financially independent adults with careers, families, and homes. They are now thinking about how they can move up in the world and this means investing their money, taking out car loans and mortgages, creating financial strategies, and even planning early for retirement. Properly designed advisory branches are the perfect (and only) fit for those needs.

A Strategic Plan First

Now, that’s not to say that every single traditional branch must be shut down immediately. You must root every decision in strategy. You must take a look at your branch network, target markets, and consumer demographics before making the decision of what type of branch you need in each area. The market surrounding a college campus would benefit a lot more from the “new” branch than the market surrounding a retirement community, for example.

Lucky for you, LEVEL5 has the leading Market Analysis team for Financial Institutions in the country. Our experts will evaluate the relevant data to draw conclusions and then align them with your strategies and goals. After that, we can come up with a game plan together and begin the execution.

Whew, that was a lot. But good stuff, right?

Contact Us today to discuss any items herein. We’ve been future-proofing growth plans for Credit Unions and Banks for twenty years, helping our clients grow at twice the national average. It’s time you work with LEVEL5.

4 Critical Things We Learned in 2021

- Announcements

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Retail

Categories:

2021 was the much-anticipated light at the end of the seemingly endless tunnel of 2020. It wasn’t an easy year, as we were all still dealing with the tribulations of the pandemic, but it was laced with hope.

Before we begin to look ahead to 2022 (our annual Crystal Ball series is close), let’s revisit this year as we highlight 4 critical things and discuss what we learned.

The Branch is Not Dead

Let’s be honest here… if anything were to have killed the branch, it would have been COVID-19. A global pandemic preventing people from gathering in groups, touching surfaces, attending events in-person, or entering closed spaces without masking up first? And all of that on TOP of the already rapid rise in digital as an alternate to in-person banking?

If that didn’t get rid of all bank and credit union branches in the country, nothing will. Brick and mortar in the banking industry is simply not going to go away – it’s just time to optimize.

According to a recent study completed by Raddon/Fiserv, 77% of consumers said they went to a branch at least once a month during pandemic. Pre-pandemic, only 69-70% of consumers said they went to a branch at least once a month. Although mobile usage is steadily rising, branch usage is now rising for different reasons. People like to interact with people, especially when it is regarding the things most important to them.

The branch is not dead, but the old way of banking is. In order to continue to thrive and grow, it is imperative to reevaluate and optimize your branch network. The first step in this process is to take a good look at which branches are underperforming and why, and then remove or relocate them. Then, take a look at which branches are performing well and make sure they are well-equipped to provide consumers with personalized experiences. Once your branch network is operating at the maximum efficiency, you can begin to expand.

OmniChannel

Although the branch is not dead, mobile banking saw big gains during the pandemic and will only become more widespread. The rapid increase and reliance on mobile banking does not mean the end of branches, however. Caroline Vahrenkamp, a Senior Research Analyst for Raddon/Fiserv, says “People like to see other people. People like to interact with other people. The challenge is they also like to do things on mobile banking. So they like to use their phones for some things, they like to use their computers for some things, and they like to do some things face to face. And there’s a pretty clear idea of what each individual person wants to do in each of those methods.

Although it’s not consistent it’s not like everyone wants to do the same thing in each of those ways, everyone has a blend. But everyone has a blend.”

The statistics of the uptick in branch usage during the pandemic is clear proof of this.

It’s not enough to use brick and mortar, online, and mobile banking arbitrarily. Those three avenues must work seamlessly together and compliment each other. The channels working separately and under different departments forces them to work against each other instead of together. Mobile and online banking should not be the enemies of brick and mortar banking. Mobile and online banking fit the average consumer’s simple, daily needs. Your branches must fill in the gaps that mobile and online banking leave. They can provide human interaction, advisory services, and various other capabilities that require thought and trust. Something not provided by the apps.

Return to the Office

as predicted, the inevitable happened and the great migration back to the office began for much of the country this year. As the vaccines rolled out, companies slowly started opening their doors back up. While some decided that remote work was the best fit for their operations, many other institutions opted for “flex” type schedules. Others decided to go back in full-swing, pre-pandemic style.

