The tech that makes density work

Modern technology enables smaller branches, bigger strategies, and scalable growth.

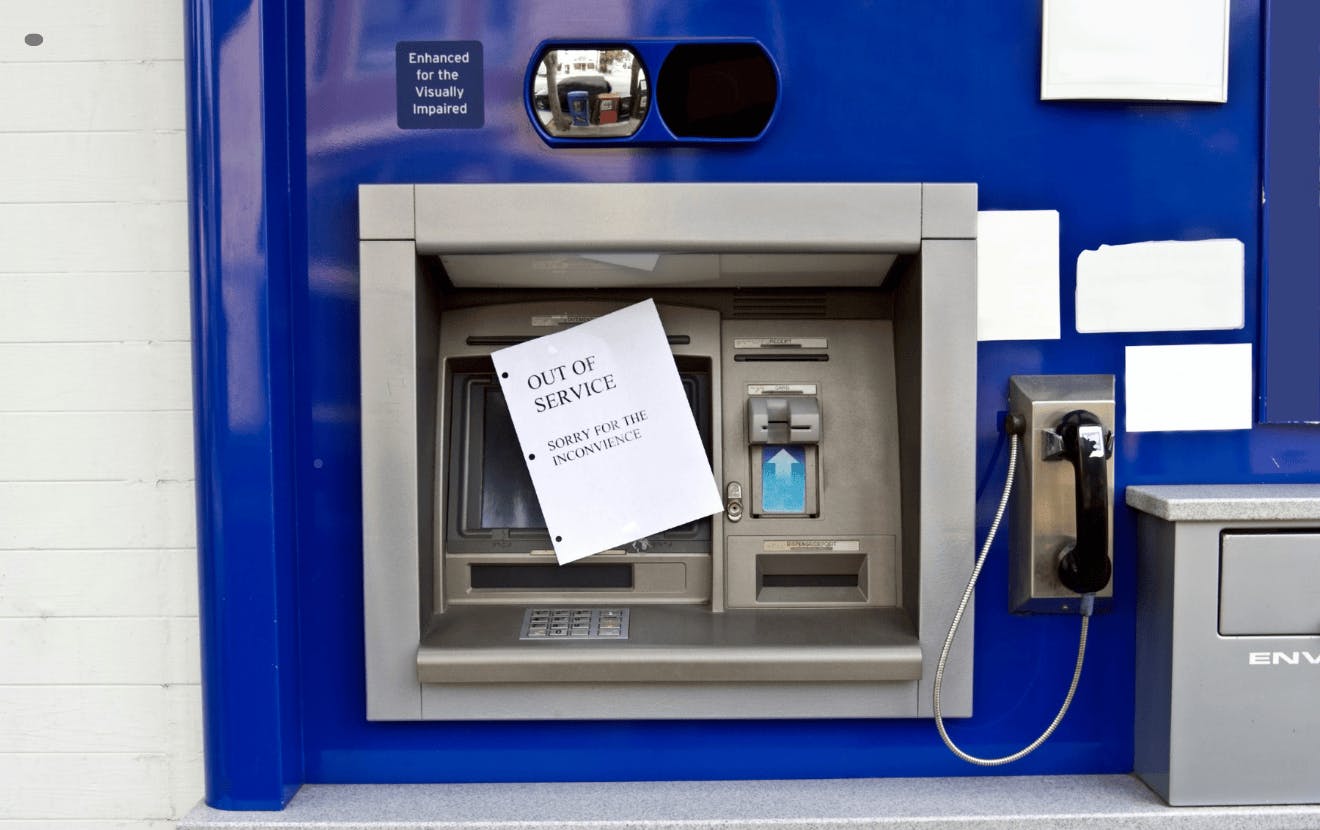

Interactive Teller Machines (ITMs)

Modern ITMs extend service hours, reduce staffing needs, and streamline basic transactions. They’re more than ATMs. They’re your 24/7 frontline.

Universal teller pods + digital tools

Universal pods paired with tablets and digital onboarding tools empower staff to float, engage, and serve multiple needs in one interaction, reducing the need for rigid teller lines.

Modular technology zones

Smaller branches don’t mean smaller expectations. Smart design means you can create zones of interaction—each with purpose-built tech for self-service, private consultation, or digital engagement. Tech should drive the floorplan, not the other way around.

Integrated back-end systems

Your digital and physical environments must sync. When a member starts a loan app online and finishes it in the branch, the transition should be frictionless. That requires tech that plays well with your core.

Data-driven site selection + performance modeling

Tech isn’t just in the branch—it powers where the branch goes in the first place. Tools like GPS-based behavioral analysis and LEVEL5’s proprietary ForeSite Methodology™ predict performance down to the intersection—so you know exactly where to invest and what kind of tech to deploy for that market.

Efficiency that drives expansion

Technology reduces friction. It also reduces cost. With the right tools:

- You shorten construction timelines with smaller square footage.

- You scale faster into new or underserved markets.

- You calibrate staffing models, empowering your best people with the tools they need.

- You extend your digital brand into physical space, reinforcing consistency and trust.

It’s not about shrinking your presence—it’s about streamlining your operations to increase your impact.