7 Deadly Sins of a Bad Branch Strategy

- Branch Transformation

- Retail

Categories:

When discussing your own branch network and the exciting prospect of a remodel or ground-up project, you often look at your competitors, other institutions for best-in-class branch designs and even brick and mortar sites outside of a branch altogether (Apple anyone?).

While we often talk about what we like and the elements that we may want to emulate in our own project, there is the other side of the story – the “not so goods” and the “what were they thinking” elements.

And so, with that, come on a journey with us down the dark alleyways that are the 7 Deadly Sins of a Bad Branch Strategy.

1. LOCATION

SIN: For not using data to inform location decisions.

Yes, the saying still holds: Location, Location, Location. But it’s never as simple as just being in the heart of town, on the main thoroughfare or at the right ingress/egress points during rush hour. Knowing your town and your neighborhood helps, but the naked eye and good intuition do not have the luxury of data, particularly the kind of data that is forward thinking and aims to future-proof strategic decisions. The right combination of Consulting Services, which will run the right queries with the right combination of data, will yield results for tomorrow, not just today. Furthermore, the right Real Estate partner goes beyond identifying the vacant building or lot – the right Real Estate partner can find the ideal property that may not even be on the market. They know property valuations and have the experience to negotiate – getting you the right price per square foot.

2. FOOTPRINT

SIN: For choosing a branch size that is too big.

Gone are the days of 5,000+ square foot branches. With many transactions now happening outside of the branch, oversized branches aren’t necessary. This is not like tennis or golf, where an oversized head increases your sweet-spot. Oversized branches, especially for the amount of transactions occurring, are not sweet. In fact, they just feel wrong. Empty space is sinful. And worse yet, filling it in with an extra Self-Service machine to gather dust or filling it with something else unnecessary altogether is a good strategy gone wrong. Downsizing new branches or reworking the footprint for a remodel is the right approach. Make the branch feel welcoming and purposeful. Not cavernous and empty.

3. DESIGN

SIN: For choosing a design not born from strategy.

This is not about pretty or not. And it’s not about modern or not. A great looking branch can be executed in a historical building, maintaining those historical elements, but does the design do your brand justice? Does it invite people in, foster interactions, flow properly and perhaps ultimately, does it help justify the branch’s existence? The Design is not just about aesthetics, though they are important. The Design should be born out of purpose, rooted in your corporate strategy and further justified by properly serving your customers in that community. Brand Deployment is especially important in a well-executed Design. It’s not just about logos and tag-lines, but the vision, mission and customer-oriented service embodied in the physical Design. So, go design your “Apple Branch,” but only if that design fits within your brand.

4. TECHNOLOGY

SIN: For introducing technology that is intimidating, unnecessary and goes unused.

It’s everywhere and rightly so. But let’s not do technology for technology’s sake. What was originally seen as a threat to the traditional brick and mortar way of doing banking (yes, we’re talking about online/mobile banking here), the right deployment of technology can actually enhance the branch experience and bring in a true omni-channel approach to transactional touch points. Digital Signage is a great way to take what used to be a static mission or vision statement, and have it brought to life in an engaging and dynamic way upon a customer entering your branch. And since we’re talking about dynamic, a well-deployed fleet of interactive touch screens can enable your customers to discover products or services, check-in, or find their way to the right section of the branch. While video conferencing is not necessarily new, it really seems to have come into its own with practical in-branch applications so customers at one branch can speak to a subject matter expert at a remote location, seamlessly, in real time, and with real, actionable next steps.

Ok, that’s enough sinning for this week. But we’re only through the first four. Tune in next week when we reveal the final 3 sins to complete the series.

If you’d like to find out what the final 3 sins are, or want to confess your sins right away, Contact Us today to repent and begin understanding how your branch network can avoid the classic pratfalls and work better for your customers.

Hoosier Heartland Transformation in the Branch and Back Office

- Announcements

- Banks

- Branch Transformation

Categories:

Hoosier Heartland State Bank Investing in the Future

Crawfordsville, IN – Hoosier Heartland State Bank has announced today a partnership with Atlanta-based LEVEL5 to transform its main branch and develop a new operations center.

