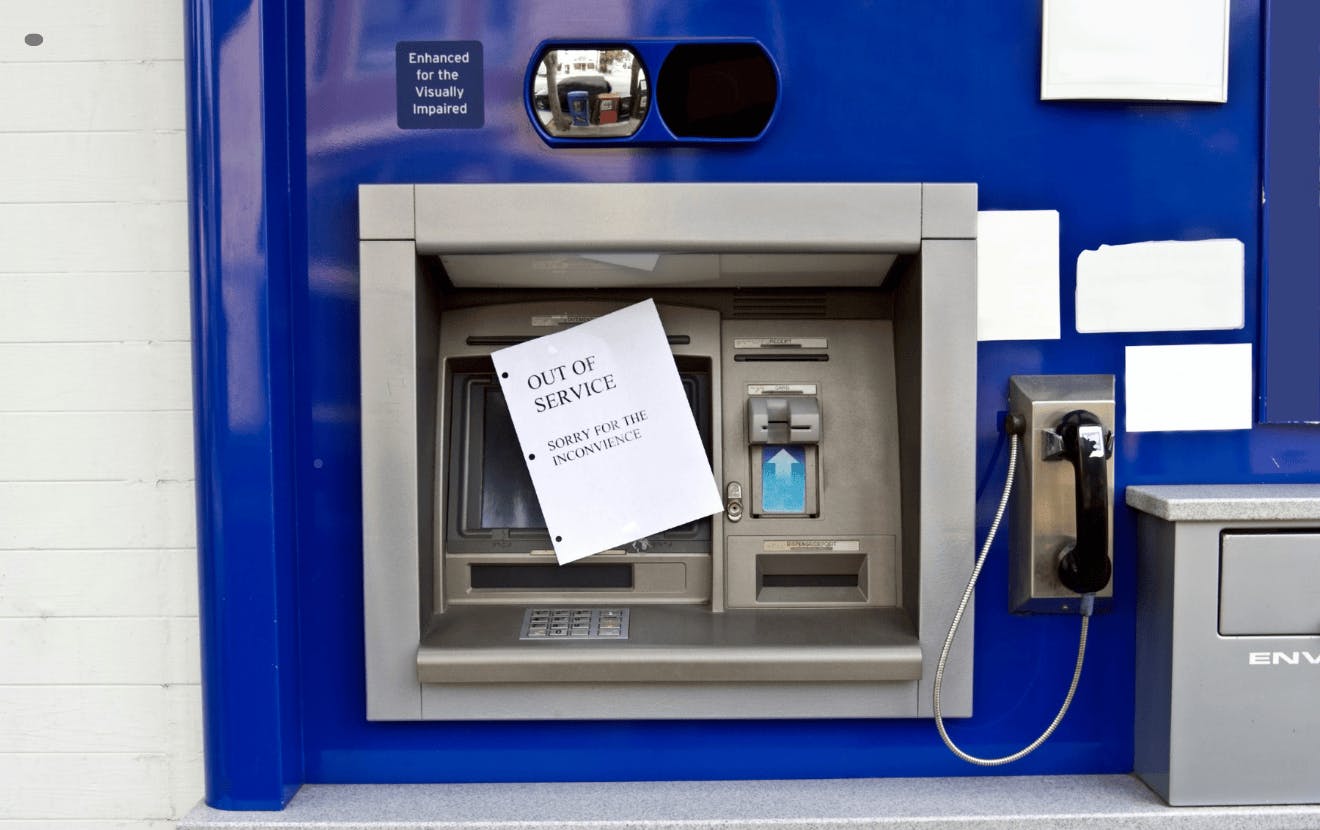

Picture this: It’s payday weekend, and your member stops by to grab some quick cash from your flagship ATM. But instead of crisp twenties, they’re met with a flashing “Out of Service” message.

From a member’s perspective, it’s a frustrating moment. From your institution’s perspective, it’s something more serious: a breakdown in operational trust and a preventable drag on performance. At the center of that disruption? Poor cash forecasting.

The unseen balance sheet burden

Cash still matters—especially when it’s not there. Making sure cash is available exactly when and where your members need it goes beyond simple convenience; it’s a direct reflection of your operational reliability and financial stewardship. Too little cash? You risk member dissatisfaction and lost trust. Too much? You’re incurring unnecessary vault fees and tying up capital that could be working harder elsewhere. That’s where intelligent forecasting comes into play.