In an era where efficiency and experience define success, many credit unions are still asking the wrong question: How much technology should we implement? A better question is this: How do we integrate technology to empower our people?

No matter how advanced the tools, your greatest asset is still your team. And when their expertise is amplified by thoughtfully deployed technology, you gain a competitive edge that’s hard to match.

Used well, technology is a force multiplier. It strips away friction from everyday tasks and allows your staff to spend more time doing what they do best: connecting, advising, and building trust. But it must be strategically placed and aligned with both your staff’s workflow and your members’ journey.

Start with the experience, not the tool

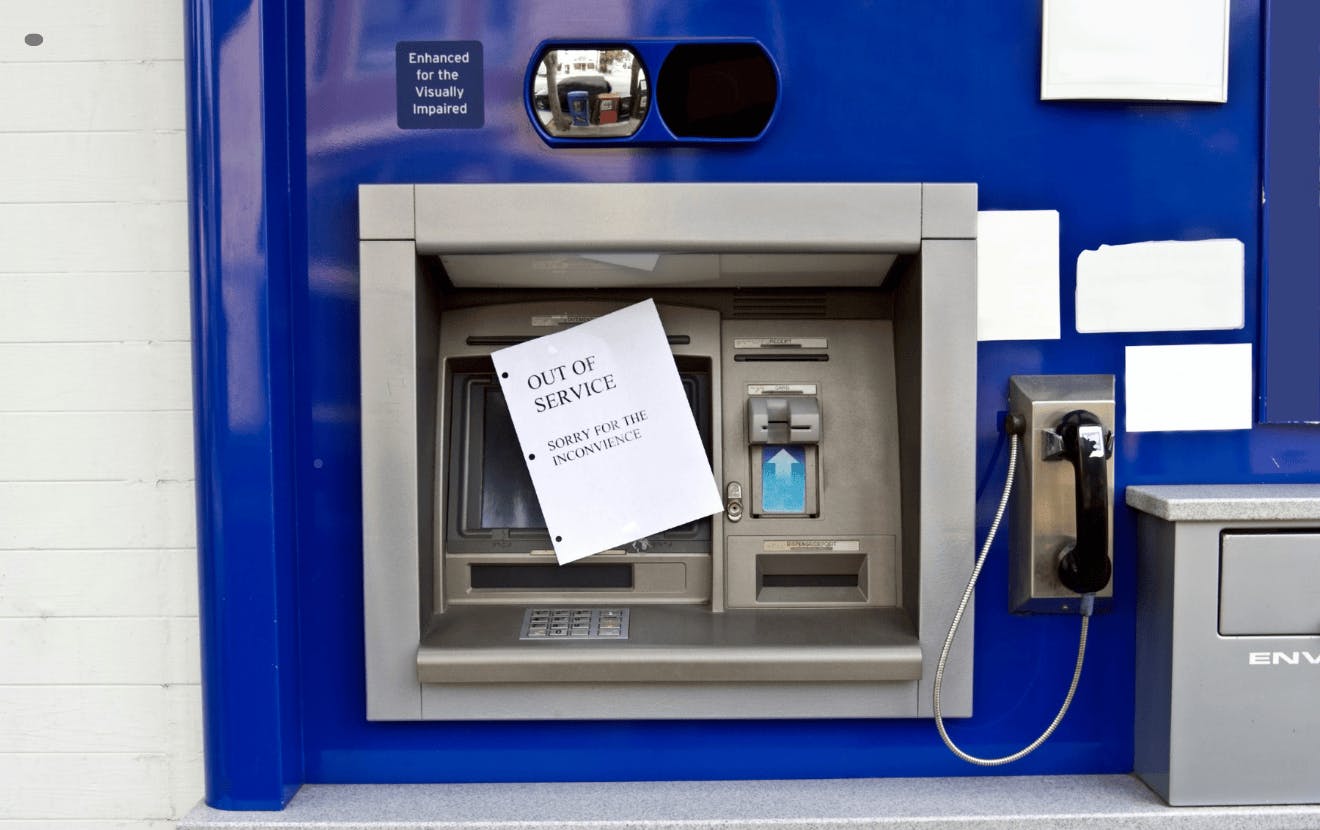

Too often, credit unions fall into the trap of implementing technology for technology’s sake. A shiny new system gets rolled out, but it doesn’t integrate with day-to-day operations—or worse, it disrupts them.

Instead, start by mapping out the member journey from start to finish. Where will self-service options reduce wait times? Where is a personal touch non-negotiable? And what does the transition between team and tech look like? Every tech decision should be made to enhance the quality of your member interactions, driving long-term loyalty.