Trey Etcheson, CEO of Hoosier Heartland stated, “We are excited to see these two important projects come to life. The investment we are making in these buildings signify our continued growth, and reinforces our commitment to serving our customers and the community.”

“Our Crawfordsville South Office is getting a dramatic, new exterior and the branch is being transformed to something that is brand new for our area. We engaged LEVEL5 because they understand the benefits and nuances of transforming our Bank’s customer experience in the branch and back office to better meet the needs of a growing customer base.”

The branch transformation continues the growing trend in banking toward technology automation and optimizing the customer experience. Instead of traditional teller lines, the branch will embrace an open retail environment. The branch’s function and experience are designed to enable staff to dive deeper into building and growing relationships.

Brad Monts, the Bank’s President said, “The new operation’s center adjacent to our Crawfordsville South Branch will solve several challenges for our Bank. First, the additional space will allow our company to grow headcount to support our long-term plans. Second, the exterior renovations and branding will allow our company to better differentiate itself.”

Brad Eller, CEO for LEVEL5 stated, “The Bank needed a solution that developed a new branch concept, and addressed its long-term back office needs. These two projects provide the complete experience Hoosier Heartland wanted for their customers and staff.”

Brad Monts added, “We chose LEVEL5 as our partner because of the value they bring to the complete design-build process. Few firms in the country can study markets, address headcount, procure real estate, design and construct facilities like their team.”

To learn how we can help you change your experience in the branch or back office, contact us today:

Mazuma Olathe Branch | Futuristic Beacon, Sitting on a Hill

- Announcements

- Banks

- Branch Transformation

- Portfolio

Categories:

Team and Technology come together in the Mazuma Olathe Branch of the Future

Today’s financial world is complex and ever-changing. Technology is moving at warp speeds and consumers are often left wondering what to do next. To combat this problem, we are proud to introduce Mazuma Credit Union’s new Olathe Branch. This branch of the future combines people and technology in a model that allows Mazuma to serve its consumers and communities in a completely new way.

Far from the transaction being the focus, this new branch brings the company’s unique culture and experience to Olathe. The branch is small – less than 2,000 square feet – and uses a small staff. But, it makes a big impact through the use of branding and technology. Interactive video and smart ATMs are implemented in the branch and drive-up, to bring efficiency and full-service to the entire community.

[metaslider id=6912 cssclass=” alignnormal”]The branch’s staff describes it as a “Futuristic Beacon, Sitting on a Hill”. (Very similar to what they said about the main office!) But, don’t take our word for it! Check out the images above, and watch the video of the finished product. Then, you can decide for yourself.

The Branch of the Future is such a mystery to so many banks and credit unions. Maybe it’s because they don’t know how to define it.

What if it was as simple as a three-legged stool?

The Universal Banker the Real Gold in the Branch

- Announcements

- Branch Transformation

Categories:

What Would Motivate Consumers to Bypass the Most Convenient Branch in the World?

Think back 11 years ago. It is the Summer of 2007 and only a select few are forecasting the fall of the financial industry. Maybe even less see that a Senator from Illinois will be our new President in 18 months. And no one knows how Steve Jobs’ brand-new invention, the iPhone, will change the world. The iPhone revolutionized consumer expectation for convenience and experience. This is especially true in banking. As the financial industry recovered from the recession, consumers had been taught that the most convenient branch in the world lives in their back pocket.

The advent of digital convenience created omni-channel banking, the triune relationship between delivery channels:

Physical Branches, Cash Automation and Virtual Branches.

What do consumers want?

In a handful of years, consumers in one voice had communicated we want multiple channels. Few consumers held on to a single-channel approach to banking; preferring multiple ways to communicate with their financial institution of choice. And by 2017, consumers had said we prefer digital channels (website plus mobile) over the physical branch for day-to-day transactions.

It’s remarkable that in less than a decade from the iPhone launch date, consumers had been reprogrammed

to understand the unique value of a digital branch.

What is so great about a digital branch?

This view (the convenience of a digital branch) is also shared by financial institutions. Thanks to some research from Bain & Co. we can quantify the real value of a mobile banking consumer. The average mobile transaction costs a bank or credit union about $0.10 for each interaction. The average teller transaction (visiting a branch or calling a person) costs at least $4. Therefore, there is tangible value in mobile banking that is unmatched by physical branches, especially for transactions.