Companies that decided on any type of in-person work had to put measures in place for the safety and comfort of people. Workplaces are now equipped with hand sanitizer stations, plexiglass dividers, and spread-out environments to accommodate those coming back to the office. Those on flex schedules go in to the office every other day and work from home the other days. They perhaps even share workspaces or common areas with others working in-office on opposite days.

LEVEL5 worked tirelessly throughout 2021 to equip our clients with the knowledge and resources they need for a safe and comfortable return to the office. We used our (Re)FI Design program to re-envision the workspace according to COVID-19 restrictions. We looked into workspace designs that allow for social distancing as well as minimizing touch points to stop the spread of germs and various other ways to allow for a safe branch.

Labor and Supply Chain

A couple of major disruptions throughout the last year that were caused by COVID-19 were the massive labor shortage and the extreme stress put on the supply chain. Although there were issues with it to begin with, the supply chain took a major hit with factories shutting down and workers losing jobs. Even when recovery seemed to be in the works, the Delta variant took some more punches – and who knows just what impact Omicron will have.

For what seemed like an eternity, the supply chain disruption happened in conjunction to a heavy decrease in demand. Factories closed and cut production while many lost jobs and couldn’t afford to spend money on anything other than the bare necessities. But not in the fun, carefree way that Baloo sings about. No one could forget about their worries and strife.

Then, as financial assistance was provided, vaccines were produced, and people returned to work, the demand grew back rapidly. This, however, put the supply chain under immense pressure. The pressure continues now as materials and resources are low along with a shortage of essential workers. In addition, the countries of the world “opening back up” is not happening in parallel. The US, for example, is opening at a much faster pace than some other countries, leaving an imbalance in the flow. The supply chain continues on the path of recovery, though. It’s making a comeback.

Although the pandemic permanently altered society, the changes that happened in banking were going to happen regardless of COVID-19. It merely kicked the evolution into overdrive. We have been preaching about the transition of branches from transactional to advisory for years now, but 2021 proved what we’ve been saying since the beginning.

Now, 2022, we’re ready for you. Bring it on.

If you’d like to know more about how you can help your bank or credit union grow in 2022, CONTACT US.

Tales of a Frankenbranch

- Branch Transformation

- Credit Union

- Portfolio

- Retail

Categories:

Nestled in a quaint, mist covered valley, far from the maddening crowd of the easterly metropolis, there was a branch.

It was the first branch. It was the flagship branch.

Then, it was an old branch, built and built again, cobbled together from disparate parts across several decades.

It was a Frankenbranch.

A stitch work job, it had different styles from different decades. It resembled a branch, but was something horrifyingly different.

It started off as the main branch in a proud paper mill town in the 1980’s. The branch’s street level floor carried much of the transactional load, while a small upstairs space acted as a meeting room. Eventually, it gave way to a series of expansions. While the expansion efforts successfully achieved the goal of expanding the overall square footage, they never took into consideration previous design elements. And don’t even start on the construction engineering side of the story…

One crew set out to do the job without any knowledge of the mechanics of the previous construction.

It wasn’t even really their fault. Plans were lost. People changed. Memories fade. Guesses were made. Lots of band-aids and looking the other way.

But what didn’t fade, or rather, what became increasingly obvious as the years turned to decades, was a patched together branch. It was undoubtedly historic, but also unabashedly stitched together to create a monster of a branch in which “good customer service” was a scary proposition.

It just wasn’t working anymore.

So…

Who you gonna call?

Enter the Branchbusters at LEVEL5, the nation’s leading Design-Build firm. They turn the country’s Frankenbranches into beautifully designed, expertly built revenue driving beacons on the hill that often times act as the prototype for high growth financial institutions.

Working with the existing infrastructure and maintaining the historical integrity of the building, the LEVEL5 design team crafted a modern branch that echoed the brand.

The construction crews never closed the branch to its members. Behind the scenes, however, on nights and weekends, they worked. They ripped out walls, re-established load bearing walls, refined the footprint for a better consumer experience, and reinvented a branch from the studs. The result delivered was a new, highly functioning branch. It was as if it had been built from the ground up.