What is so great about the branch?

However, consumers still visit branches on a regular basis. Study after study shows that over 50% of all consumers visit branches on a monthly basis, and 60% of consumers visit branches twice year. What’s more, millennials are the most likely demographic to visit branches every month.

Bringing the channels together…

So, what’s really going on? A 2018 report by Foresee brings many of the pieces together. In their study, they found that 60% of all bank and credit union new-account journeys start online. (About 35% of consumers go straight to the branch.) Probably not too shocking to hear that people shop online? What is shocking is that over 70% of all consumers end up in a branch during their journey.

The Real Gold in the Branch

Therefore, there must be something intrinsically valuable to a consumer that they would bypass the most convenient branch in the world to visit one further away than their elbow, back pocket, or purse. The ongoing dance by consumers between digital and physical branches explains why physical branches continue to transform at a rapid pace. Consumers use the branch for something they cannot get over a device – a face-to-face personal interaction. Open environments, cash automation, pods, branding, point-of-purchase imagery, and transformative experiences are in place in today’s branch to leverage the high-value opportunity of a face-to-face interaction with consumers.

In 10 years from now will we have fewer branches? Yes. Over the next decade will the branch continue to change? Yes. Will the need for a human experience diminish? No. Because the real gold in today’s branch isn’t in the vault, it is you and your team. We call this the Universal Banker.

Since everything in today’s physical branch is about optimizing the face-to-face interaction with the consumer, then we need a guide to walk us through the process.

How about a three-legged stool?

Bricks, Clicks and Community Banks Webinar

- Announcements

- Branch Transformation

Categories:

Maximizing Digital and the Branch Equals Transformation

Our recent webinar on Bricks, Clicks and Community Banks dove into the need for financial institutions to optimize digital and physical channels. Consumers today desire an omni-channel approach (online, physical and automation) because digital channels have redefined the notion of “convenience”. A financial institutions ability to maximize online and mobile banking can have a dramatic impact on performance. Digital transactions cost banks and credit unions about 10 cents per interaction compared to $4 for a transaction with an employee in a physical branch. By automating the routine, then the scale and efficiency provided through online channels is possible in a way that physical branches cannot duplicate.

Consumers and the Branch

Yet, consumers still visit branches on a regular basis, including millennials (generation Y). In fact, research shows that millennials are the mostly likely demographic to visit a branch to apply for an receive a loan. A 2018 study by Foresee sheds more light on consumer behavior across all channels. Their research looked at customer acquisition throughout their journey to open an account. Foresee uncovered that 60% of all bank and credit union consumers start their journey online (website and mobile) – whereas 35% start at the branch. Not too shocking that most consumers would start their banking journey online. However, 60% of online originators (remember the original 60%?) end up in branch. The main point is more than 70% of all customers end up in a branch at some point in their journey.

The Gold in the Branch

All the data points to customers believe something more valuable than gold is within the four walls of today’s branch. The real gold are the bankers within a bank or credit union’s facility. Today’s universal banker has the ability to serve consumer’s needs better than ever. So optimizing optimizing the branch is a top priority. Matching consumer needs and the services offered at bank or credit union is sucess.

The process for Branch of the Future and/or Transformation is a Three-Legged Stool. The three legged stool is Function, Experience and Technology. (We’ve written an entire blog post on this topic)

Stories from the Field

To bring the concepts and presentation into a real life context, Shaun Burke – President and CEO of Guaranty Bank in Springfield, MO joined the webinar. Shaun and his team are going through the process of transforming so much at their Bank. He walked the audience through where they have been, where they are today and where they are tomorrow. Some of the evidence of transformation is in the Bank’s new Headquarters which houses their “Branch of the Future”. (You can watch the the headquarter’s story here and download the entire 45-minute webinar below)

As always, there is so much more to be said and done in regards to optimizing the digital and physical channels. This webinar sought to bring together several pieces of the puzzle, and focus on a process to optimize the branch portion.

To download the webinar and watch it at your convenience click below.

Branch Success is a Three-Legged Stool

- Announcements

- Branch Transformation

Categories:

The branch of the future may not resemble the serious, conservative look of the past, but what’s behind all that glitz is anything, but fly-by-night.

Lobbies filled with furniture that looks as if it could double as a set from the 60’s era sci-fi show Star Trek. Lounging areas that are one disco ball short of a setting for a hot new nightclub. Lighting that would feel equally at home in an art gallery for postmodern sculpture.

Is this the lobby of a bank, or a leftover set from a 60’s sci-fi show? Actually, it’s Mazuma’s 50,000 square ft. main office. And thanks for asking!

What’s behind all that design

This is, after all, the place where all of your bank and credit union’s channels converge. It’s the key cog in your service delivery network. The branch is more than just four walls, a vault and a teller line. As the saying goes, there’s a method to the madness. The branch of the future is a three-legged stool composed of the right mix of:

- Function

- Experience

- Technology Integration

What’s your function?

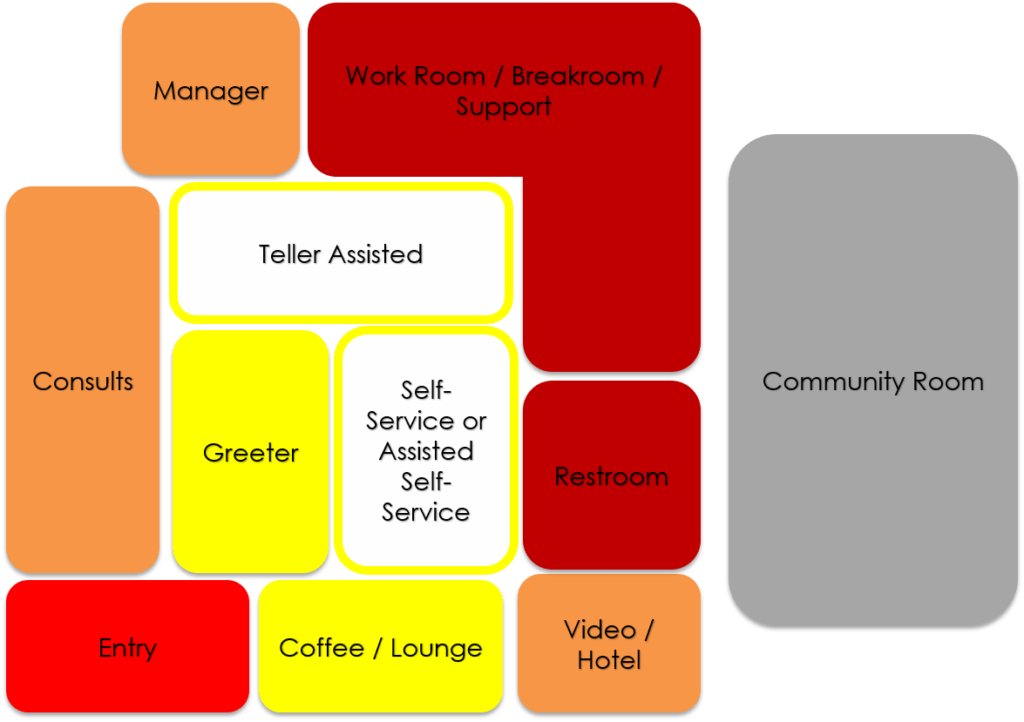

The branch houses a process for people – staff and customers. So, the first step in developing a branch is to understand what functions are needed within it. A common starting point is uncovering and understanding the function of a transaction. Is the transaction teller-assisted (teller line or pods)? Self-service (ATMs)? Or assisted self-service (Interactive Teller Machines)?

Knowing and naming all the functions for the branch process is the key to decisions about placement, staffing and tools needed. Additional services offered in the branch potentially include lending, insurance or investments and should be included in this phase.

The design process starts inside the branch and then builds layers to offer services for the customers or members, and the community.

Experience – Think in Zones

As the function takes shape, then the desired experience is layered on top of the function. (The second piece of the three-legged stool.) Many a bank or credit union skip over the branch’s function and go straight for the experience because that is what is considered hip, cool or relevant. Certainly the experience matters, and matters a lot, but not at the expense of function – first.

The branch experience starts from the first impression, then zones of customer activity, and support. Each zone accomplishes both a function and experience through the branch’s staff and tools. Zones are established by length of time:

- Entry zone – where first impressions happen

- 1-5 minute zone – where self-service, assisted self-service, or teller-assisted decisions are made

- 5-20 minute zone – consultants, manager access, and full screen video helps customers or members solve larger concerns or questions

- Support zone – workroom, break rooms and storage are part of the process too – don’t forget about it

- Add on – something extra, like a community room

Zones are matched with function to facilitate experience of the branch with customers and members.

Tech is the final piece

Once the functions of the branch, and the desired experience of customers and members are identified, the all-important integration of technology is applied to make everything run. (The three-legged stool is complete!) Cash automation and recycling at the point of the transaction creates time for staff to focus less on counting, and balancing and more on tending to the needs of the customer. Self-service tools like ATMs and ITMs (Interactive Teller Machines) allow customers or members to serve themselves or with the assistance of staff during our after hours. Automation is not limited to cash transactions. It also includes video conferencing, security, and back office equipment – anything to accelerate the business.

When all three legs come together, it often looks something…like this:

LEVEL5 is trusted by banks and credit unions across the country for our ability to implement the three-legged stool to a successful branch. Each component of the stool is needed or you risk sinking the Titanic.

The branch is as important as ever for customers and members to conduct business. However, it is not just about the design. What else helps you avoid the Iceberg?

As branch numbers go down, is the future of banking going with them?

- Announcements

- Branch Transformation

Categories:

If you’ve done any scanning of the financial headlines lately, you’d think the banking industry was in some sort of downturn.

Numbers back up the concern.

The Wall Street Journal recently reported 1,700 branches were closed in 2017 alone. That represents 2% of all the branches in the United States, bringing the total down to somewhere around 90,000. This headline grabbed a lot of attention.

We know that the rise of mobile banking has reduced the amount of foot traffic in many locations. Are we in the midst of another digitally-led upheaval? Have millennials decided they’d rather conduct their banking without having to look up from their phones and actually talk to someone in person? (We kid, we kid).

What’s the real story?

Big banks aren’t necessarily in trouble. They’re just pivoting. Each mobile interaction costs about 10 cents per customer, while an interaction with an actual human being is around $4 (see infographic below from Bain & Co.). It doesn’t take a CPA to realize the cost savings of closing a branch that’s not being utilized.

Another reason the numbers are skewed.

Another data point that makes the closures sound more alarming than they actually are, is that they are attributable to the top ten banks. When larger banks make cutbacks to save money, the numbers reflect it, and the market pays attention.

Do we even need the branch anymore?

All the studies say: Yes, absolutely.While consumers are certainly shifting their routine banking needs to their mobile devices, they still visit branches. Studies put the numbers as high as 90% as noted below from Bain & Co. The need for customers to spend time speaking to their banker, either face-to-face or over the phone, is still important.

What happens when a branch closes?

When branches serving less populated areas decide it’s not financially feasible to keep a branch open, longtime customers are forced to drive miles and miles to their nearest branch.

Customers may love you, but do they love you that much? Studies have shown that 40% of the time, customers will switch to a different bank that has a branch nearby. All banks deal with “churn” to a degree, and closing a branch can be a self-inflicted pain that may cost the bank in the long run.

What does this mean?

If the branch solution is built on a “If we build it they will come” mentality, perhaps the big banks closing branches did a poor job identifying the real opportunity in their markets. Otherwise, they they wouldn’t have to be closing the branch.

There is a precision to branching that can rear its ugly head later if not done well. At LEVEL5 we specialize in solutions that go beyond design-build, by helping you decide what kind of branch solution works best for your markets and needs.

What can we learn from big banks on what not to do?

Bear State Bank Enters with a Roar

- Branch Transformation

Categories:

Bear State Bank enters with a Roar | $25 Million in Loans in the first year!

Bear State Bank headquartered in Little Rock, Arkansas, opened its first branch in Conway, AR with a big bear roar! The Bank acquired a vacated branch at the corner of Prince Street and Salem Road and worked with our LEVEL5 team to transform the branch from a traditional, stuffy environment into an open, modern and welcoming environment that is designed to transform the banking experience for its consumers.

The branch offers high-touch, personalized banking service to its consumers that includes a dialog tower (a kiosk/pod to replace the teller line), a waiting area with refreshment bar, flat screen HD monitors, technology bar and a “Community Wall” to highlight local events, activities and businesses. The design-build team at LEVEL5 also incorporated a Bear State Bank gumball machine into lobby design and customer experience.

The new Bear State Bank customer experience begins even before the customer enters the facility. The branch has a prime location, so the Bank’s team and LEVEL5 wanted to create a unique exterior element that would make a big impact in the Conway market. The Bear State Bank logo was a perfect solution that put the Bear State Bank ‘stamp’ on the renovated exterior of the branch.

“The feedback from the public has been very positive this past year. The friendly and inviting environment has people staying inside the doors a longer period of time, giving our team the opportunity for further conversations, and getting to know one another on a more personal level.” said Chad Russell, Conway Market President of Bear State Bank.

Shelly Loftin, Chief Marketing Officer of Bear State Bank stated, “Conway is a young and vibrant city with 3 universities. We wanted to make a splash in this market with our first location. LEVEL5’s experience in designing and building branches helped us create an atmosphere that allows our bankers to deliver a high level of personal service to our customers. LEVEL5 has been great to work with. They understand how to integrate new technology, and methods of constructing banking services in more open, contemporary and unique environments.”

The Branch opened last year and has $12 Million in Deposits and a $25 Million loan portfolio!

To view more images of this project click, HERE!

Branch transformation is an omni-channel experience because the focus is density. Density of the right kind of branches, automation and virtual channels. One of the newest kinds of branches is the Micro Branch.

What is a Micro Branch? Maybe this will help.

Ready, Fire, Aim! | Branch & Main Office Transformation

- Branch Transformation

Categories:

Expansion and loan growth lead to transformation.

The number one question we hear about branch and main office transformation is “What’s in it for us?”

This is an indirect way of asking about Return on Investment (ROI) for transforming their business. Discussions about loan growth, market expansion and the future of banking are about transforming the business to allow it to flourish and grow. All CEOs want to know what’s in it for their company if they invest in growth.

Question #1 – How do you calculate returns for transformation?

To solve ROI for transformation, we divide the Return by the Investment. So, the first variable to solve for is return that is the opportunity. Opportunity is what we get from a market for the investment. Therefore, return is defined by the loans and deposits (i.e. opportunity) resulting from a project. Historically, our consulting team can quantify loans and deposits with 92% accuracy. How do they do it? Well, read more about it here:

Question #2 – How do you define the investment?

So with the opportunity quantified, the cost to acquire the business is a major variable yet to be solved. The white paper linked below addresses the investment portion of the equation. This article is quick page-turner that will help you lower the risk of developing your next branch or main office. We all want the return, so maximizing the investment can be a reality.

Click on the target below to download the white paper…you won’t regret it.

Building Relationships: the Heartbeat of the Universal Banker

- Announcements

- Branch Transformation

Categories:

Technology hasn’t just required an upgrade in equipment, but a shift in employee skill sets.

As American as apple pie. Community based financial institutions (FI’s) are the heart and soul of America. These locally owned and operated institutions are woven into the fabric of the communities we live in, work in, raise our families and build our lives. That building involves our careers, our hobbies and our futures. That future in large part depends on…money, investment and risk.

The saying “It takes money to make money” is still…right on the money. Most of us are not born with the equity we need to see our hopes and dreams come true. We need money to finance our education, our houses, cars and businesses. We need equipment, tools, facilities and employees to make our lives work. The local community bank and credit union steps in to make all of this possible. It is the reason they were created, and they fuel the economy and future.

In order to serve, first we must adapt. In today’s changing consumer environment, where omni-channel delivery is the norm, community banks and credit unions are also challenged with delivering services in a way that deepens their wallet share, household penetration and margins…so they can continue to fuel the American spirit.

The old way worked. In years past, that service was almost universally delivered the same way. A customer interacted with a “banker” in a branch across three feet of mahogany. Most interactions were transactional in purpose…check cashing, payments and order filling. The world had fewer channels for consumers to access financial resources and the delivery model…worked. No, it worked great!

Automation is Everything!

Times have changed. However, today we have smart phones, the Internet, and global mobilization thanks to technology. Routine components of all things financial are now automated. Checking balances, moving money, making payments and even loan applications are handled via smart phones, tablets, laptops, drive thru’s, and ATMs. Therefore, the purpose of the physical channel i.e. the branch has changed and with it the identity of the banker.

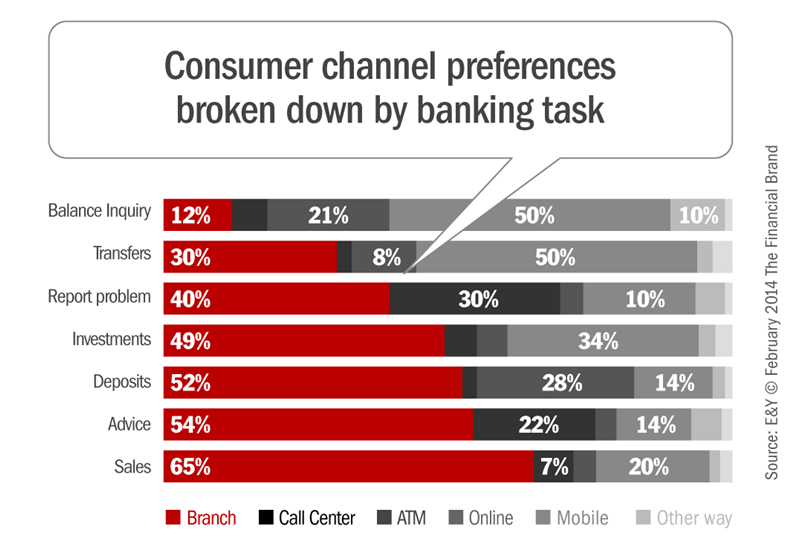

Change didn’t happen overnight. But it still came fast. A 2014 study by Ernst & Young sheds tremendous light on what is happening, and what FI’s have done to adapt. The graph below shows consumer channel preference by banking task. The study found the more routine and automated the task, the more likely the consumer is to choose a “nonhuman” interfacing channel. However, the more complex the interaction, the more likely the consumer prefers a physical channel…especially when it comes to sales.

New skill sets emerged. Over the last decade, FI’s have been moving toward a different branch delivery model based on these preferences by consumers, so they can continue to deepen wallet share, reach more households, businesses and boost margins. What was born are Universal Bankers who do so much more than the routine…they now educate, advise, and teach consumers as they discuss products, introduce experts and create deeper relationships with their customer or member in the process. In fact, NCR estimates Universal Bankers can handle up to 95% of customer requests; the remaining 5% are referred to subject matter experts.

From “doer” to “partner”. The deepening of relationships with the customer is the key. Consumers today are becoming so much better at research and analysis, but they need help making decisions and choosing a partner. So, they’ll ask a friend or a thought leader, and then go and meet the people others also trust.

How to grow your people. FIs can strengthen these interactions and introductions by following these steps as they develop their own Universal Bankers:

- Hire people who like people and are engaging. Customer engagement is a culture shift that moves away from transactions and toward conversations.

- Train the banker to ask questions. Educate the consumer before offering solutions. The Banker’s job is to listen first, and then speak from his/her wealth of knowledge or bring in experts…when needed.

- Invest in tools that automate routine activities and create margin for the banker to invest time with their customers. Scheduling tools, staffing models, cash handling equipment, ATMs, and or Interactive Teller Machines (ITMs) are examples of such investments.

- Remove the barriers to the customer. Often this involves eliminating fixtures that separate the customer from the banker, but it doesn’t have to be radical. The key is the facilitation of the desired experience.

- Promote the bank or credit union’s brand in the physical environment. Stay away from artwork and use flat screens and marketing materials to communicate your unique brand message. Promote your value proposition so the community and customer know what you are about.

Why move in this direction? The answer…ROI.

Banks and credit unions that embrace this model often see dramatic results. According to FDIC reports, a community bank in the Southwest organically grew its assets from $1.0 billion to $3.5 billion in five years with this engagement model. Furthermore, NCUA loan and asset data prove a credit union in Tennessee grew its loan portfolio by 50% in four years and another in the Carolinas grew its book of business by over $100 million in a similar period. These are real results, from real financial institutions who have embraced the Universal Banker model - engaging customers in a new way…and there are more.

Investment in people and creating an environment that fosters engagement can change cultures. And, that culture is about building relationships…the heartbeat of the Universal Banker.